Kinnevik Results Presentation Deck

CHALLENGING MARKETS CONTINUES TO PUT PRESSURE ON GROWTH INVESTING

WHILE ALSO PRESENTING LONGER-TERM OPPORTUNITIES

budbee

instabox

Note:

Solugen

monese

H2green steel

Highlights of The Quarter

Q3 2022

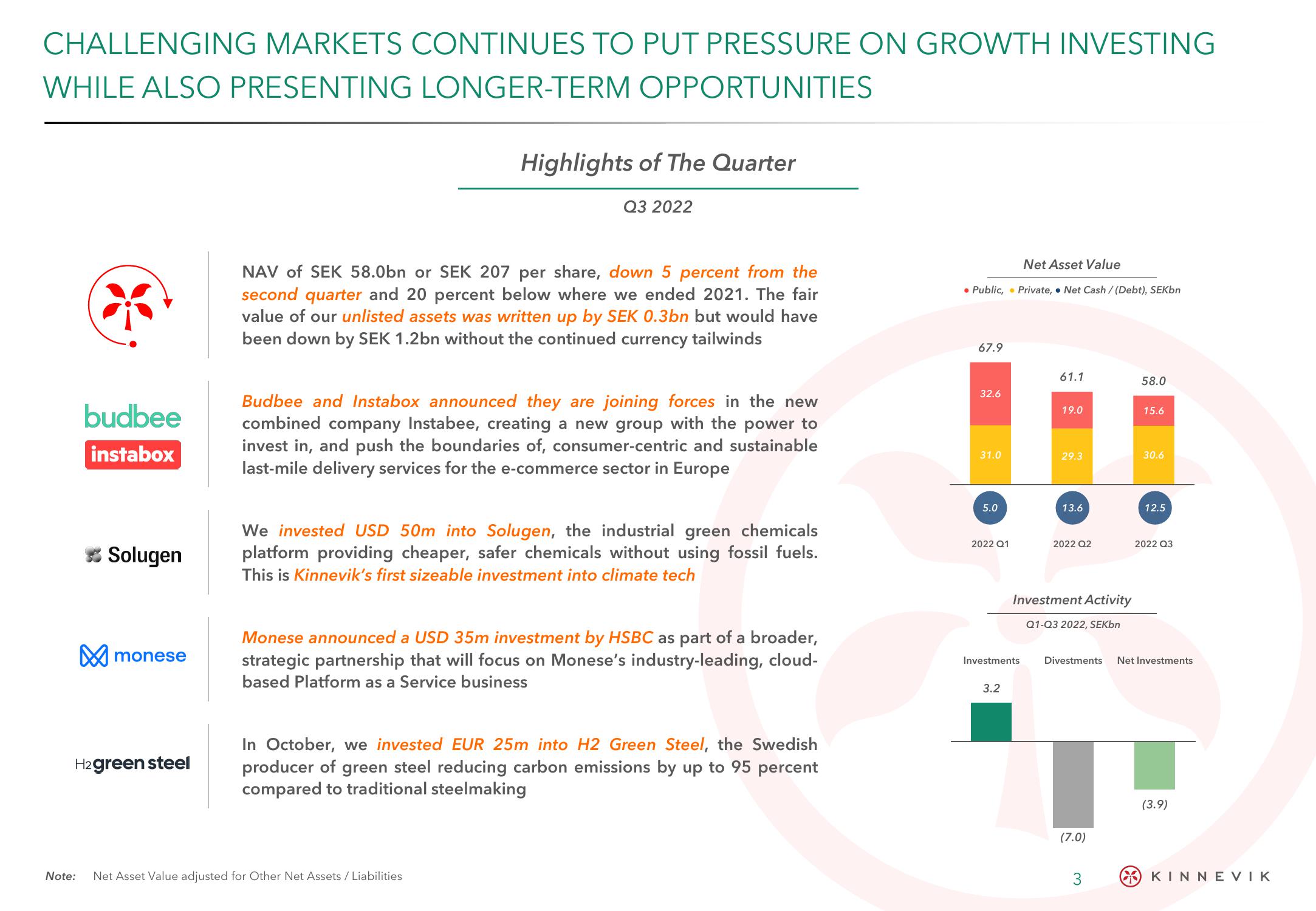

NAV of SEK 58.0bn or SEK 207 per share, down 5 percent from the

second quarter and 20 percent below where we ended 2021. The fair

value of our unlisted assets was written up by SEK 0.3bn but would have

been down by SEK 1.2bn without the continued currency tailwinds

Budbee and Instabox announced they are joining forces in the new

combined company Instabee, creating a new group with the power to

invest in, and push the boundaries of, consumer-centric and sustainable

last-mile delivery services for the e-commerce sector in Europe

We invested USD 50m into Solugen, the industrial green chemicals

platform providing cheaper, safer chemicals without using fossil fuels.

This is Kinnevik's first sizeable investment into climate tech

Monese announced a USD 35m investment by HSBC as part of a broader,

strategic partnership that will focus on Monese's industry-leading, cloud-

based Platform as a Service business

Net Asset Value adjusted for Other Net Assets / Liabilities

In October, we invested EUR 25m into H2 Green Steel, the Swedish

producer of green steel reducing carbon emissions by up to 95 percent

compared to traditional steelmaking

Net Asset Value

• Public, Private, Net Cash / (Debt), SEKbn

67.9

32.6

31.0

5.0

2022 Q1

Investments

3.2

61.1

19.0

29.3

13.6

2022 Q2

Investment Activity

Q1-Q3 2022, SEKbn

(7.0)

58.0

3

15.6

30.6

12.5

Divestments Net Investments

2022 Q3

(3.9)

KINNEVIKView entire presentation