Q1 2023 Earnings Presentation

Q1 2023 YEAR-OVER-YEAR COMPARISON

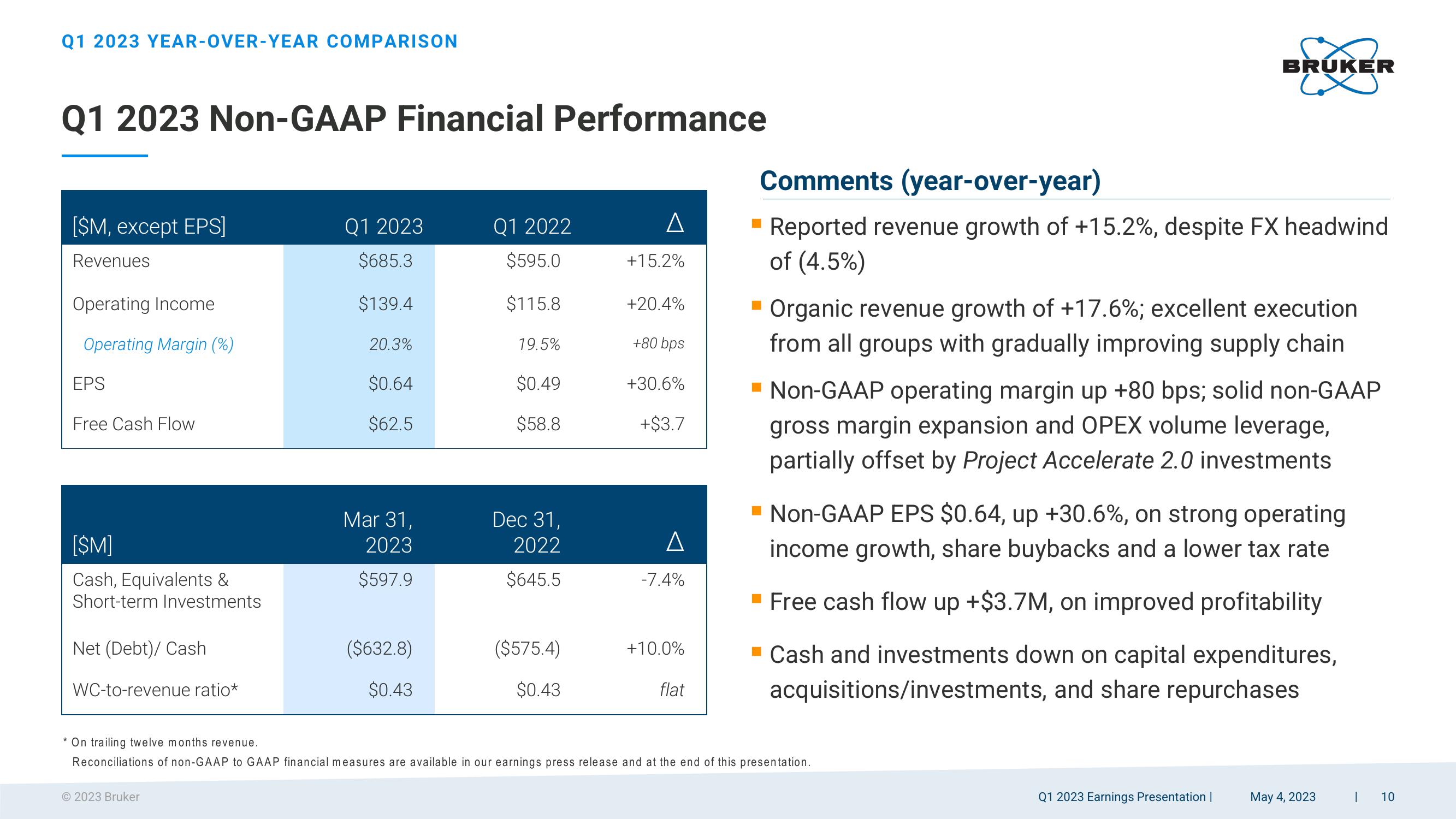

Q1 2023 Non-GAAP Financial Performance

[$M, except EPS]

Revenues

Operating Income

Operating Margin (%)

EPS

Free Cash Flow

[$M]

Cash, Equivalents &

Short-term Investments

Net (Debt)/ Cash

WC-to-revenue ratio*

Q1 2023

$685.3

$139.4

2023 Bruker

20.3%

$0.64

$62.5

Mar 31,

2023

$597.9

($632.8)

$0.43

Q1 2022

$595.0

$115.8

19.5%

$0.49

$58.8

Dec 31,

2022

$645.5

($575.4)

$0.43

A

+15.2%

+20.4%

+80 bps

+30.6%

+$3.7

A

-7.4%

+10.0%

flat

Comments (year-over-year)

Reported revenue growth of +15.2%, despite FX headwind

of (4.5%)

BRUKER

▪ Organic revenue growth of +17.6%; excellent execution

from all groups with gradually improving supply chain

Non-GAAP operating margin up +80 bps; solid non-GAAP

gross margin expansion and OPEX volume leverage,

partially offset by Project Accelerate 2.0 investments

▪ Non-GAAP EPS $0.64, up +30.6%, on strong operating

income growth, share buybacks and a lower tax rate

*On trailing twelve months revenue.

Reconciliations of non-GAAP to GAAP financial measures are available in our earnings press release and at the end of this presentation.

■ Free cash flow up +$3.7M, on improved profitability

▪ Cash and investments down on capital expenditures,

acquisitions/investments, and share repurchases

Q1 2023 Earnings Presentation |

May 4, 2023

I

10View entire presentation