LionTree Investment Banking Pitch Book

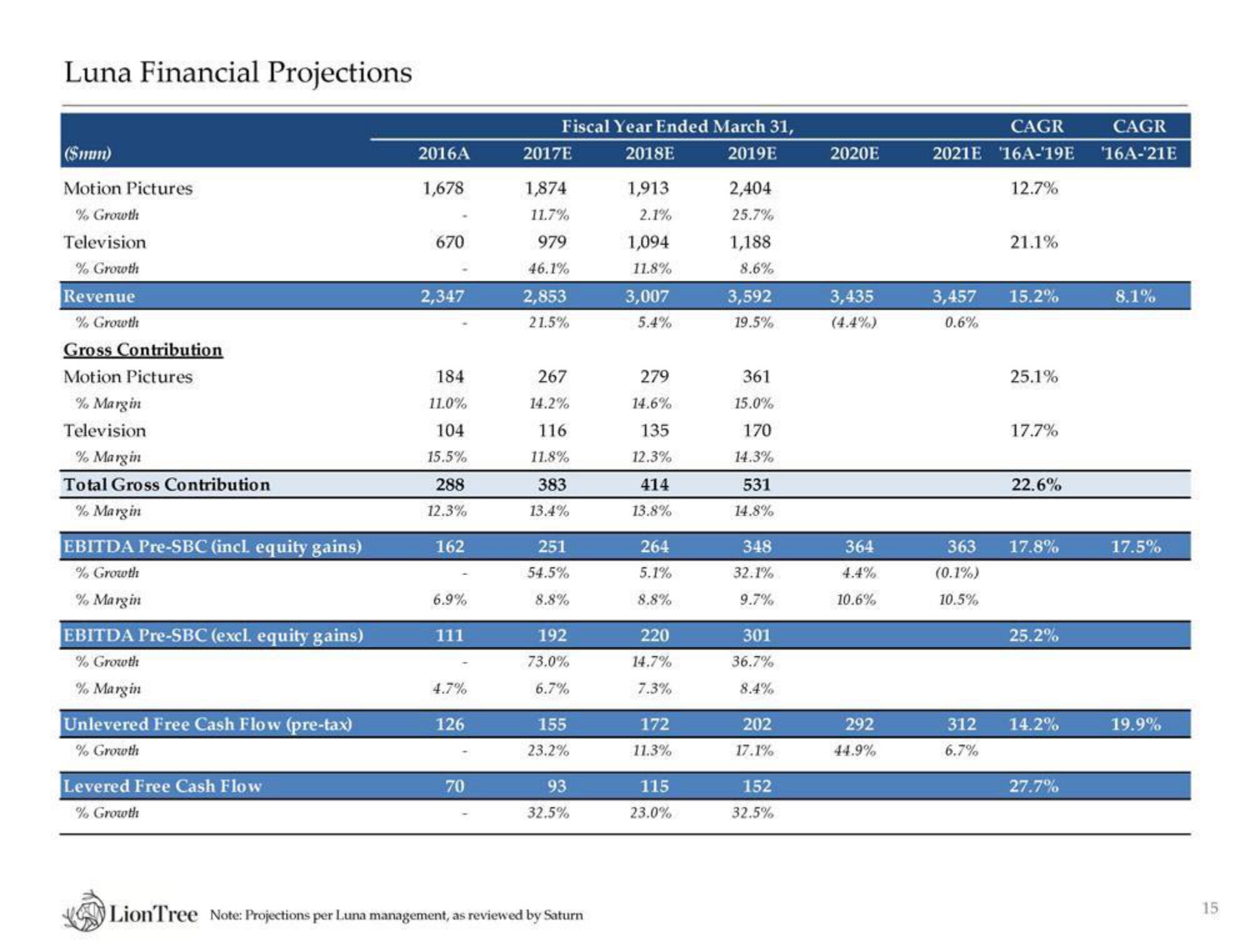

Luna Financial Projections

($mm)

Motion Pictures

% Growth

Television

% Growth

Revenue

% Growth

Gross Contribution

Motion Pictures

% Margin

Television

% Margin

Total Gross Contribution

% Margin

EBITDA Pre-SBC (incl. equity gains)

% Growth

% Margin

EBITDA Pre-SBC (excl. equity gains)

% Growth

% Margin

Unlevered Free Cash Flow (pre-tax)

% Growth

Levered Free Cash Flow

% Growth

2016A

1,678

670

2,347

184

11.0%

104

15.5%

288

12.3%

162

6.9%

111

4.7%

126

70

Fiscal Year Ended March 31,

2018E

2019E

2017E

1,874

11.7%

979

46.1%

2,853

21.5%

267

14.2%

116

11.8%

383

13.4%

251

54.5%

8.8%

192

73.0%

6.7%

155

23.2%

93

32.5%

LionTree Note: Projections per Luna management, as reviewed by Saturn

1,913

2.1%

1,094

11.8%

3,007

5.4%

279

14.6%

135

12.3%

414

13.8%

264

5.1%

8.8%

220

14.7%

7.3%

172

11.3%

115

23.0%

2,404

25.7%

1,188

8.6%

3,592

19.5%

361

15.0%

170

14.3%

531

14.8%

348

32.1%

9.7%

301

36.7%

8.4%

202

17.1%

152

32.5%

2020E

3,435

364

4.4%

10.6%

292

44.9%

CAGR

CAGR

2021E 16A-'19E '16A-¹21E

12.7%

3,457 15.2%

0.6%

363

(0.1%)

10.5%

21.1%

312

6.7%

25.1%

17.7%

22.6%

17.8%

25.2%

14.2%

27.7%

8.1%

17.5%

19.9%

15View entire presentation