Oatly IPO Presentation Deck

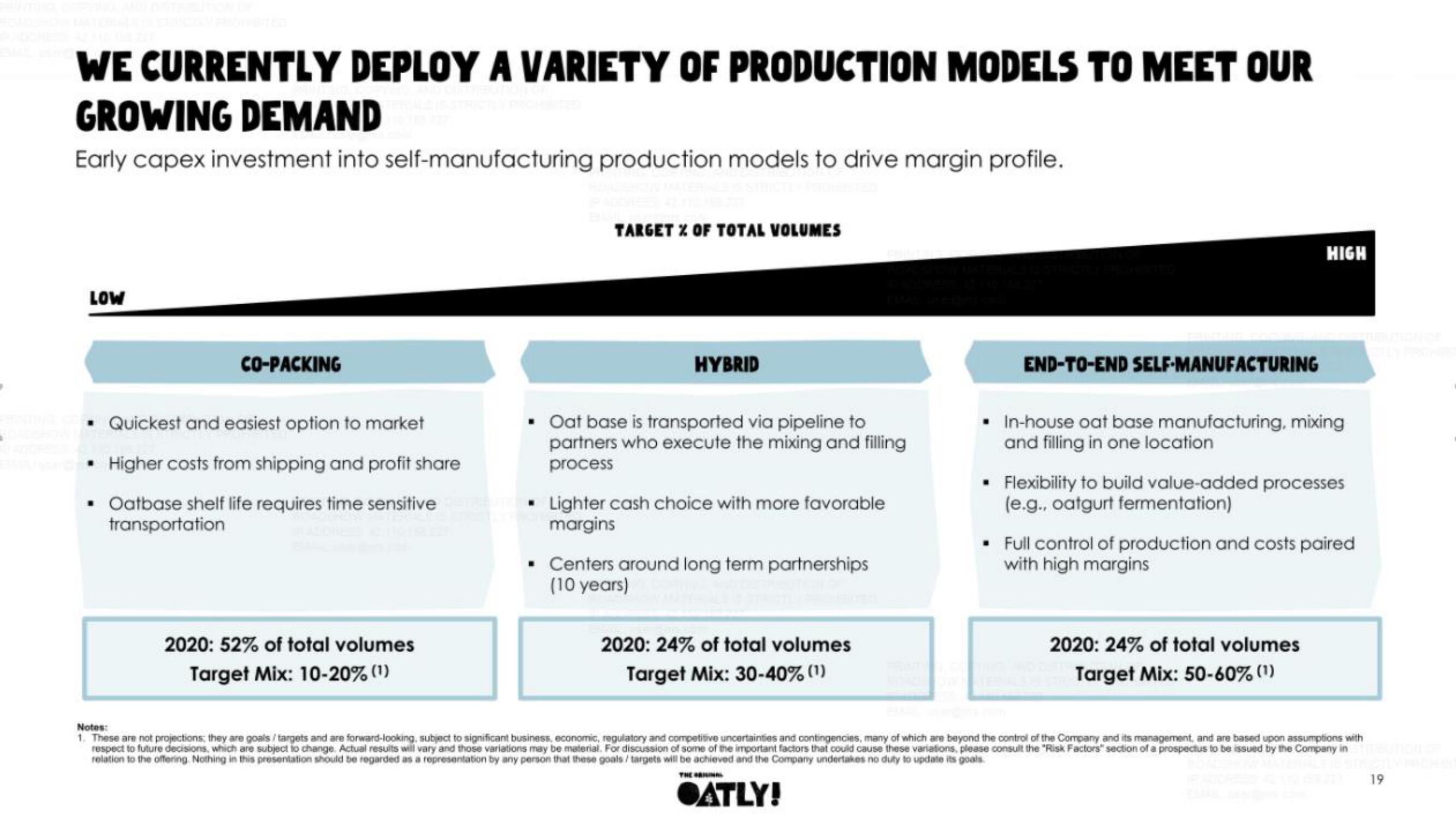

WE CURRENTLY DEPLOY A VARIETY OF PRODUCTION MODELS TO MEET OUR

GROWING DEMAND

Early capex investment into self-manufacturing production models to drive margin profile.

LOW

CO-PACKING

• Quickest and easiest option to market

•

Higher costs from shipping and profit share

Oatbase shelf life requires time sensitive

transportation

2020: 52% of total volumes

Target Mix: 10-20% (¹)

TARGET % OF TOTAL VOLUMES

HYBRID

Oat base is transported via pipeline to

partners who execute the mixing and filling

process

▪ Lighter cash choice with more favorable

margins

Centers around long term partnerships

(10 years)

2020:24% of total volumes

Target Mix: 30-40% (¹)

END-TO-END SELF-MANUFACTURING

OATLY!

HIGH

• In-house oat base manufacturing, mixing

and filling in one location

Flexibility to build value-added processes

(e.g., oatgurt fermentation)

. Full control of production and costs paired

with high margins

2020: 24% of total volumes

Target Mix: 50-60% (¹)

Notes:

1. These are not projections; they are goals/targets and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with

respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk Factors" section of a prospectus to be issued by the Company into OF

relation to the offering. Nothing in this presentation should be regarded as a representation by any person that these goals/ targets will be achieved and the Company undertakes no duty to update its goals.

THE ORIGINAL

19View entire presentation