Experienced Senior Team Overview

ESG Considerations

■

■

■

AC

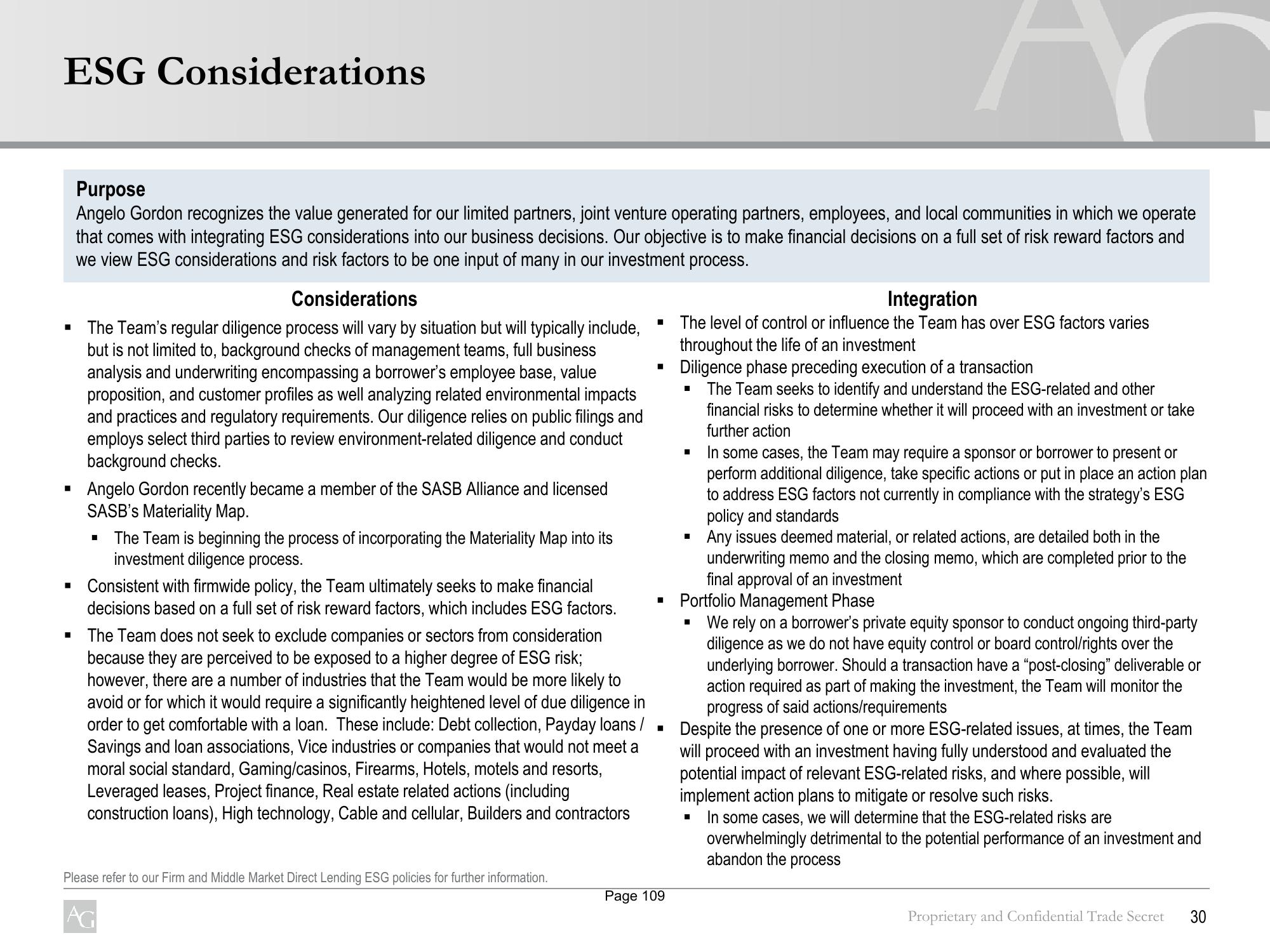

Purpose

Angelo Gordon recognizes the value generated for our limited partners, joint venture operating partners, employees, and local communities in which we operate

that comes with integrating ESG considerations into our business decisions. Our objective is to make financial decisions on a full set of risk reward factors and

we view ESG considerations and risk factors to be one input of many in our investment process.

I

Considerations

The Team's regular diligence process will vary by situation but will typically include,

but is not limited to, background checks of management teams, full business

analysis and underwriting encompassing a borrower's employee base, value

proposition, and customer profiles as well analyzing related environmental impacts

and practices and regulatory requirements. Our diligence relies on public filings and

employs select third parties to review environment-related diligence and conduct

background checks.

Angelo Gordon recently became a member of the SASB Alliance and licensed

SASB's Materiality Map.

The Team is beginning the process of incorporating the Materiality Map into its

investment diligence process.

Consistent with firmwide policy, the Team ultimately seeks to make financial

decisions based on a full set of risk reward factors, which includes ESG factors.

The Team does not seek to exclude companies or sectors from consideration

because they are perceived to be exposed to a higher degree of ESG risk;

however, there are a number of industries that the Team would be more likely to

avoid or for which it would require a significantly heightened level of due diligence in

order to get comfortable with a loan. These include: Debt collection, Payday loans /

Savings and loan associations, Vice industries or companies that would not meet a

moral social standard, Gaming/casinos, Firearms, Hotels, motels and resorts,

Leveraged leases, Project finance, Real estate related actions (including

construction loans), High technology, Cable and cellular, Builders and contractors

Please refer to our Firm and Middle Market Direct Lending ESG policies for further information.

AG

■

■

Page 109

Integration

The level of control or influence the Team has over ESG factors varies

throughout the life of an investment

Diligence phase preceding execution of a transaction

The Team seeks to identify and understand the ESG-related and other

financial risks to determine whether it will proceed with an investment or take

further action

I

In some cases, the Team may require a sponsor or borrower to present or

perform additional diligence, take specific actions or put in place an action plan

to address ESG factors not currently in compliance with the strategy's ESG

policy and standards

Any issues deemed material, or related actions, are detailed both in the

underwriting memo and the closing memo, which are completed prior to the

final approval of an investment

Portfolio Management Phase

We rely on a borrower's private equity sponsor to conduct ongoing third-party

diligence as we do not have equity control or board control/rights over the

underlying borrower. Should a transaction have a "post-closing" deliverable or

action required as part of making the investment, the Team will monitor the

progress of said actions/requirements

Despite the presence of one or more ESG-related issues, at times, the Team

will proceed with an investment having fully understood and evaluated the

potential impact of relevant ESG-related risks, and where possible, will

implement action plans to mitigate or resolve such risks.

In some cases, we will determine that the ESG-related risks are

overwhelmingly detrimental to the potential performance of an investment and

abandon the process

■

Proprietary and Confidential Trade Secret

30View entire presentation