Stem SPAC Presentation Deck

stem Financial Forecast

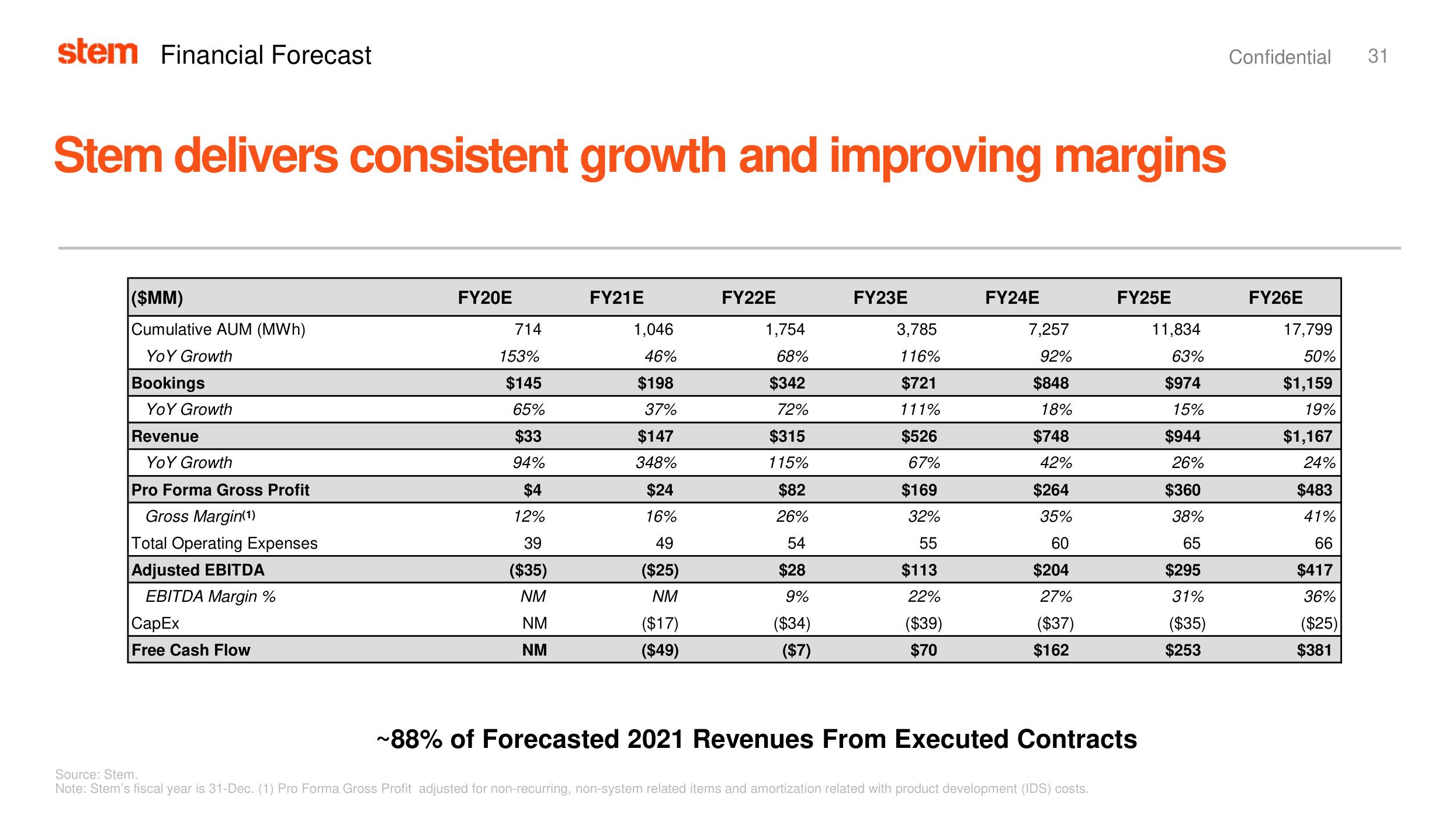

Stem delivers consistent growth and improving margins

($MM)

Cumulative AUM (MWh)

Yo Y Growth

Bookings

YOY Growth

Revenue

YOY Growth

Pro Forma Gross Profit

Gross Margin(1)

Total Operating Expenses

Adjusted EBITDA

EBITDA Margin %

CapEx

Free Cash Flow

FY20E

714

153%

$145

65%

$33

94%

$4

12%

39

($35)

NM

NM

NM

FY21E

1,046

46%

$198

37%

$147

348%

$24

16%

49

($25)

NM

($17)

($49)

FY22E

1,754

68%

$342

72%

$315

115%

$82

26%

54

$28

9%

($34)

($7)

FY23E

3,785

116%

$721

111%

$526

67%

$169

32%

55

$113

22%

($39)

$70

FY24E

7,257

92%

$848

18%

$748

42%

$264

35%

60

$204

27%

($37)

$162

FY25E

~88% of Forecasted 2021 Revenues From Executed Contracts

Source: Stem.

Note: Stem's fiscal year is 31-Dec. (1) Pro Forma Gross Profit adjusted for non-recurring, non-system related items and amortization related with product development (IDS) costs.

11,834

63%

$974

15%

$944

26%

$360

38%

65

$295

31%

($35)

$253

Confidential 31

FY26E

17,799

50%

$1,159

19%

$1,167

24%

$483

41%

66

$417

36%

($25)

$381View entire presentation