Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

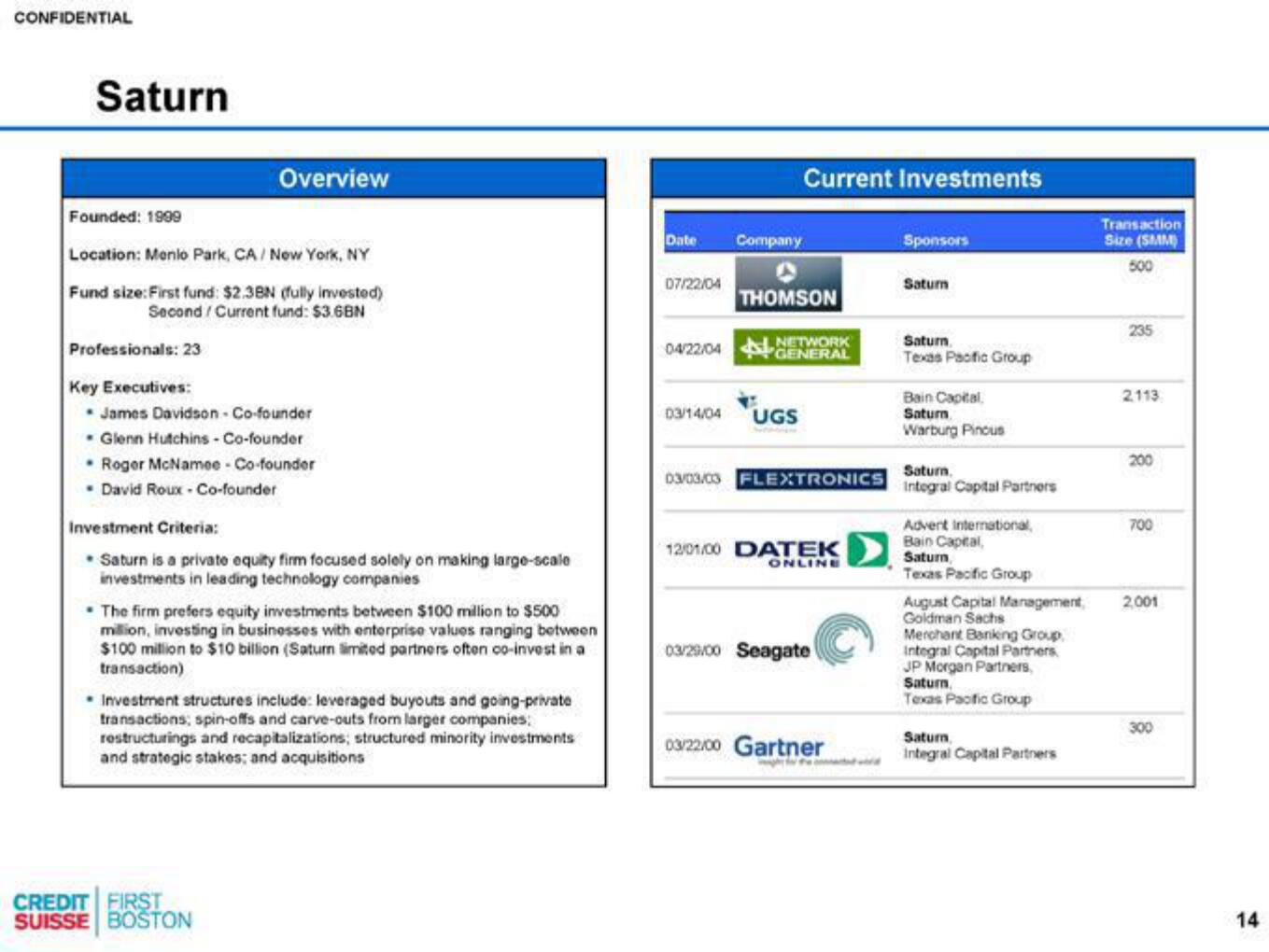

Saturn

Founded: 1999

Location: Menlo Park, CA/ New York, NY

Fund size: First fund: $2.3BN (fully invested)

Second / Current fund: $3.6BN

Professionals: 23

Overview

Key Executives:

* James Davidson- Co-founder

Glenn Hutchins - Co-founder

Roger McNamee - Co-founder

• David Roux - Co-founder

Investment Criteria:

• Saturn is a private equity firm focused solely on making large-scale

investments in leading technology companies

The firm prefers equity investments between $100 million to $500

million, investing in businesses with enterprise values ranging between

$100 million to $10 billion (Saturn limited partners often co-invest in a

transaction)

Investment structures include: leveraged buyouts and going-private

transactions; spin-offs and carve-outs from larger companies:

restructurings and recapitalizations; structured minority investments

and strategic stakes; and acquisitions

CREDIT FIRST

SUISSE BOSTON

Date

07/22/04

Current Investments

Company

THOMSON

04/22/04 NETWORK

GENERAL

03/14/04 UGS

03/03/03 FLEXTRONICS

12/01/00 DATEK

ONLINE

03/29/00 Seagate

03/22/00 Gartner

edward

Sponsors

Saturn

Saturn.

Texas Pacific Group

Bain Capital

Saturn

Warburg Pincus

Saturn.

Integral Capital Partners

Advent International,

Bain Capital,

Saturn

Texas Pacific Group

August Capital Management,

Goldman Sachs

Merchant Banking Group,

Integral Capital Partners

JP Morgan Partners,

Saturn

Texas Pacific Group

Saturn,

Integral Capital Partners

Transaction

Size (SMM)

500

235

2113

200

700

2,001

300

14View entire presentation