Eutelsat ESG Presentation Deck

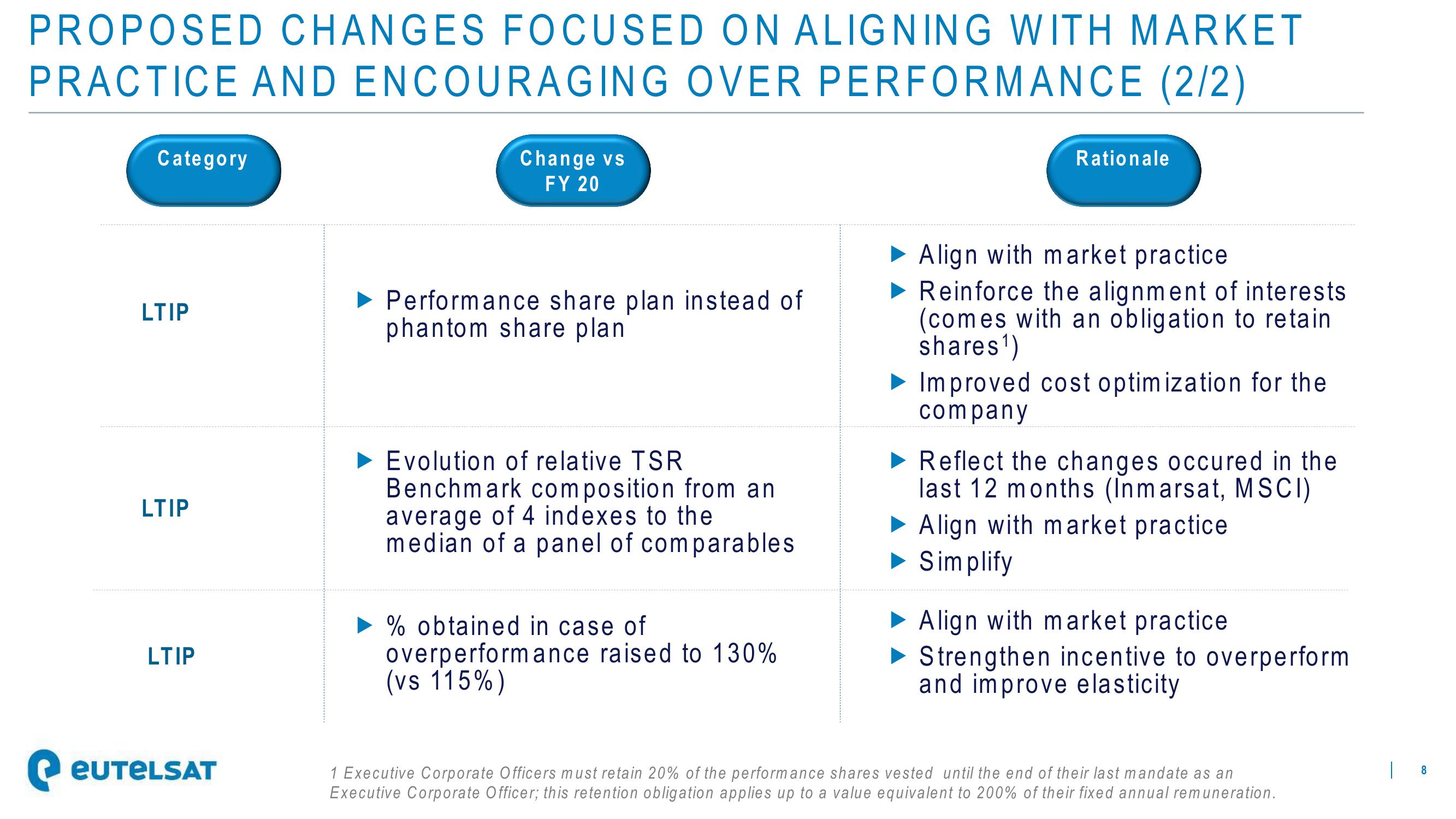

PROPOSED CHANGES FOCUSED ON ALIGNING WITH MARKET

PRACTICE AND ENCOURAGING OVER PERFORMANCE (2/2)

Category

LTIP

LTIP

LTIP

EUTELSAT

Change vs

FY 20

► Performance share plan instead of

phantom share plan

► Evolution of relative TSR

Benchmark composition from an

average of 4 indexes to the

median of a panel of comparables

► % obtained in case of

overperformance raised to 130%

(vs 115%)

Rationale

Align with market practice

► Reinforce the alignment of interests

(comes with an obligation to retain

shares¹)

Improved cost optimization for the

company

► Reflect the changes occured in the

last 12 months (Inmarsat, MSCI)

► Align with market practice

Simplify

► Align with market practice.

►Strengthen incentive to overperform

and improve elasticity

1 Executive Corporate Officers must retain 20% of the performance shares vested until the end of their last mandate as an

Executive Corporate Officer; this retention obligation applies up to a value equivalent to 200% of their fixed annual remuneration.

8View entire presentation