Proterra SPAC Presentation Deck

TRANSACTION SUMMARY

Peer

Median:

23%

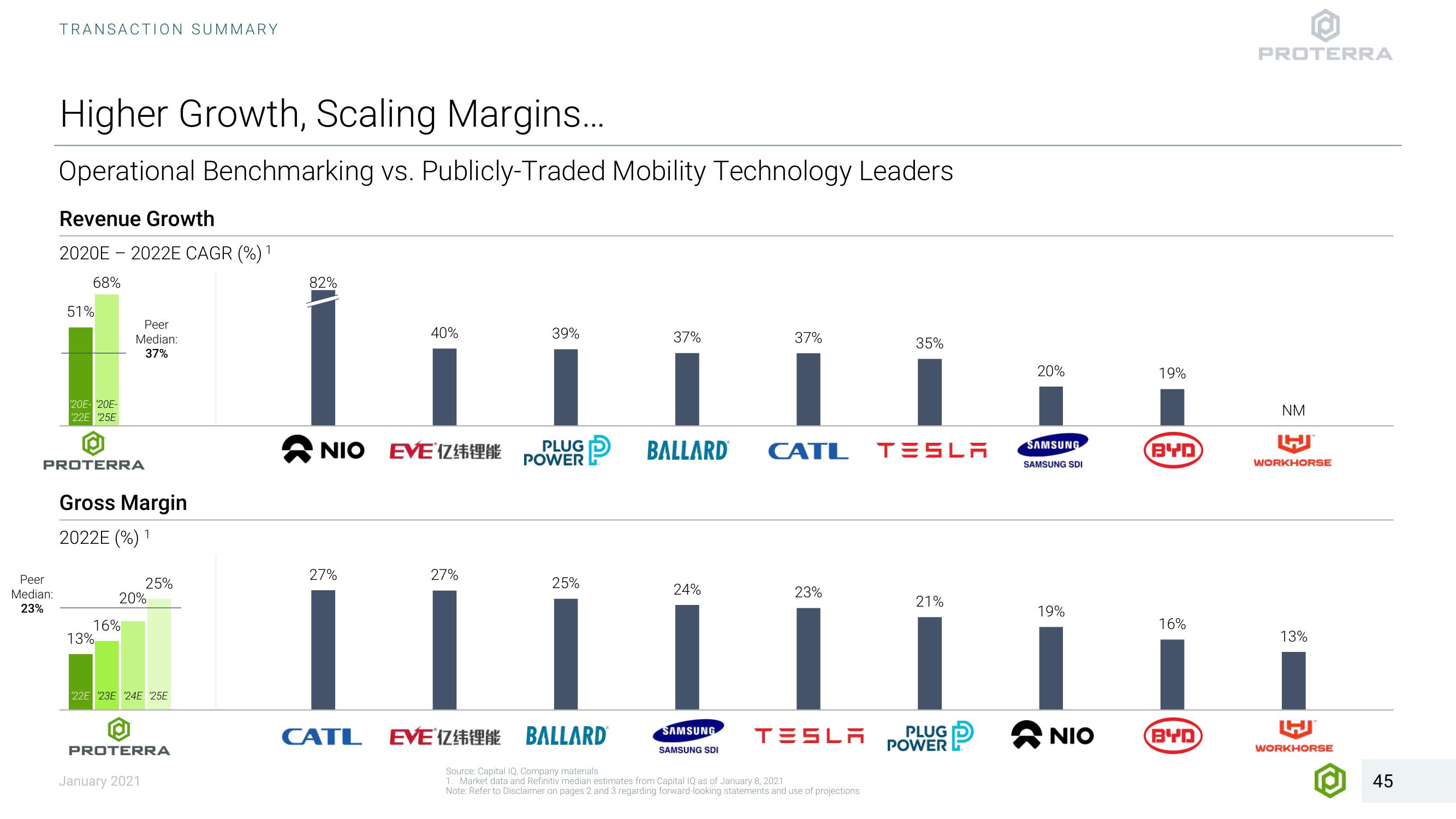

Higher Growth, Scaling Margins...

Operational Benchmarking vs. Publicly-Traded Mobility Technology Leaders

Revenue Growth

2020E2022E CAGR (%) ¹

68%

51%

20E-20E-

22E 25E

PROTERRA

Peer

Median:

37%

Gross Margin

2022E (%) 1

16%

13%

20%

25%

22E 23E 24E 25E

PROTERRA

January 2021

82%

40%

NIO

NIO EVE亿纬锂能

39%

PLUG

POWER

37%

P BALLARD

37%

35%

CATL TESLA

27%

27%

25%

24%

23%

21%

| | | | | |

PLUG

CATL EVE IZ BALLARD

SAMSUNG

SAMSUNG SDI

TESLA

POWER

Source: Capital IQ, Company materials

1. Market data and Refinitiv median estimates from Capital IQ as of January 8, 2021

Note: Refer to Disclaimer on pages 2 and 3 regarding forward-looking statements and use of projections

20%

SAMSUNG

SAMSUNG SDI

19%

NIO

19%

BYD

16%

BYD

PROTERRA

NM

WORKHORSE

13%

WORKHORSE

45View entire presentation