First Citizens BancShares Results Presentation Deck

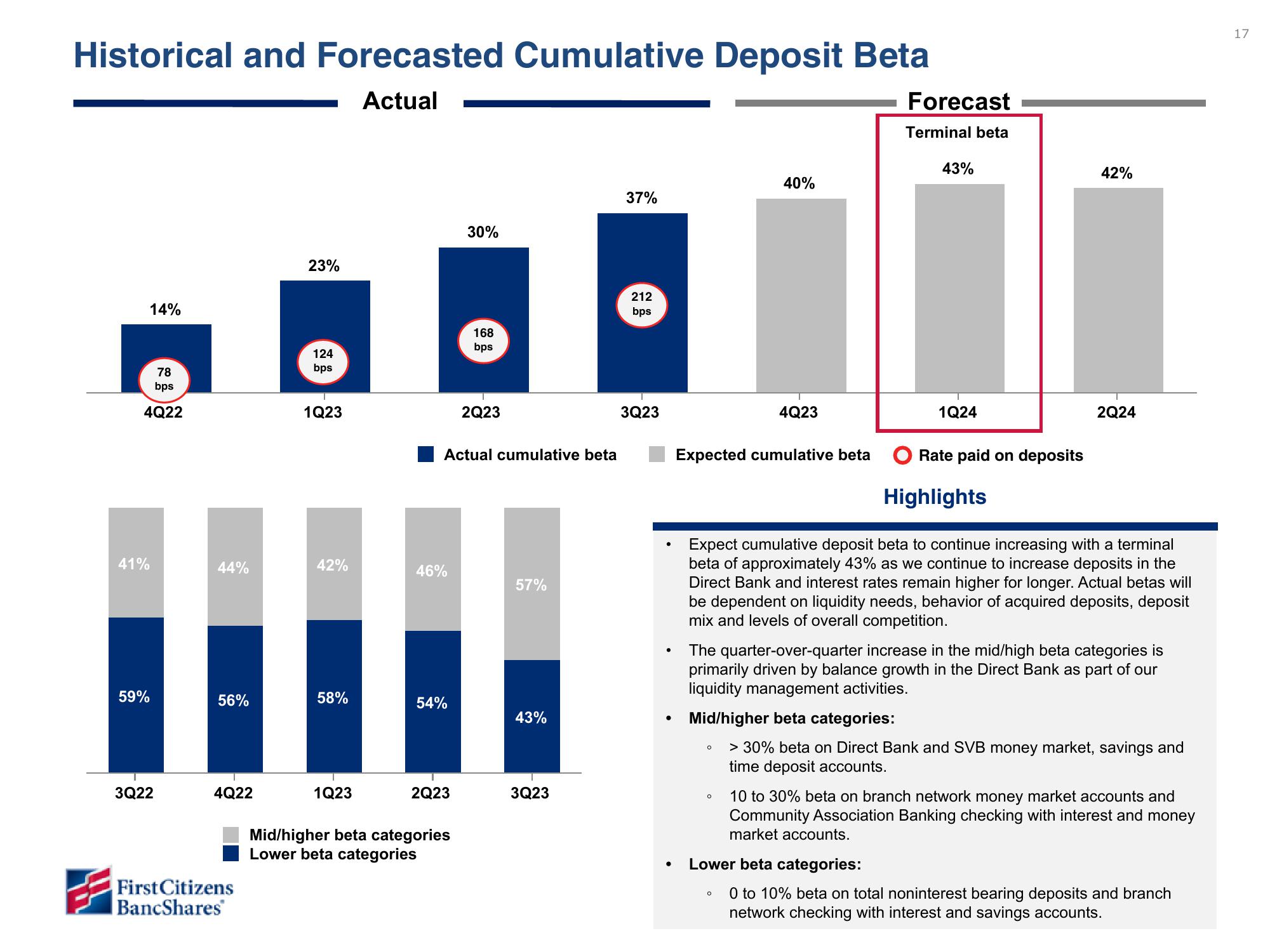

Historical and Forecasted Cumulative Deposit Beta

Actual

78

bps

4Q22

41%

14%

59%

3Q22

44%

56%

4Q22

First Citizens

BancShares

23%

124

bps

1Q23

42%

58%

1Q23

46%

54%

Actual cumulative beta

2Q23

30%

Mid/higher beta categories

Lower beta categories

168

bps

2Q23

57%

43%

3Q23

37%

212

bps

3Q23

●

●

Expected cumulative beta

40%

o

4Q23

O

Forecast

Terminal beta

O

43%

1Q24

Rate paid on deposits

Highlights

Expect cumulative deposit beta to continue increasing with a terminal

beta of approximately 43% as we continue to increase deposits in the

Direct Bank and interest rates remain higher for longer. Actual betas will

be dependent on liquidity needs, behavior of acquired deposits, deposit

mix and levels of overall competition.

42%

The quarter-over-quarter increase in the mid/high beta categories is

primarily driven by balance growth in the Direct Bank as part of our

liquidity management activities.

Mid/higher beta categories:

> 30% beta on Direct Bank and SVB money market, savings and

time deposit accounts.

2Q24

10 to 30% beta on branch network money market accounts and

Community Association Banking checking with interest and money

market accounts.

Lower beta categories:

0 to 10% beta on total noninterest bearing deposits and branch

network checking with interest and savings accounts.

17View entire presentation