Netstreit IPO Presentation Deck

3

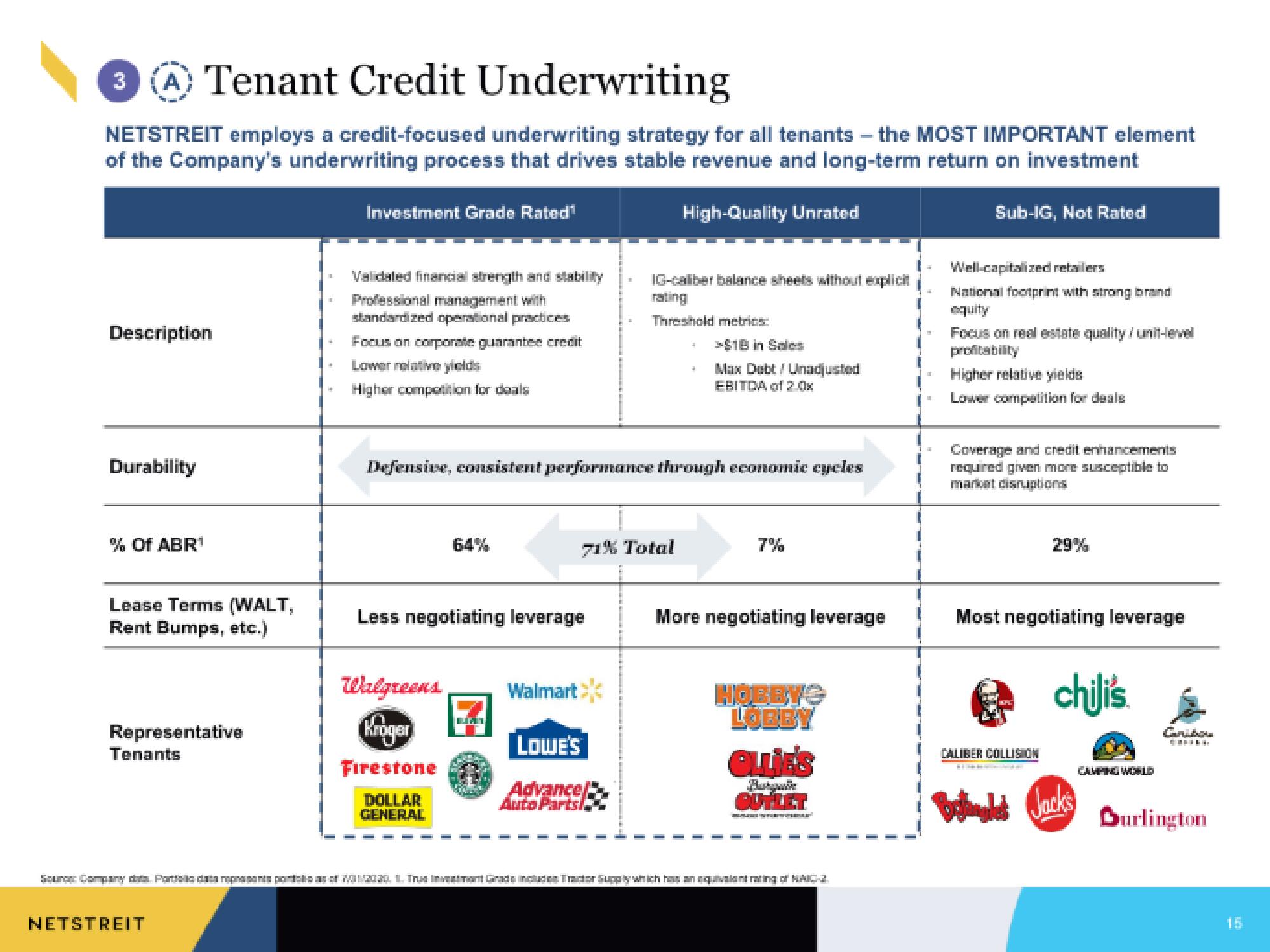

Tenant Credit Underwriting

NETSTREIT employs a credit-focused underwriting strategy for all tenants - the MOST IMPORTANT element

of the Company's underwriting process that drives stable revenue and long-term return on investment

High-Quality Unrated

Sub-IG, Not Rated

H

19 1

Description

Durability

% Of ABR¹

Lease Terms (WALT,

Rent Bumps, etc.)

Representative

Tenants

NETSTREIT

Investment Grade Rated¹

Validated financial strength and stability

Professional management with

standardized operational practices

Focus on corporate guarantee credit

Lower relative yields

Higher competition for deals

Less negotiating leverage

Walgreens

Kroger

Firestone

DOLLAR

GENERAL

Defensive, consistent performance through economic cycles

UAN

Walmart

IG-caliber balance sheets without explicit

rating

Threshold metrics:

71% Total

LOWE'S

Advance

Auto Partsilo

#

#

>$1B in Sales

Max Debt / Unadjusted

EBITDA of 2.0x

7%

More negotiating leverage

HOBBYS

LOBBY

OLLIE'S

Sour Company data. Particia data represents portlas of 20/2020 1. Trus Investment Grade includes Tractor Supply which has an equivalent rating of NAIC-2

Well-capitalized retailers

National footprint with strong brand

Focus on real estate quality / unit-level

profitability

Higher relative yields

Lower competition for deals

Coverage and credit enhancements

required given more susceptible to

market disruptions

29%

Most negotiating leverage

CALIBER COLLISION

chili's

Jacks

CAMPING WORLD

*****

BurlingtonView entire presentation