IGI SPAC Presentation Deck

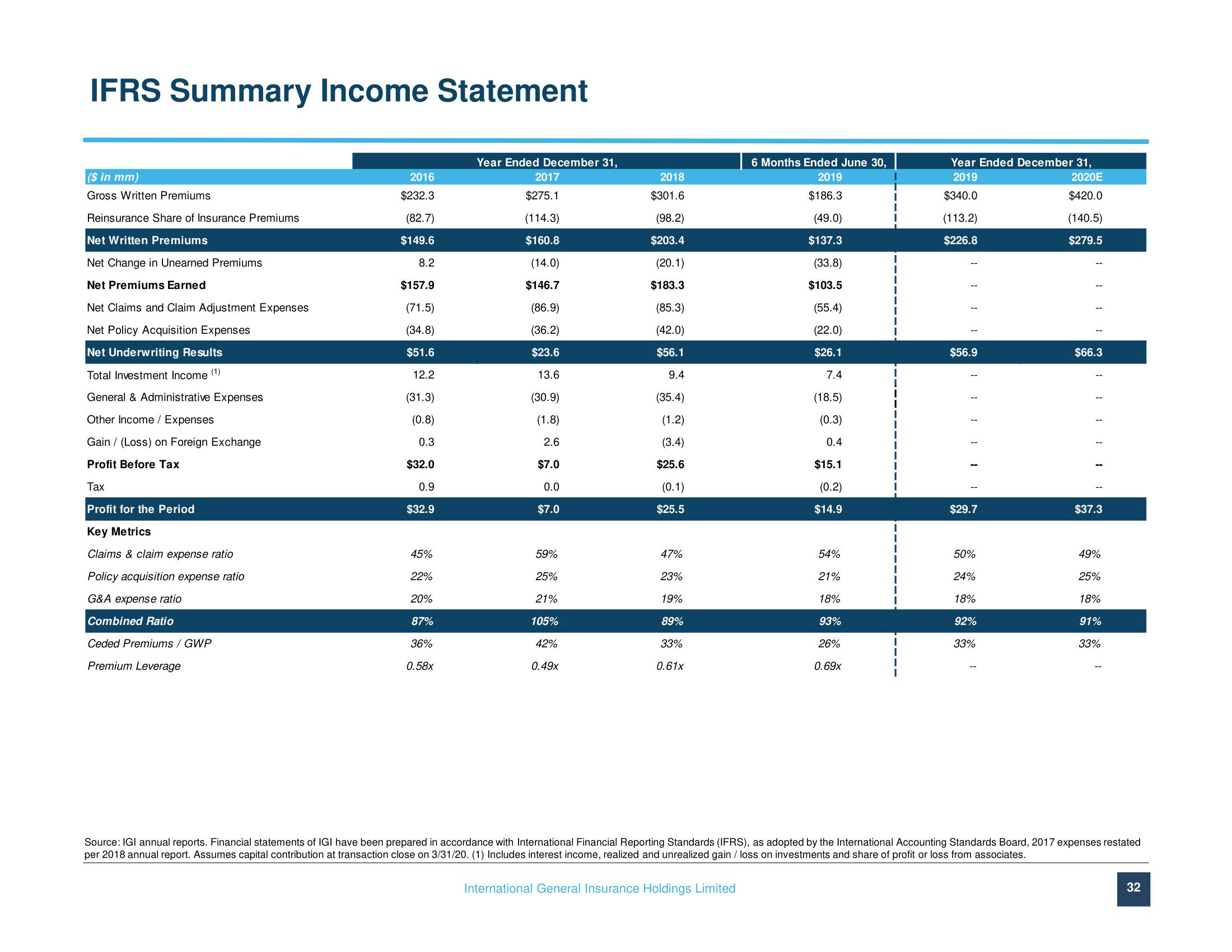

IFRS Summary Income Statement

($ in mm)

Gross Written Premiums

Reinsurance Share of Insurance Premiums

Net Written Premiums

Net Change in Unearned Premiums

Net Premiums Earned

Net Claims and Claim Adjustment Expenses

Net Policy Acquisition Expenses

Net Underwriting Results

Total Investment Income (1)

General & Administrative Expenses

Other Income / Expenses

Gain (Loss) on Foreign Exchange

Profit Before Tax

Tax

Profit for the Period

Key Metrics

Claims & claim expense ratio

Policy acquisition expense ratio

G&A expense ratio

Combined Ratio

Ceded Premiums / GWP

Premium Leverage

2016

$232.3

(82.7)

$149.6

8.2

$157.9

(71.5)

(34.8)

$51.6

12.2

(31.3)

(0.8)

0.3

$32.0

0.9

$32.9

45%

22%

20%

87%

36%

0.58x

Year Ended December 31,

2017

$275.1

(114.3)

$160.8

(14.0)

$146.7

(86.9)

(36.2)

$23.6

13.6

(30.9)

(1.8)

2.6

$7.0

0.0

$7.0

59%

25%

21%

105%

42%

0.49x

2018

$301.6

(98.2)

$203.4

(20.1)

$183.3

(85.3)

(42.0)

$56.1

9.4

(35.4)

(1.2)

(3.4)

$25.6

(0.1)

$25.5

47%

23%

19%

89%

33%

0.61x

6 Months Ended June 30,

2019

$186.3

(49.0)

$137.3

(33.8)

$103.5

(55.4)

(22.0)

$26.1

7.4

(18.5)

(0.3)

0.4

$15.1

(0.2)

$14.9

54%

21%

18%

93%

26%

0.69x

Year Ended December 31,

2019

2020E

$340.0

$420.0

(113.2)

$226.8

$56.9

$29.7

50%

24%

18%

92%

33%

(140.5)

$279.5

$66.3

$37.3

49%

25%

18%

91%

33%

Source: IGI annual reports. Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board, 2017 expenses restated

per 2018 annual report. Assumes capital contribution at transaction close on 3/31/20. (1) Includes interest income, realized and unrealized gain / loss on investments and share of profit or loss from associates.

International General Insurance Holdings Limited

32View entire presentation