ironSource SPAC Presentation Deck

Proposed transaction summary

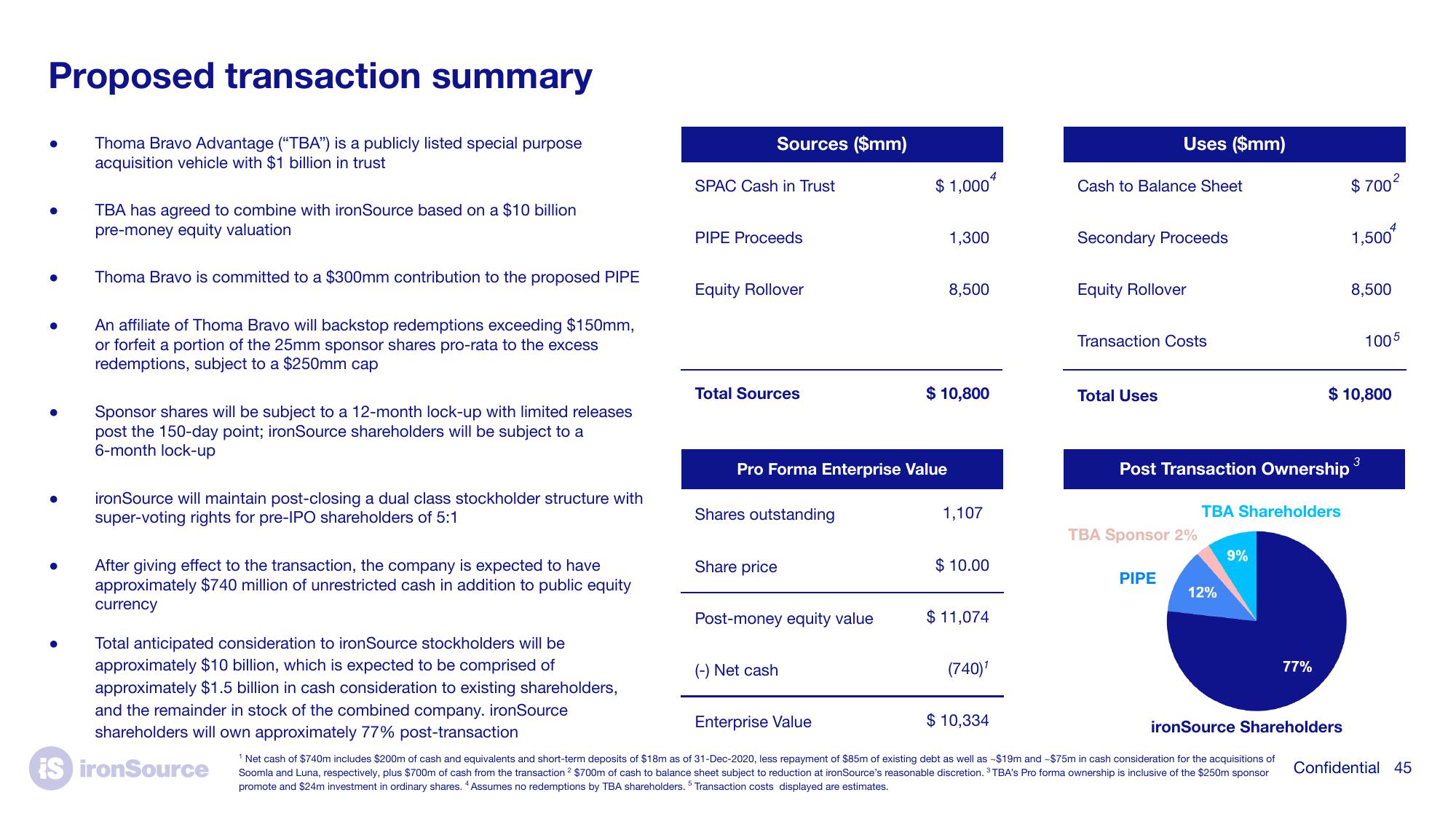

Thoma Bravo Advantage ("TBA") is a publicly listed special purpose

acquisition vehicle with $1 billion in trust

TBA has agreed to combine with ironSource based on a $10 billion

pre-money equity valuation

Thoma Bravo is committed to a $300mm contribution to the proposed PIPE

An affiliate of Thoma Bravo will backstop redemptions exceeding $150mm,

or forfeit a portion of the 25mm sponsor shares pro-rata to the excess

redemptions, subject to a $250mm cap

Sponsor shares will be subject to a 12-month lock-up with limited releases

post the 150-day point; ironSource shareholders will be subject to a

6-month lock-up

ironSource will maintain post-closing a dual class stockholder structure with

super-voting rights for pre-IPO shareholders of 5:1

After giving effect to the transaction, the company is expected to have

approximately $740 million of unrestricted cash in addition to public equity

currency

Total anticipated consideration to ironSource stockholders will be

approximately $10 billion, which is expected to be comprised of

approximately $1.5 billion in cash consideration to existing shareholders,

and the remainder in stock of the combined company. ironSource

shareholders will own approximately 77% post-transaction

IS ironSource

Sources ($mm)

SPAC Cash in Trust

PIPE Proceeds

Equity Rollover

Total Sources

Shares outstanding

Pro Forma Enterprise Value

Share price

Post-money equity value

$1,000

(-) Net cash

1,300

8,500

$ 10,800

1,107

$10.00

$ 11,074

(740)¹

Cash to Balance Sheet

Uses ($mm)

Secondary Proceeds

Equity Rollover

Transaction Costs

Total Uses

TBA Sponsor 2%

PIPE

Post Transaction Ownership

TBA Shareholders

12%

9%

77%

$700²

1,500

Enterprise Value

$ 10,334

ironSource Shareholders

¹ Net cash of $740m includes $200m of cash and equivalents and short-term deposits of $18m as of 31-Dec-2020, less repayment of $85m of existing debt as well as -$19m and -$75m in cash consideration for the acquisitions of

Soomla and Luna, respectively, plus $700m of cash from the transaction 2 $700m of cash to balance sheet subject to reduction at ironSource's reasonable discretion. ³ TBA's Pro forma ownership is inclusive of the $250m sponsor

promote and $24m investment in ordinary shares. 4 Assumes no redemptions by TBA shareholders. 5 Transaction costs displayed are estimates.

$ 10,800

8,500

1005

3

Confidential 45View entire presentation