Melrose Results Presentation Deck

Cash generation in the year

Melrose

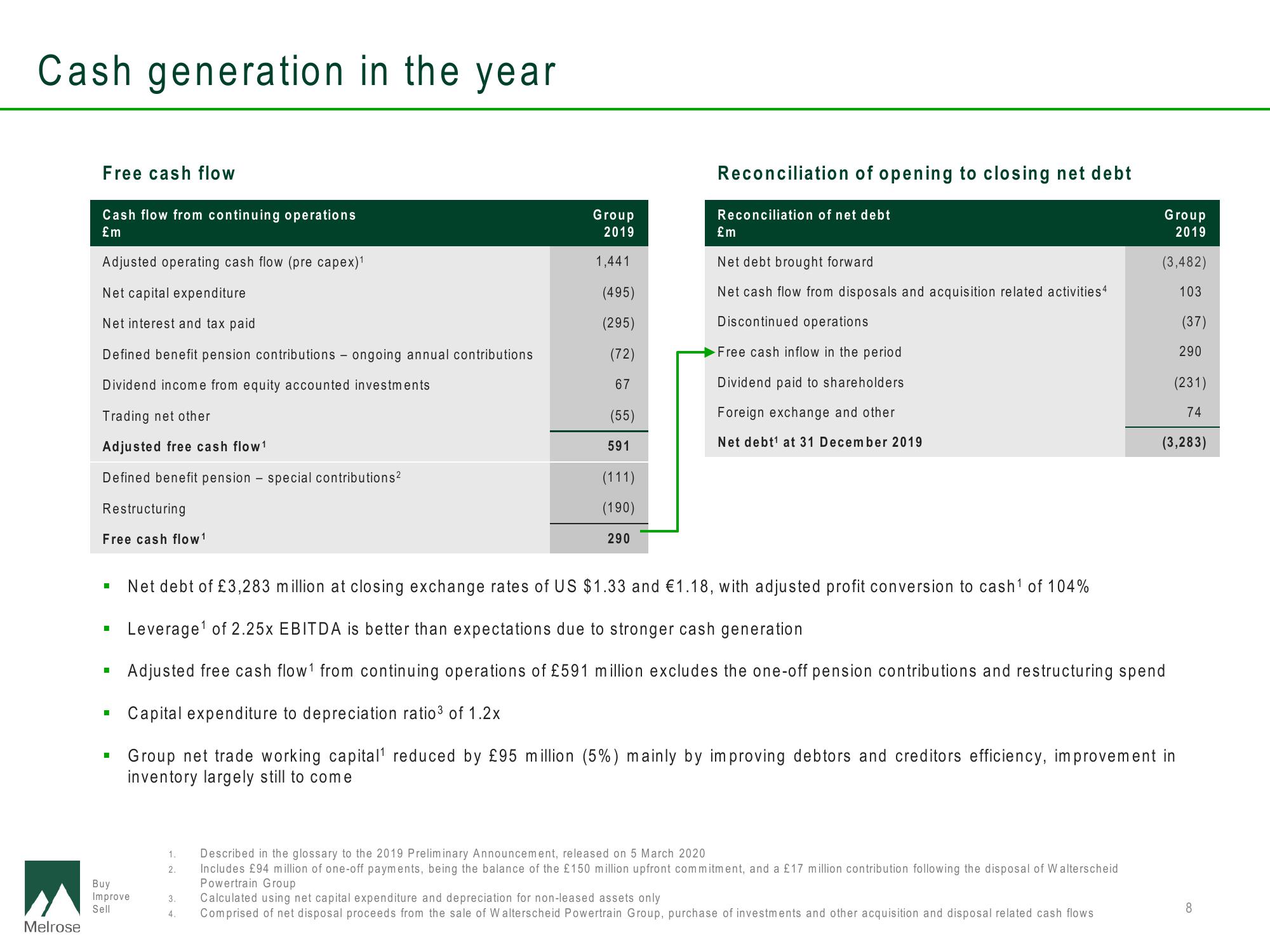

Free cash flow

Cash flow from continuing operations

£m

Adjusted operating cash flow (pre capex)¹

Net capital expenditure

Net interest and tax paid

Defined benefit pension contributions - ongoing annual contributions

Dividend income from equity accounted investments

Trading net other

Adjusted free cash flow 1

Defined benefit pension - special contributions²

Restructuring

Free cash flow 1

■

■

I

■

Buy

Improve

Sell

1.

2.

Group

2019

1,441

3.

4.

(495)

(295)

(72)

67

(55)

591

(111)

(190)

290

Reconciliation of opening to closing net debt

Reconciliation of net debt

£m

Net debt brought forward

Net cash flow from disposals and acquisition related activities 4

Discontinued operations

Free cash inflow in the period

Dividend paid to shareholders

Foreign exchange and other

Net debt¹ at 31 December 2019

Net debt of £3,283 million at closing exchange rates of US $1.33 and €1.18, with adjusted profit conversion to cash¹ of 104%

Leverage ¹ of 2.25x EBITDA is better than expectations due to stronger cash generation

Adjusted free cash flow¹ from continuing operations of £591 million excludes the one-off pension contributions and restructuring spend

Capital expenditure to depreciation ratio³ of 1.2x

Group net trade working capital¹ reduced by £95 million (5%) mainly by improving debtors and creditors efficiency, improvement in

inventory largely still to come

Group

2019

Described in the glossary to the 2019 Preliminary Announcement, released on 5 March 2020

Includes £94 million of one-off payments, being the balance of the £150 million upfront commitment, and a £17 million contribution following the disposal of Walterscheid

Powertrain Group

Calculated using net capital expenditure and depreciation for non-leased assets only

Comprised of net disposal proceeds from the sale of Walterscheid Powertrain Group, purchase of investments and other acquisition and disposal related cash flows

(3,482)

103

(37)

290

(231)

74

(3,283)

8View entire presentation