Maersk Investor Presentation Deck

Key statements

Strategic Transformation update

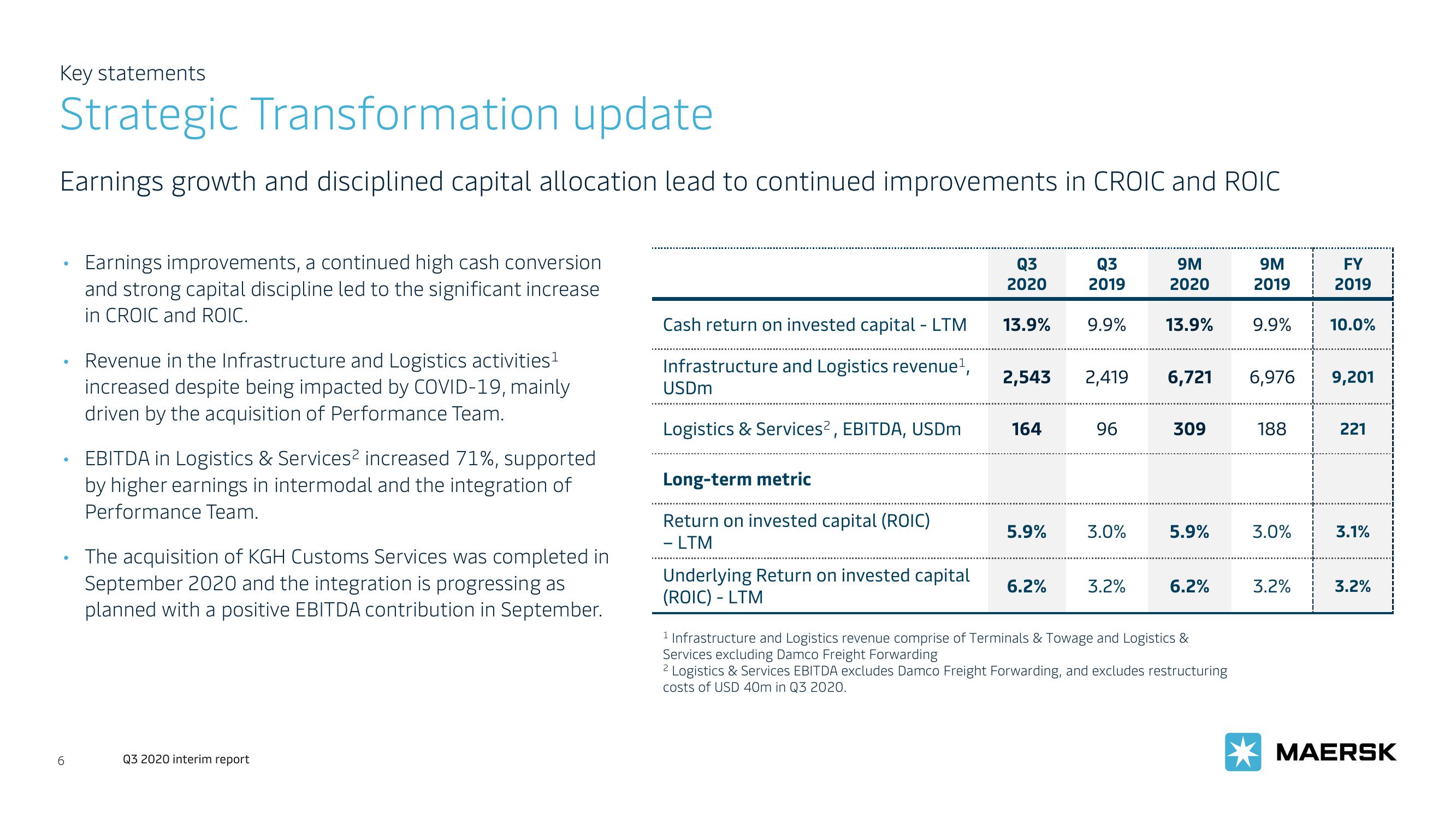

Earnings growth and disciplined capital allocation lead to continued improvements in CROIC and ROIC

●

Earnings improvements, a continued high cash conversion

and strong capital discipline led to the significant increase

in CROIC and ROIC.

• EBITDA in Logistics & Services² increased 71%, supported

by higher earnings in intermodal and the integration of

Performance Team.

6

Revenue in the Infrastructure and Logistics activities¹

increased despite being impacted by COVID-19, mainly

driven by the acquisition of Performance Team.

The acquisition of KGH Customs Services was completed in

September 2020 and the integration is progressing as

planned with a positive EBITDA contribution in September.

Q3 2020 interim report

Cash return on invested capital - LTM

Infrastructure and Logistics revenue¹,

USDm

Logistics & Services², EBITDA, USDm

Long-term metric

Return on invested capital (ROIC)

- LTM

Underlying Return on invested capital

(ROIC) - LTM

Q3

2020

13.9% 9.9%

2,543

164

5.9%

Q3

2019

6.2%

2,419

96

3.0%

3.2%

9M

2020

13.9%

309

6,721 6,976

5.9%

6.2%

9M

2019

¹ Infrastructure and Logistics revenue comprise of Terminals & Towage and Logistics &

Services excluding Damco Freight Forwarding

2 Logistics & Services EBITDA excludes Damco Freight Forwarding, and excludes restructuring

costs of USD 40m in Q3 2020.

9.9%

188

3.0%

3.2%

FY

2019

10.0%

9,201

221

3.1%

3.2%

MAERSKView entire presentation