Masterworks Investor Update

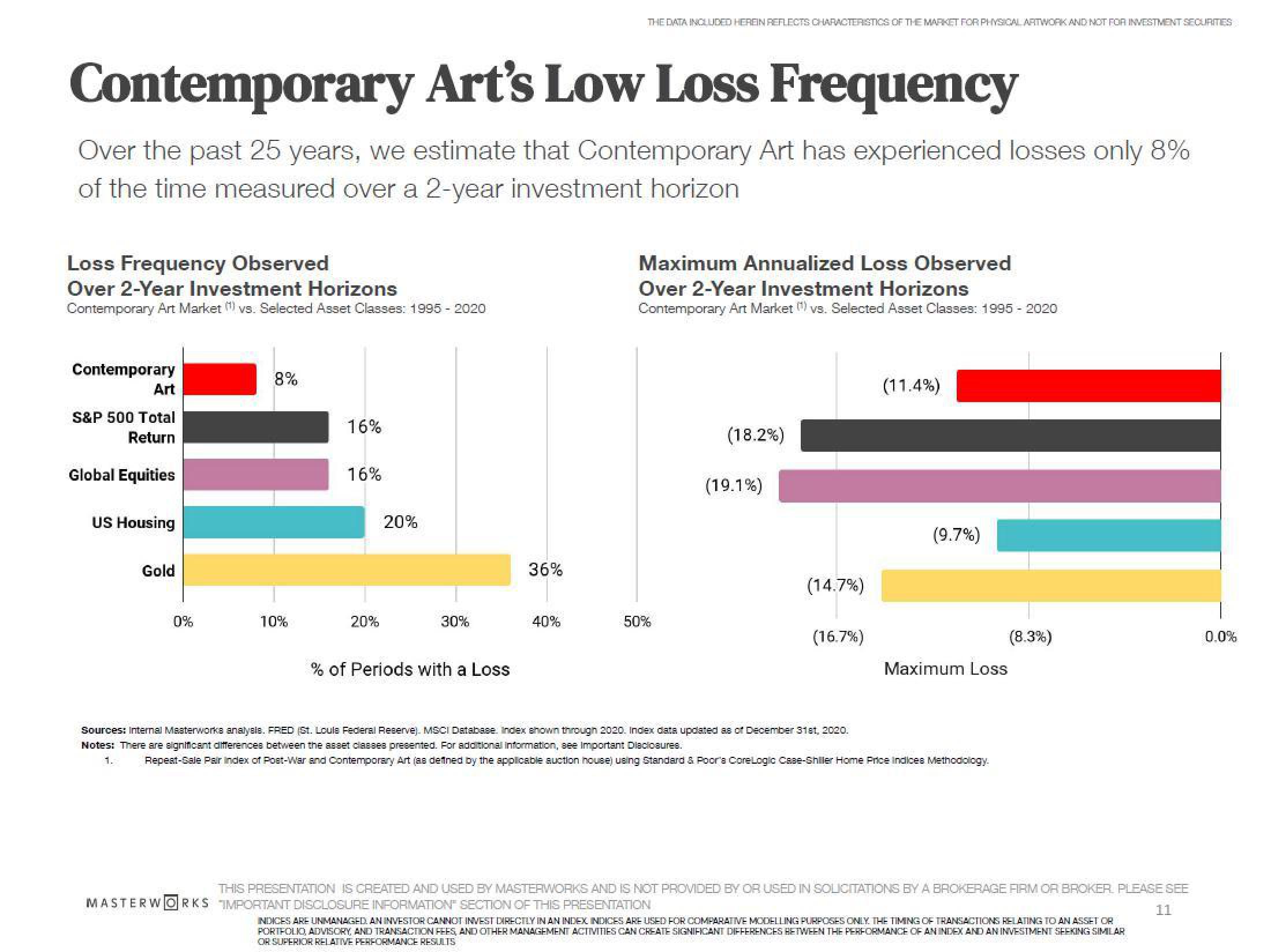

Contemporary Art's Low Loss Frequency

Over the past 25 years, we estimate that Contemporary Art has experienced losses only 8%

of the time measured over a 2-year investment horizon

Loss Frequency Observed

Over 2-Year Investment Horizons

Contemporary Art Market (¹) vs. Selected Asset Classes: 1995 - 2020

Contemporary

Art

S&P 500 Total

Return

Global Equities

US Housing

Gold

0%

8%

10%

16%

16%

20%

20%

30%

% of Periods with a Loss

36%

THE DATA INCLUDED HEREIN REFLECTS CHARACTERISTICS OF THE MARKET FOR PHYSICAL ARTWORK AND NOT FOR INVESTMENT SECURITIES

40%

Maximum Annualized Loss Observed

Over 2-Year Investment Horizons

Contemporary Art Market (¹) vs. Selected Asset Classes: 1995 - 2020

50%

(18.2%)

(19.1%)

MASTERWORKS IMPORTANT DISCLOSURE INFORMATION SECTION OF THIS PRESENTATION

(14.7%)

(16.7%)

(11.4%)

(9.7%)

Maximum Loss

Sources: Internal Masterworks analysis. FRED (St. Loula Federal Reserve). MSCI Database. Index shown through 2020. Index data updated as of December 31st, 2020.

Notes: There are significant differences between the asset classes presented. For additional information, see Important Diaclosures.

1.

Repest-Sale Pair index of Post-War and Contemporary Art (as defined by the applicable auction house) using Standard & Poor's Core Logic Case-Shiller Home Price Indices Methodology

(8.3%)

THIS PRESENTATION IS CREATED AND USED BY MASTERWORKS AND IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A BROKERAGE FIRM OR BROKER. PLEASE SEE

11

INDICES ARE UNMANAGED. AN INVESTOR CANNOT INVEST DIRECTLY IN AN INDEX INDICES ARE USED FOR COMPARATIVE MODELLING PURPOSES ONLY THE TIMING OF TRANSACTIONS RELATING TO AN ASSET OR

PORTFOLIO, ADVISORY, AND TRANSACTION FEES, AND OTHER MANAGEMENT ACTIVITIES CAN CREATE SIGNIFICANT DIFFERENCES BETWEEN THE PERFORMANCE OF AN INDEX AND AN INVESTMENT SEEKING SIMILAR

OR SUPERIOR RELATIVE PERFORMANCE RESULTS

0.0%View entire presentation