FY 2017 Second Quarter Earnings Call

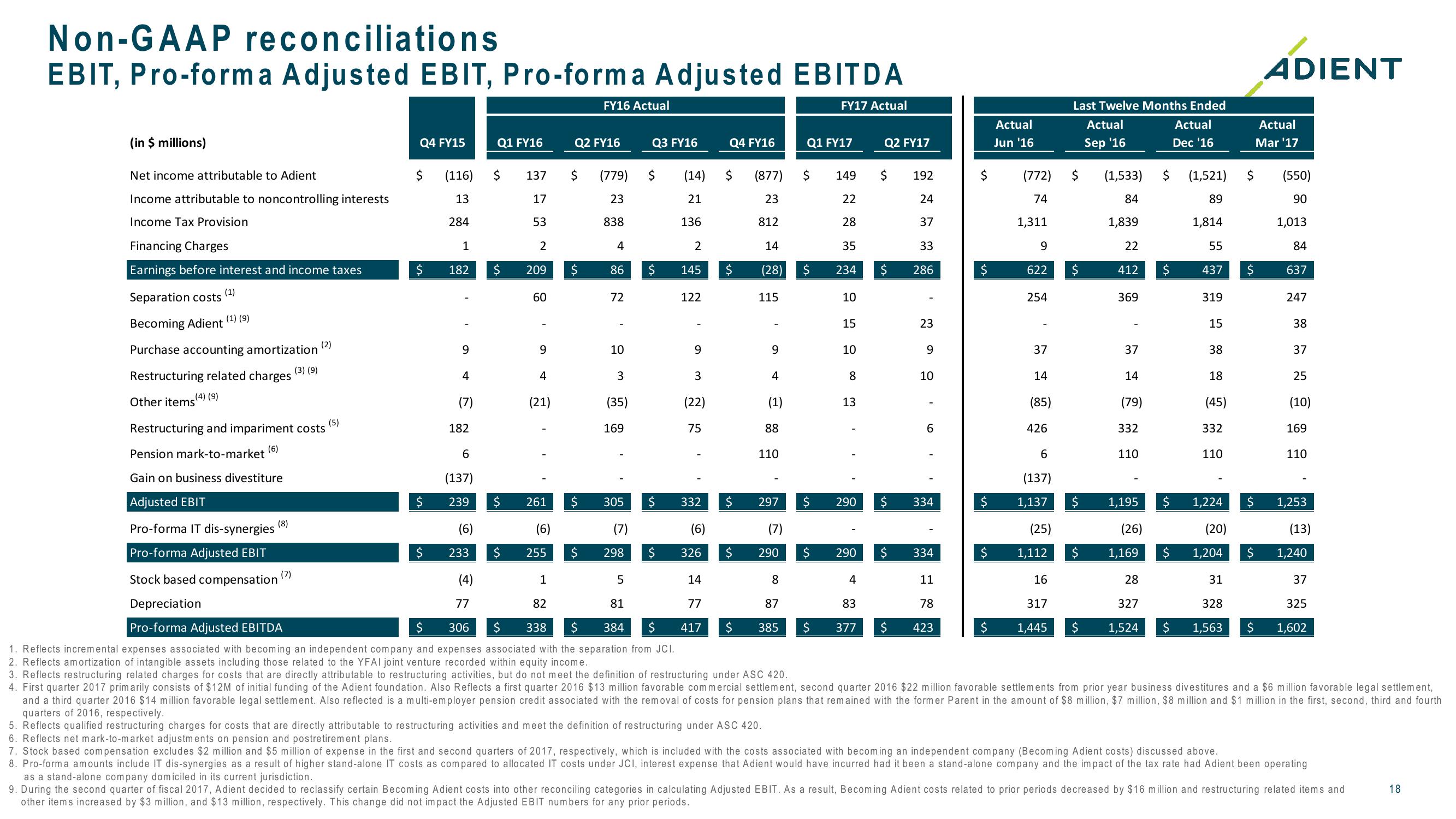

Non-GAAP reconciliations

EBIT, Pro-forma Adjusted EBIT, Pro-forma Adjusted EBITDA

FY16 Actual

FY17 Actual

Last Twelve Months Ended

ADIENT

Actual

(in $ millions)

