Blackwells Capital Activist Presentation Deck

PRO FORMA MONMOUTH + WPT

The NewCo. Would Be the 12th Largest Industrial Real Estate Company in the U.S.

Combining Monmouth and WPT's portfolio the NewCo would have over 220 buildings and over 60 million square feet of

industrial real estate space

With Monmouth's preexisting relationships in sourcing and acquiring newly built facilities and WPT's pipeline of

development the NewCo would have a healthy growth prospective both organically and inorganically

The NewCo would also solve the many issues that weigh upon Monmouth and WPT's valuations currently including the

FedEx exposure, inefficient debt structure, lack of rent escalators, and a refreshed and capable management team

The NewCo would also have one of the strongest portfolios in the industrial real estate space with 98% occupancy, an

average asset age of 12.2 years and a 6.1 year weighted average lease maturity

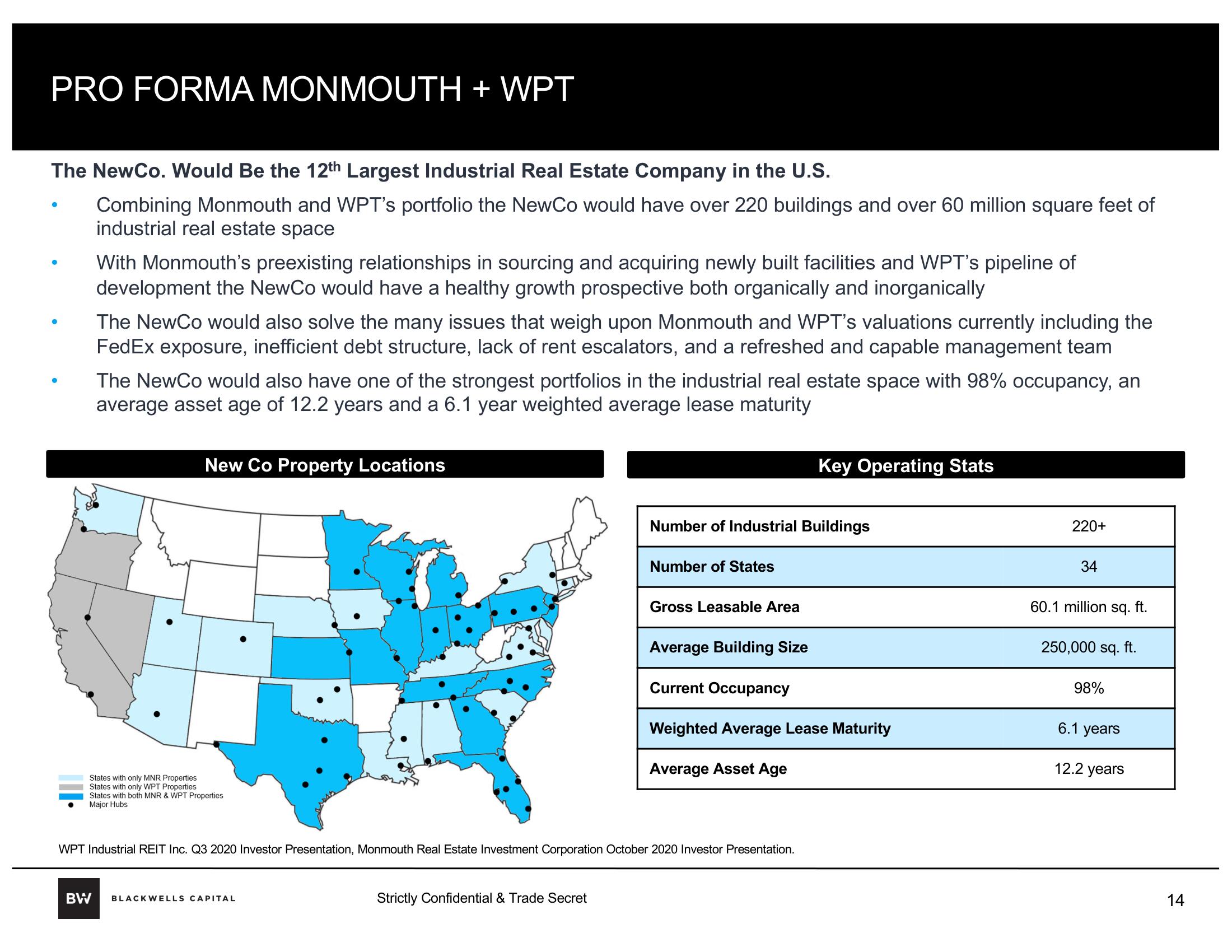

New Co Property Locations

States with only MNR Properties

States with only WPT Properties

States with both MNR & WPT Properties

Major Hubs

BW BLACKWELLS CAPITAL

Strictly Confidential & Trade Secret

Number of Industrial Buildings

Number of States

Gross Leasable Area

WPT Industrial REIT Inc. Q3 2020 Investor Presentation, Monmouth Real Estate Investment Corporation October 2020 Investor Presentation.

Key Operating Stats

Average Building Size

Current Occupancy

Weighted Average Lease Maturity

Average Asset Age

220+

34

60.1 million

sq.

98%

250,000 sq. ft.

6.1 years

ft.

12.2 years

14View entire presentation