FY 2023 Second Quarter Earnings Call

Cash flow

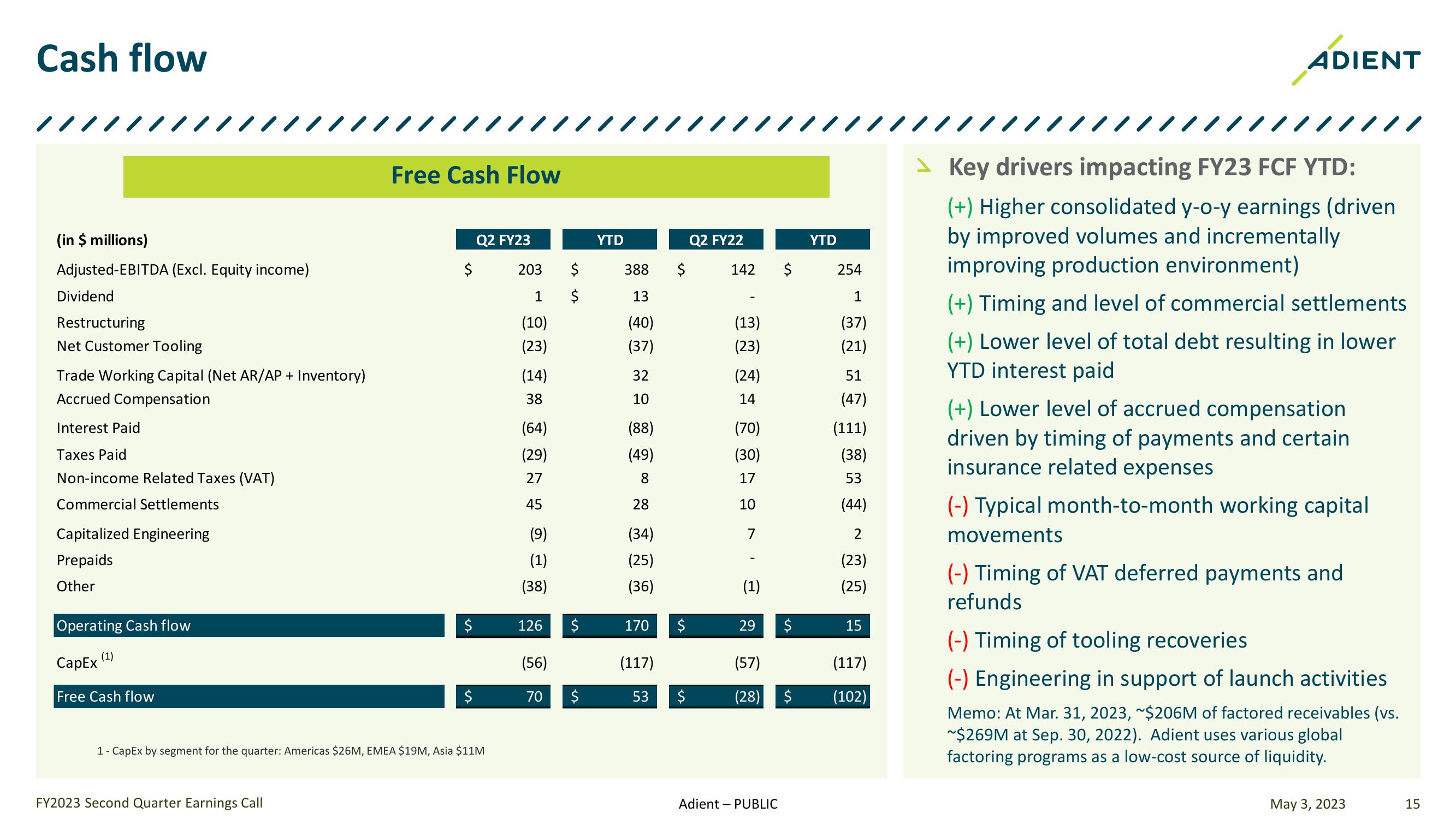

Free Cash Flow

(in $ millions)

Q2 FY23

YTD

Q2 FY22

YTD

Adjusted-EBITDA (Excl. Equity income)

$

203

$

388

$

142

$

254

Dividend

Restructuring

Net Customer Tooling

1

$

13

1

(10)

(40)

(13)

(37)

(23)

(37)

(23)

(21)

Trade Working Capital (Net AR/AP + Inventory)

(14)

32

(24)

51

Accrued Compensation

38

10

14

14

(47)

Interest Paid

(64)

(88)

(70)

(111)

Taxes Paid

(29)

(49)

(30)

(38)

Non-income Related Taxes (VAT)

27

8

17

53

Commercial Settlements

45

28

10

(44)

Capitalized Engineering

Prepaids

Other

Operating Cash flow

(9)

(34)

2

(1)

(25)

(23)

(38)

(36)

(1)

(25)

ՄՌ

$

126

$

170

$

29

$

15

(1)

CapEx

(56)

(117)

(57)

(117)

Free Cash flow

$

70

70

$

53

$

(28) $

(102)

1 - CapEx by segment for the quarter: Americas $26M, EMEA $19M, Asia $11M

FY2023 Second Quarter Earnings Call

Adient PUBLIC

ADIENT

→ Key drivers impacting FY23 FCF YTD:

(+) Higher consolidated y-o-y earnings (driven

by improved volumes and incrementally

improving production environment)

(+) Timing and level of commercial settlements

(+) Lower level of total debt resulting in lower

YTD interest paid

(+) Lower level of accrued compensation

driven by timing of payments and certain

insurance related expenses

(-) Typical month-to-month working capital

movements

(-) Timing of VAT deferred payments and

refunds

(-) Timing of tooling recoveries

(-) Engineering in support of launch activities

Memo: At Mar. 31, 2023, ~$206M of factored receivables (vs.

~$269M at Sep. 30, 2022). Adient uses various global

factoring programs as a low-cost source of liquidity.

May 3, 2023

15View entire presentation