CorpAcq SPAC Presentation Deck

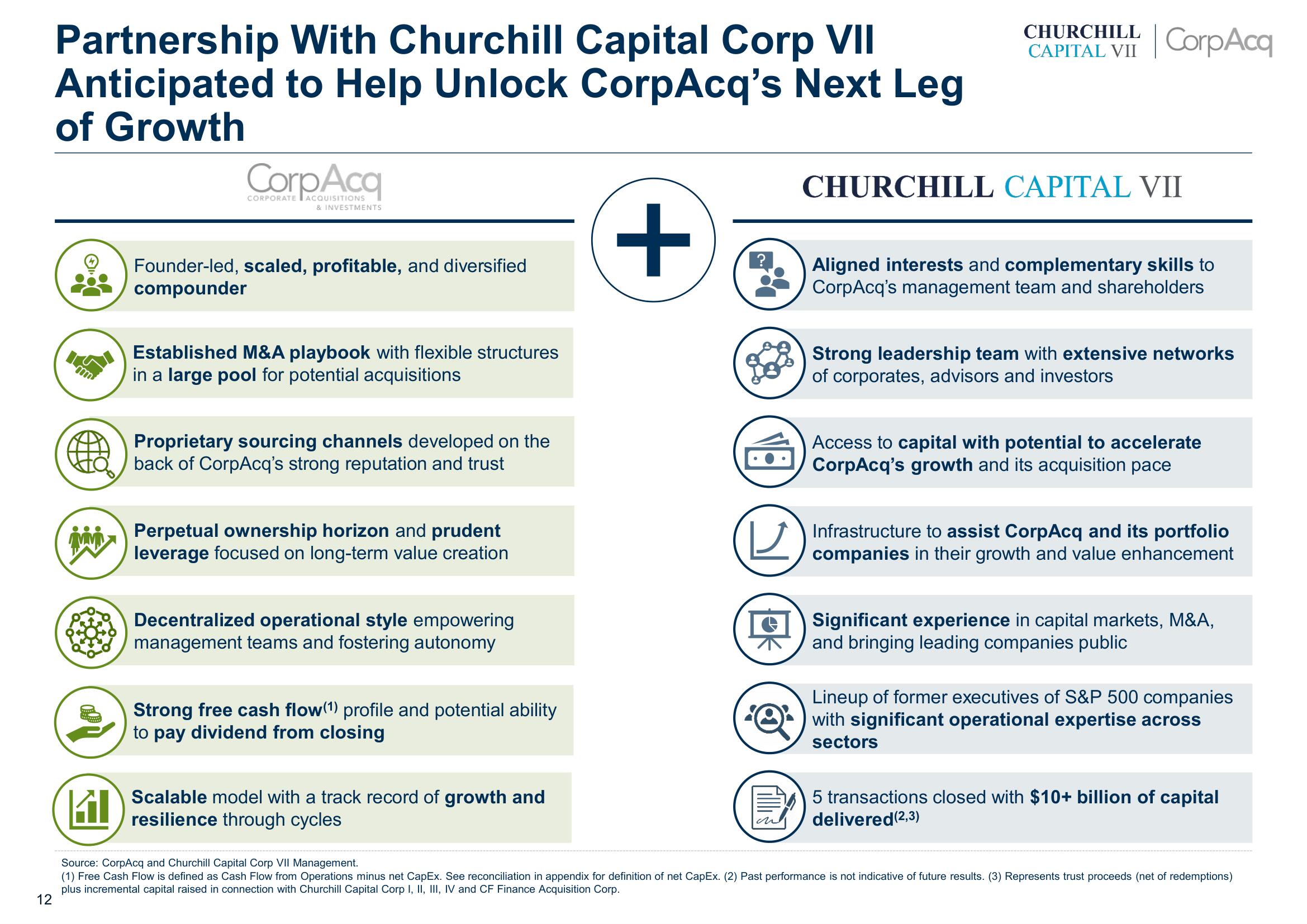

Partnership With Churchill Capital Corp VII

Anticipated to Help Unlock CorpAcq's Next Leg

of Growth

KI

CORPORATE ACQUISITIONS

& INVESTMENTS

Founder-led, scaled, profitable, and diversified

compounder

Established M&A playbook with flexible structures

in a large pool for potential acquisitions

Proprietary sourcing channels developed on the

back of CorpAcq's strong reputation and trust

Perpetual ownership horizon and prudent

leverage focused on long-term value creation

Decentralized operational style empowering

management teams and fostering autonomy

Strong free cash flow(1) profile and potential ability

to pay dividend from closing

Scalable model with a track record of growth and

resilience through cycles

+

BO

CHURCHILL

CAPITAL VII CorpAcq

CHURCHILL CAPITAL VII

Aligned interests and complementary skills to

CorpAcq's management team and shareholders

Strong leadership team with extensive networks

of corporates, advisors and investors

Access to capital with potential to accelerate

CorpAcq's growth and its acquisition pace

Infrastructure to assist CorpAcq and its portfolio

companies in their growth and value enhancement

Significant experience in capital markets, M&A,

and bringing leading companies public

Lineup of former executives of S&P 500 companies

with significant operational expertise across

sectors

5 transactions closed with $10+ billion of capital

delivered (2,3)

Source: CorpAcq and Churchill Capital Corp VII Management.

(1) Free Cash Flow is defined as Cash Flow from Operations minus net CapEx. See reconciliation in appendix for definition of net CapEx. (2) Past performance is not indicative of future results. (3) Represents trust proceeds (net of redemptions)

plus incremental capital raised in connection with Churchill Capital Corp I, II, III, IV and CF Finance Acquisition Corp.

12View entire presentation