Dragonfly Energy SPAC Presentation Deck

Adj.

EBITDA

Margin

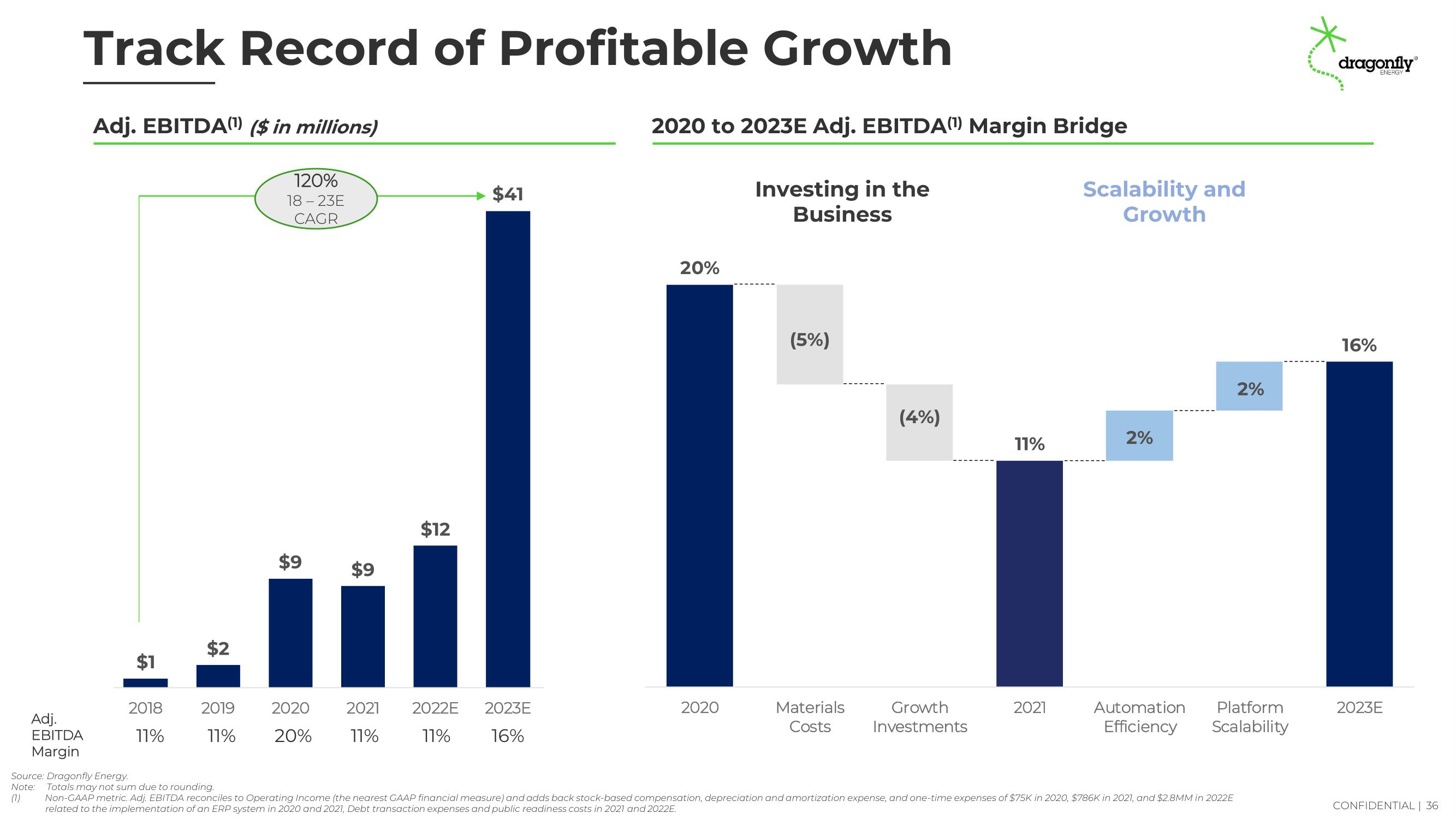

Track Record of Profitable Growth

Adj. EBITDA(¹) ($in millions)

120%

18-23E

CAGR

$1

MI

$12

$9 $9

2018

11%

$2

2019

11%

2020

20%

$41

2021 2022E

11%

11%

2020 to 2023E Adj. EBITDA(¹) Margin Bridge

Investing in the

Business

2023E

16%

20%

2020

(5%)

Materials

Costs

(4%)

Growth

Investments

11%

2021

Scalability and

Growth

2%

Automation

Efficiency

2%

Platform

Scalability

Source: Dragonfly Energy.

Note:

(7)

Totals may not sum due to rounding.

Non-GAAP metric. Adj. EBITDA reconciles to Operating Income (the nearest GAAP financial measure) and adds back stock-based compensation, depreciation and amortization expense, and one-time expenses of $75K in 2020, $786K in 2021, and $2.8MM in 2022E

related to the implementation of an ERP system in 2020 and 2021, Debt transaction expenses and public readiness costs in 2021 and 2022E.

dragonfly

ENERGY

16%

2023E

CONFIDENTIAL | 36View entire presentation