J.P.Morgan Investment Banking Pitch Book

VALUATION ANALYSIS

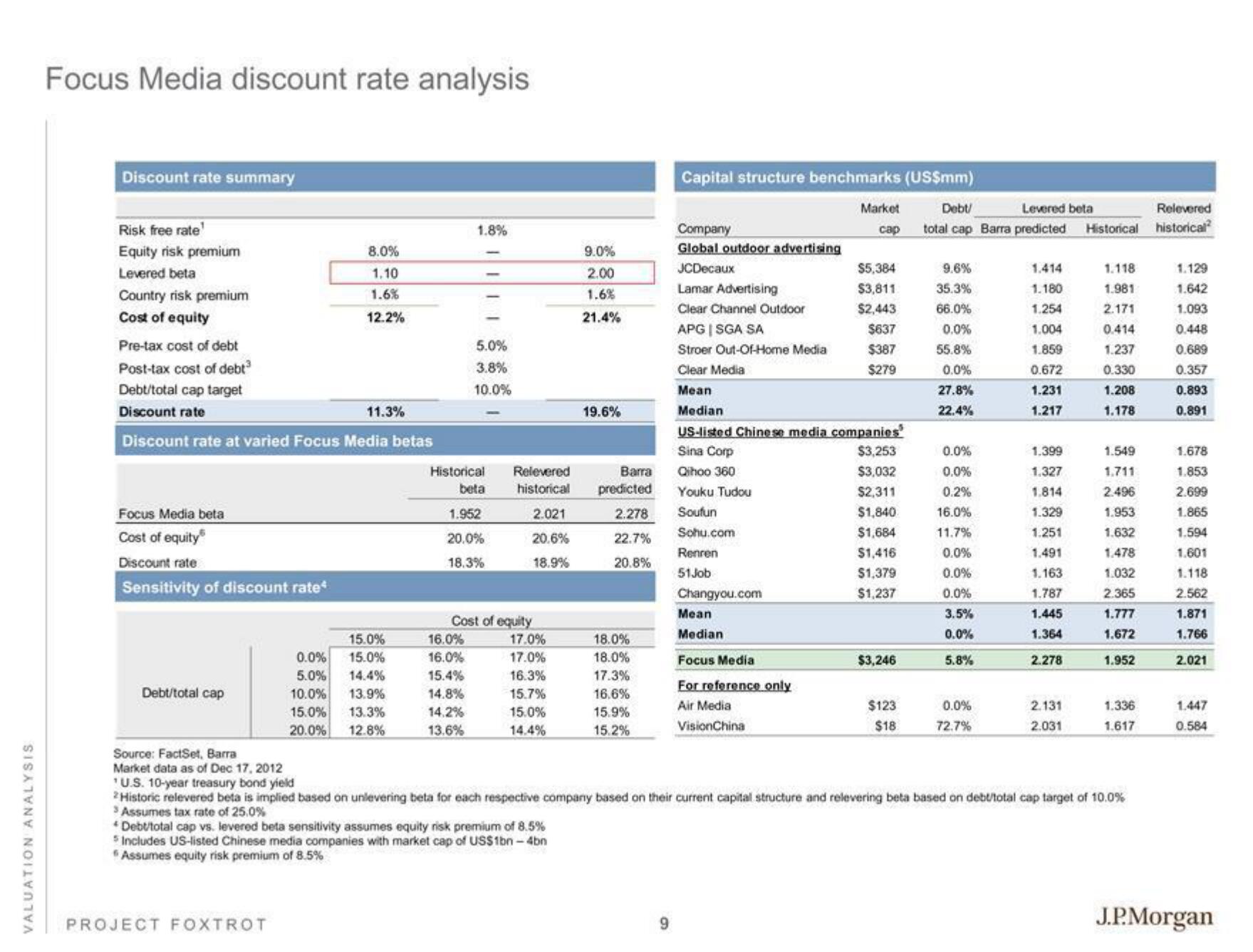

Focus Media discount rate analysis

Discount rate summary

Risk free rate¹

Equity risk premium

Levered beta

Country risk premium

Cost of equity

Pre-tax cost of debt

Post-tax cost of debt³

Debt/total cap target

Discount rate

11.3%

Discount rate at varied Focus Media betas

Focus Media beta

Cost of equity

Discount rate

Sensitivity of discount rate*

Debt/total cap

8.0%

1.10

1.6%

12.2%

15.0%

0.0% 15.0%

5.0% 14.4%

10.0% 13.9%

15.0% 13.3%

20.0% 12.8%

PROJECT FOXTROT

1.8%

5.0%

3.8%

10.0%

Historical

beta

1.952

20.0%

18.3%

16.0%

16.0%

15.4%

14.8%

14.2%

13.6%

Cost of equit

Relevered

Barra

historical predicted

2.021

2.278

20.6%

22.7%

18.9%

20.8%

17.0%

17.0%

16.3%

15.7%

15.0%

14.4%

9.0%

2.00

1.6%

21.4%

*Debt/total cap vs. levered beta sensitivity assumes equity risk premium of 8.5%

5 Includes US-listed Chinese media companies with market cap of US$1bn-4bn

Assumes equity risk premium of 8.5%

19.6%

18.0%

18.0%

17.3%

16.6%

15.9%

15.2%

Capital structure benchmarks (US$mm)

9

Company

Global outdoor advertising

JCDecaux

Lamar Advertising

Clear Channel Outdoor

APG | SGA SA

Stroer Out-Of-Home Media

Clear Media

Mean

Median

US-listed Chinese media companies

$3,253

$3,032

$2,311

$1,840

$1,684

$1,416

$1,379

$1,237

Sina Corp

Gihoo 360

Youku Tudou

Soufun

Sohu.com

Renren

51Job

Changyou.com

Mean

Median

Market

cap

Focus Media

For reference only

Air Media

VisionChina

$5,384

$3,811

$2,443

$637

$387

$279

$3,246

$123

$18

Debt/

total cap Barra predicted

9.6%

35.3%

66.0%

55.8%

0.0%

27.8%

22.4%

0.0%

0.0%

0.2%

16.0%

11.7%

0.0%

0.0%

0.0%

3.5%

0.0%

5.8%

0.0%

72.7%

Levered beta

1.414

1.180

1.254

1.004

1.859

0.672

1.231

1.217

1.399

1.327

1.814

1.329

1.251

1.491

1.163

1.787

1.445

1.364

2.278

2.131

2.031

Historical

1.118

1.981

2.171

1.237

0.330

1.208

1.178

Source: FactSet, Barra

Market data as of Dec 17, 2012

U.S. 10-year treasury bond yield

Historic relevered beta is implied based on unlevering beta for each respective company based on their current capital structure and relevering beta based on debutotal cap target of 10.0%

3 Assumes tax rate of 25.0%

1.549

1.711

2.496

1.953

1.632

1.478

1.032

2.365

1.777

1.672

1.952

1.336

1.617

Relevered

historical²

1.129

1.642

1.093

148

0.689

0.357

0.893

0.891

1.678

1.853

2.699

1.865

1.594

1.601

1.118

2.562

1.871

1.766

2.021

1.447

0.584

J.P.MorganView entire presentation