Grindr SPAC Presentation Deck

●

●

●

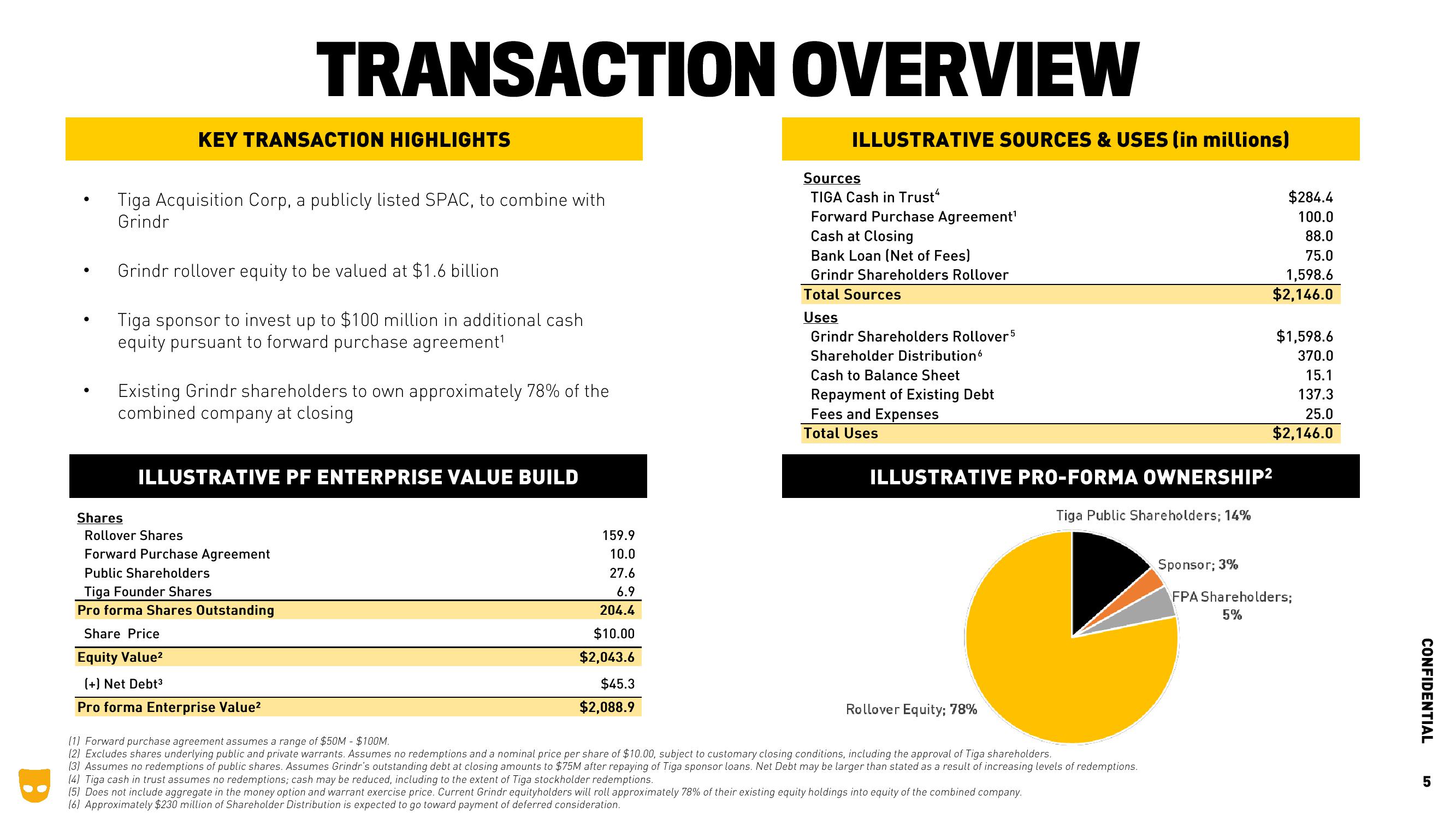

KEY TRANSACTION HIGHLIGHTS

Tiga Acquisition Corp, a publicly listed SPAC, to combine with

Grindr

Grindr rollover equity to be valued at $1.6 billion

Tiga sponsor to invest up to $100 million in additional cash

equity pursuant to forward purchase agreement¹

TRANSACTION OVERVIEW

Existing Grindr shareholders to own approximately 78% of the

combined company at closing

ILLUSTRATIVE PF ENTERPRISE VALUE BUILD

Shares

Rollover Shares

Forward Purchase Agreement

Public Shareholders

Tiga Founder Shares

Pro forma Shares Outstanding

Share Price

Equity Value²

(+) Net Debt³

Pro forma Enterprise Value²

159.9

10.0

27.6

6.9

204.4

$10.00

$2,043.6

$45.3

$2,088.9

ILLUSTRATIVE SOURCES & USES (in millions)

Sources

TIGA Cash in Trust4

Forward Purchase Agreement¹

Cash at Closing

Bank Loan (Net of Fees)

Grindr Shareholders Rollover

Total Sources

Uses

Grindr Shareholders Rollover 5

Shareholder Distribution

Cash to Balance Sheet

Repayment of Existing Debt

Fees and Expenses

Total Uses

Rollover Equity; 78%

ILLUSTRATIVE PRO-FORMA OWNERSHIP²

Tiga Public Shareholders; 14%

(1) Forward purchase agreement assumes a range of $50M - $100M.

(2) Excludes shares underlying public and private warrants. Assumes no redemptions and a nominal price per share of $10.00, subject to customary closing conditions, including the approval of Tiga shareholders.

(3) Assumes no redemptions of public shares. Assumes Grindr's outstanding debt at closing amounts to $75M after repaying of Tiga sponsor loans. Net Debt may be larger than stated as a result of increasing levels of redemptions.

(4) Tiga cash in trust assumes no redemptions; cash may be reduced, including to the extent of Tiga stockholder redemptions.

(5) Does not include aggregate in the money option and warrant exercise price. Current Grindr equityholders will roll approximately 78% of their existing equity holdings into equity of the combined company.

(6) Approximately $230 million of Shareholder Distribution is expected to go toward payment of deferred consideration.

$284.4

100.0

88.0

75.0

1,598.6

$2,146.0

Sponsor; 3%

$1,598.6

370.0

15.1

137.3

25.0

$2,146.0

FPA Shareholders;

5%

CONFIDENTIAL

5View entire presentation