Frontier IPO Presentation Deck

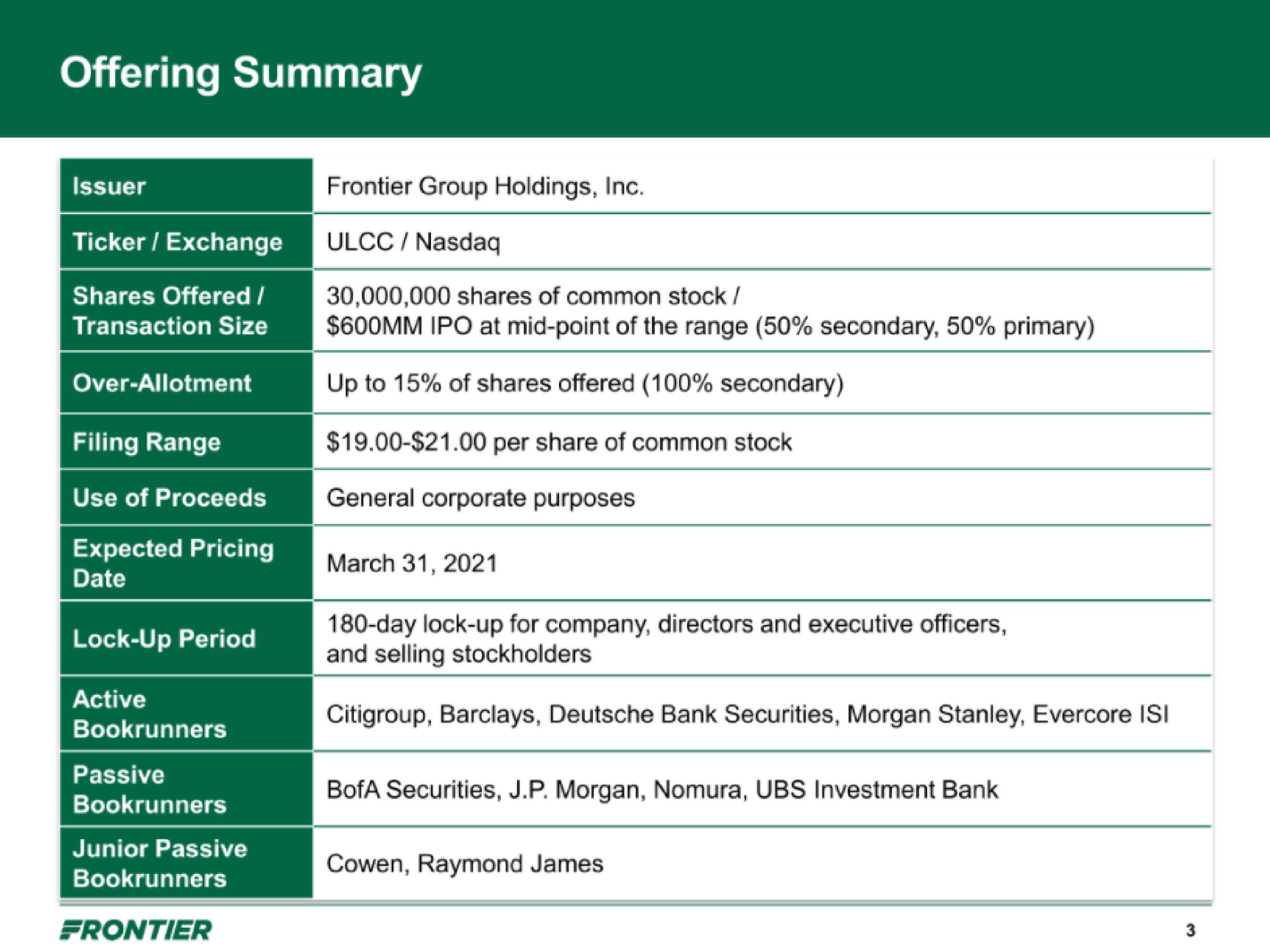

Offering Summary

Issuer

Ticker / Exchange

Shares Offered /

Transaction Size

Over-Allotment

Filing Range

Use of Proceeds

Expected Pricing

Date

Lock-Up Period

Active

Bookrunners

Passive

Bookrunners

Junior Passive

Bookrunners

FRONTIER

Frontier Group Holdings, Inc.

ULCC / Nasdaq

30,000,000 shares of common stock /

$600MM IPO at mid-point of the range (50% secondary, 50% primary)

Up to 15% of shares offered (100% secondary)

$19.00-$21.00 per share of common stock.

General corporate purposes

March 31, 2021

180-day lock-up for company, directors and executive officers,

and selling stockholders

Citigroup, Barclays, Deutsche Bank Securities, Morgan Stanley, Evercore ISI

BofA Securities, J.P. Morgan, Nomura, UBS Investment Bank

Cowen, Raymond James

3View entire presentation