Credit Suisse Investment Banking Pitch Book

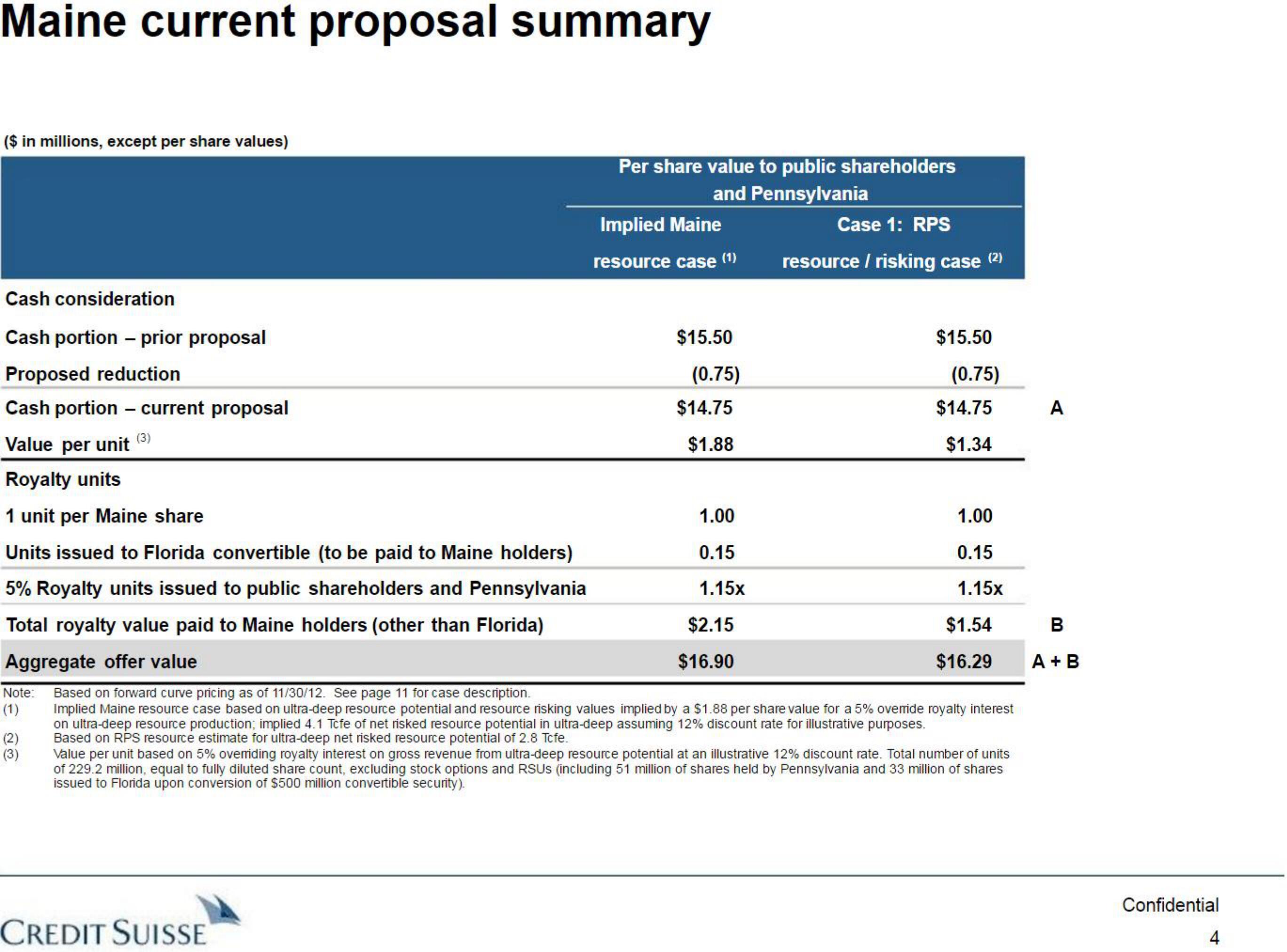

Maine current proposal summary

($ in millions, except per share values)

(2)

(3)

Per share value to public shareholders

and Pennsylvania

Implied Maine

resource case (1)

Cash consideration

Cash portion - prior proposal

Proposed reduction

Cash portion - current proposal

Value per unit (3)

Royalty units

1 unit per Maine share

Units issued to Florida convertible (to be paid to Maine holders)

5% Royalty units issued to public shareholders and Pennsylvania

Total royalty value paid to Maine holders (other than Florida)

Aggregate offer value

(1)

Note: Based on forward curve pricing as of 11/30/12. See page 11 for case description.

Implied Maine resource case based on ultra-deep resource potential and resource risking values implied by a $1.88 per share value for a 5% override royalty interest

on ultra-deep resource production; implied 4.1 Tcfe of net risked resource potential in ultra-deep assuming 12% discount rate for illustrative purposes.

Based on RPS resource estimate for ultra-deep net risked resource potential of 2.8 Tcfe.

Credit SuissE

$15.50

(0.75)

$14.75

$1.88

1.00

0.15

1.15x

Case 1: RPS

resource / risking case (2)

$2.15

$16.90

$15.50

(0.75)

$14.75

$1.34

1.00

0.15

1.15x

$1.54

$16.29

Value per unit based on 5% overriding royalty interest on gross revenue from ultra-deep resource potential at an illustrative 12% discount rate. Total number of units

of 229.2 million, equal to fully diluted share count, excluding stock options and RSUS (including 51 million of shares held by Pennsylvania and 33 million of shares

issued to Florida upon conversion of $500 million convertible security).

A

B

A + B

Confidential

4View entire presentation