UBS Results Presentation Deck

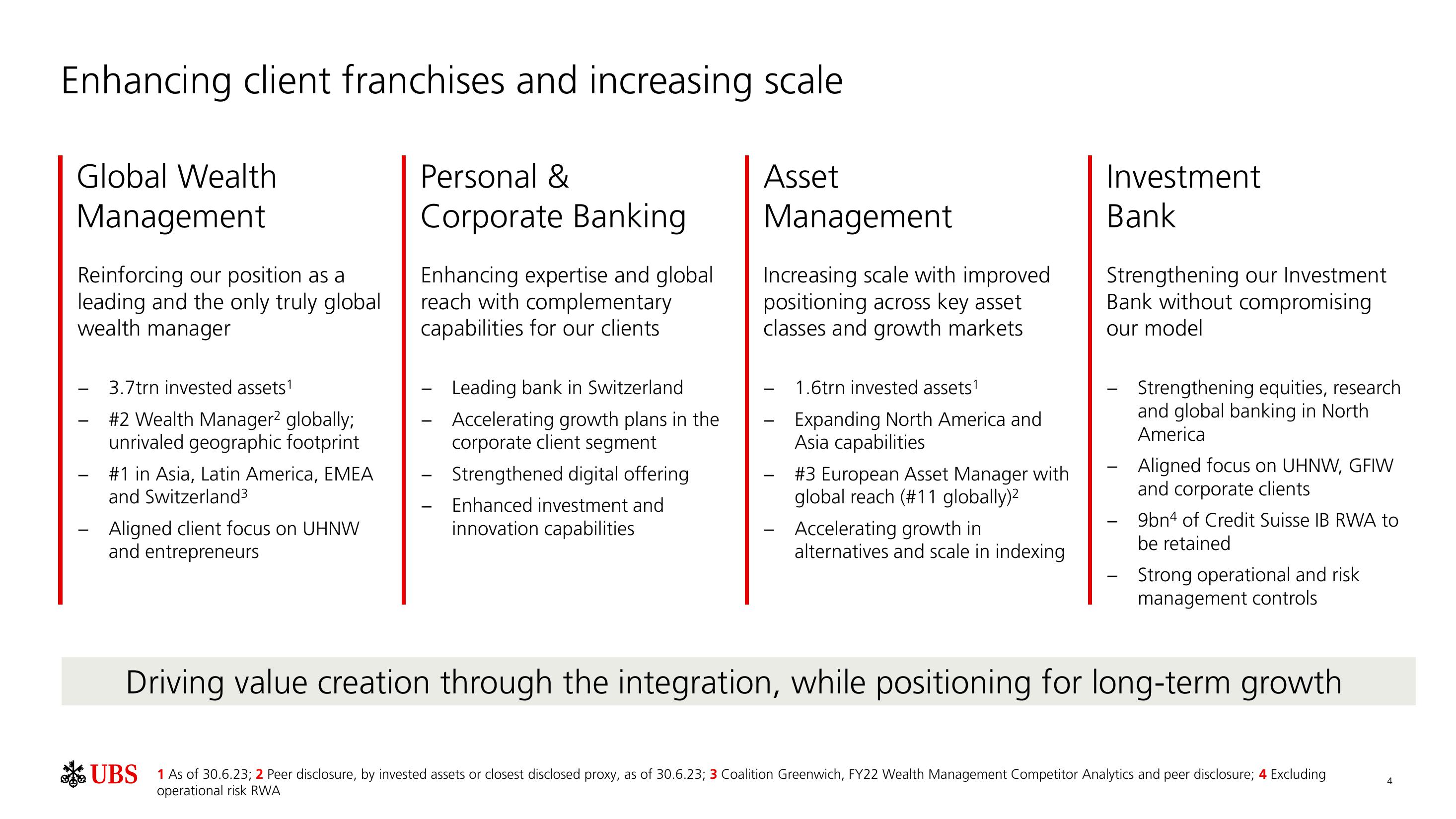

Enhancing client franchises and increasing scale

Global Wealth

Management

Reinforcing our position as a

leading and the only truly global

wealth manager

-

3.7trn invested assets¹

#2 Wealth Manager² globally;

unrivaled geographic footprint

#1 in Asia, Latin America, EMEA

and Switzerland³

Aligned client focus on UHNW

and entrepreneurs

Personal &

Corporate Banking

Enhancing expertise and global

reach with complementary

capabilities for our clients.

-

-

Leading bank in Switzerland

Accelerating growth plans in the

corporate client segment

Strengthened digital offering

Enhanced investment and

innovation capabilities

Asset

Management

Increasing scale with improved

positioning across key asset

classes and growth markets

-

-

1.6trn invested assets¹

Expanding North America and

Asia capabilities

#3 European Asset Manager with

global reach (#11 globally)²

Accelerating growth in

alternatives and scale in indexing

Investment

Bank

Strengthening our Investment

Bank without compromising

our model

Strengthening equities, research

and global banking in North

America

Aligned focus on UHNW, GFIW

and corporate clients

9bn4 of Credit Suisse IB RWA to

be retained

Strong operational and risk

management controls

Driving value creation through the integration, while positioning for long-term growth

UBS 1 As of 30.6.23; 2 Peer disclosure, by invested assets or closest disclosed proxy, as of 30.6.23; 3 Coalition Greenwich, FY22 Wealth Management Competitor Analytics and peer disclosure; 4 Excluding

operational risk RWA

4View entire presentation