Q4 FY15

Q1 FY16

Q2 FY16

Q3 FY16

Q4 FY16

Q1 FY17

Q2 FY17

Jun '16

Actual

Sep '16

Actual

Dec '16

Actual

Mar '17

Net income attributable to Adient

(116)

$

137

(779)

(14)

(877)

149

$

192

$

(772)

(1,533)

Income attributable to noncontrolling interests

13

17

23

21

23

22

24

74

84

(1,521)

89

(550)

90

Income Tax Provision

284

53

838

136

812

28

37

1,311

1,839

1,814

1,013

Financing Charges

Earnings before interest and income taxes

1

2

4

2

14

35

33

9

22

55

84

$

182

$

209

$

86

$

145

$

(28)

$

234

$

286

$

622

$

412

$

437

$

637

(1)

Separation costs

60

72

122

115

10

254

369

319

247

Becoming Adient

(1) (9)

15

23

15

38

(2)

Purchase accounting amortization

9

9

10

9

9

10

9

37

37

38

37

Restructuring related charges

Other items (4) (9)

(3) (9)

4

4

3

3

4

8

10

14

14

18

25

(7)

(21)

(35)

(22)

(1)

13

(85)

(79)

(45)

(10)

(5)

Restructuring and impariment costs

182

169

75

88

6

426

332

332

169

(6)

Pension mark-to-market

6

110

6

110

110

110

Gain on business divestiture

(137)

(137)

Adjusted EBIT

$

239

$

261

$

305

ՄԴ

332

es

$

297

$

290

334

1,137

$ 1,195

$

1,224

1,253

Pro-forma IT dis-synergies

(8)

(6)

(6)

(7)

(6)

(7)

(25)

(26)

(20)

(13)

Pro-forma Adjusted EBIT

$

233

$

255

$

298

$ 326

290

$

290

$

334

1,112

1,169 $

1,204 $

1,240

Stock based compensation

Depreciation

(7)

(4)

1

5

14

8

4

11

16

28

31

37

77

82

81

77

87

83

78

317

327

328

325

Pro-forma Adjusted EBITDA

$

306

$

338

$

384 $

417

$ 385

$

377

$

423

$

1,445 $

1,524

$

1,563 $

1,602

1. Reflects incremental expenses associated with becoming an independent company and expenses associated with the separation from JCI.

2. Reflects amortization of intangible assets including those related to the YFAI joint venture recorded within equity income.

3. Reflects restructuring related charges for costs that are directly attributable to restructuring activities, but do not meet the definition of restructuring under ASC 420.

4. First quarter 2017 primarily consists of $12M of initial funding of the Adient foundation. Also Reflects a first quarter 2016 $13 million favorable commercial settlement, second quarter 2016 $22 million favorable settlements from prior year business divestitures and a $6 million favorable legal settlement,

and a third quarter 2016 $14 million favorable legal settlement. Also reflected is a multi-employer pension credit associated with the removal of costs for pension plans that remained with the former Parent in the amount of $8 million, $7 million, $8 million and $1 million in the first, second, third and fourth

quarters of 2016, respectively.

5. Reflects qualified restructuring charges for costs that are directly attributable to restructuring activities and meet the definition of restructuring under ASC 420.

6. Reflects net mark-to-market adjustments on pension and postretirement plans.

7. Stock based compensation excludes $2 million and $5 million of expense in the first and second quarters of 2017, respectively, which is included with the costs associated with becoming an independent company (Becoming Adient costs) discussed above.

8. Pro-forma amounts include IT dis-synergies as a result of higher stand-alone IT costs as compared to allocated IT costs under JCI, interest expense that Adient would have incurred had it been a stand-alone company and the impact of the tax rate had Adient been operating

as a stand-alone company domiciled in its current jurisdiction.

9. During the second quarter of fiscal 2017, Adient decided to reclassify certain Becoming Adient costs into other reconciling categories in calculating Adjusted EBIT. As a result, Becoming Adient costs related to prior periods decreased by $16 million and restructuring related items and

other items increased by $3 million, and $13 million, respectively. This change did not impact the Adjusted EBIT numbers for any prior periods.

18View entire presentation