Disney Results Presentation Deck

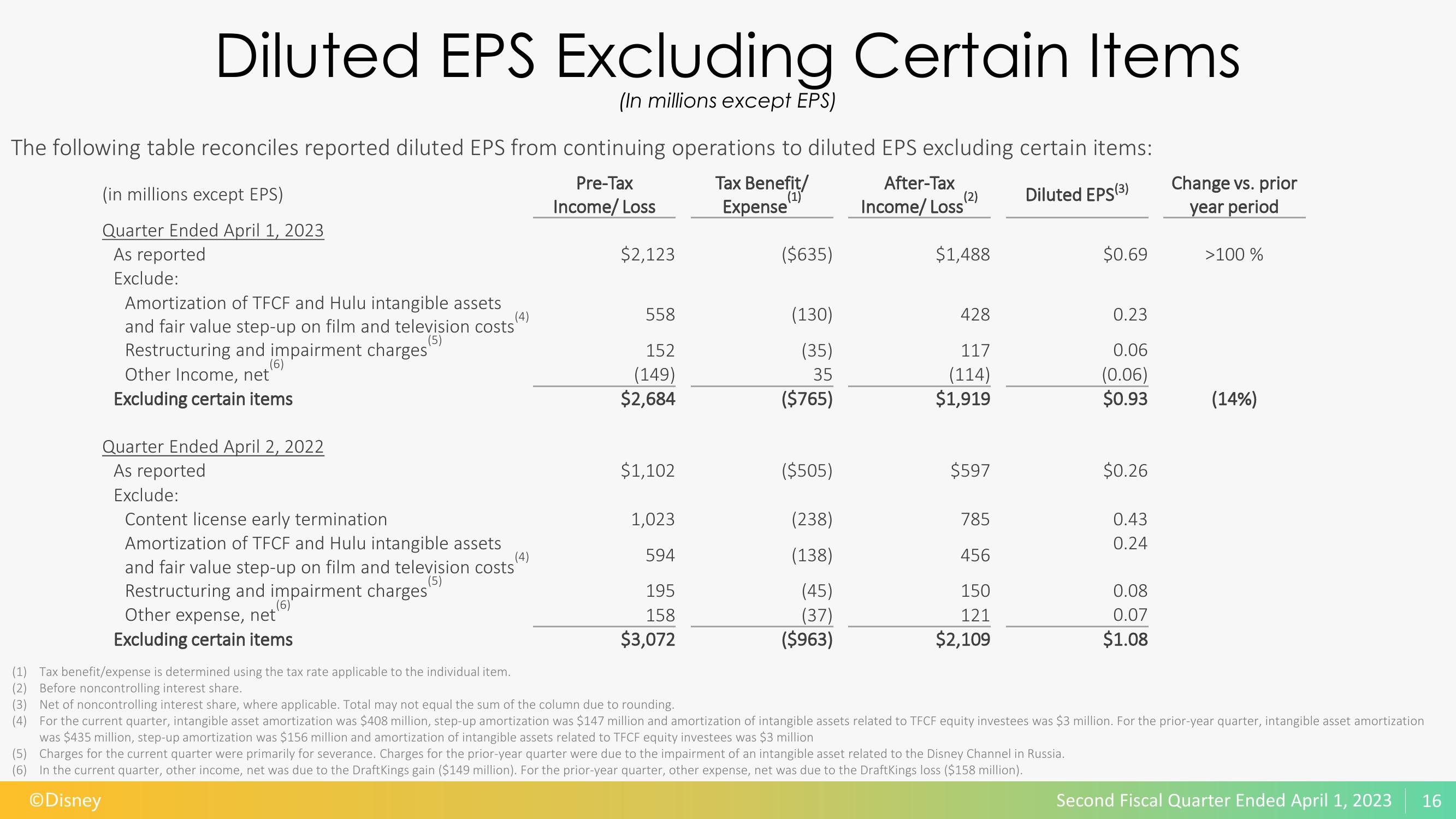

Diluted EPS Excluding Certain Items

(In millions except EPS)

The following table reconciles reported diluted EPS from continuing operations to diluted EPS excluding certain items:

Tax Benefit/

(1)

Expense

Diluted EPS (3)

(in millions except EPS)

Quarter Ended April 1, 2023

As reported

Exclude:

(4)

Amortization of TFCF and Hulu intangible assets

and fair value step-up on film and television costs

(5)

Restructuring and impairment charges

Other Income, net

(6)

Excluding certain items

Quarter Ended April 2, 2022

As reported

Exclude:

Content license early termination

(4)

Amortization of TFCF and Hulu intangible assets

and fair value step-up on film and television costs

Restructuring and impairment charges

Other expense, net

Excluding certain items

Pre-Tax

Income/ Loss

$2,123

558

152

(149)

$2,684

$1,102

1,023

594

195

158

$3,072

($635)

(130)

(35)

35

($765)

($505)

(238)

(138)

(45)

(37)

($963)

After-Tax

Income/Loss

(2)

$1,488

428

117

(114)

$1,919

$597

785

456

150

121

$2,109

$0.69

(5) Charges for the current quarter were primarily for severance. Charges for the prior-year quarter were due to the impairment of an intangible asset related to the Disney Channel in Russia.

(6) In the current quarter, other income, net was due to the DraftKings gain ($149 million). For the prior-year quarter, other expense, net was due to the DraftKings loss ($158 million).

ⒸDisney

0.23

0.06

(0.06)

$0.93

$0.26

0.43

0.24

0.08

0.07

$1.08

Change vs. prior

year period

>100 %

(14%)

(1) Tax benefit/expense is determined using the tax rate applicable to the individual item.

(2) Before noncontrolling interest share.

(3) Net of noncontrolling interest share, where applicable. Total may not equal the sum of the column due to rounding.

(4) For the current quarter, intangible asset amortization was $408 million, step-up amortization was $147 million and amortization of intangible assets related to TFCF equity investees was $3 million. For the prior-year quarter, intangible asset amortization

was $435 million, step-up amortization was $156 million and amortization of intangible assets related to TFCF equity investees was $3 million

Second Fiscal Quarter Ended April 1, 2023 16View entire presentation