Kimco and Weingarten Strategic Merger investor presentaton

PRO FORMA BALANCE SHEET SUMMARY

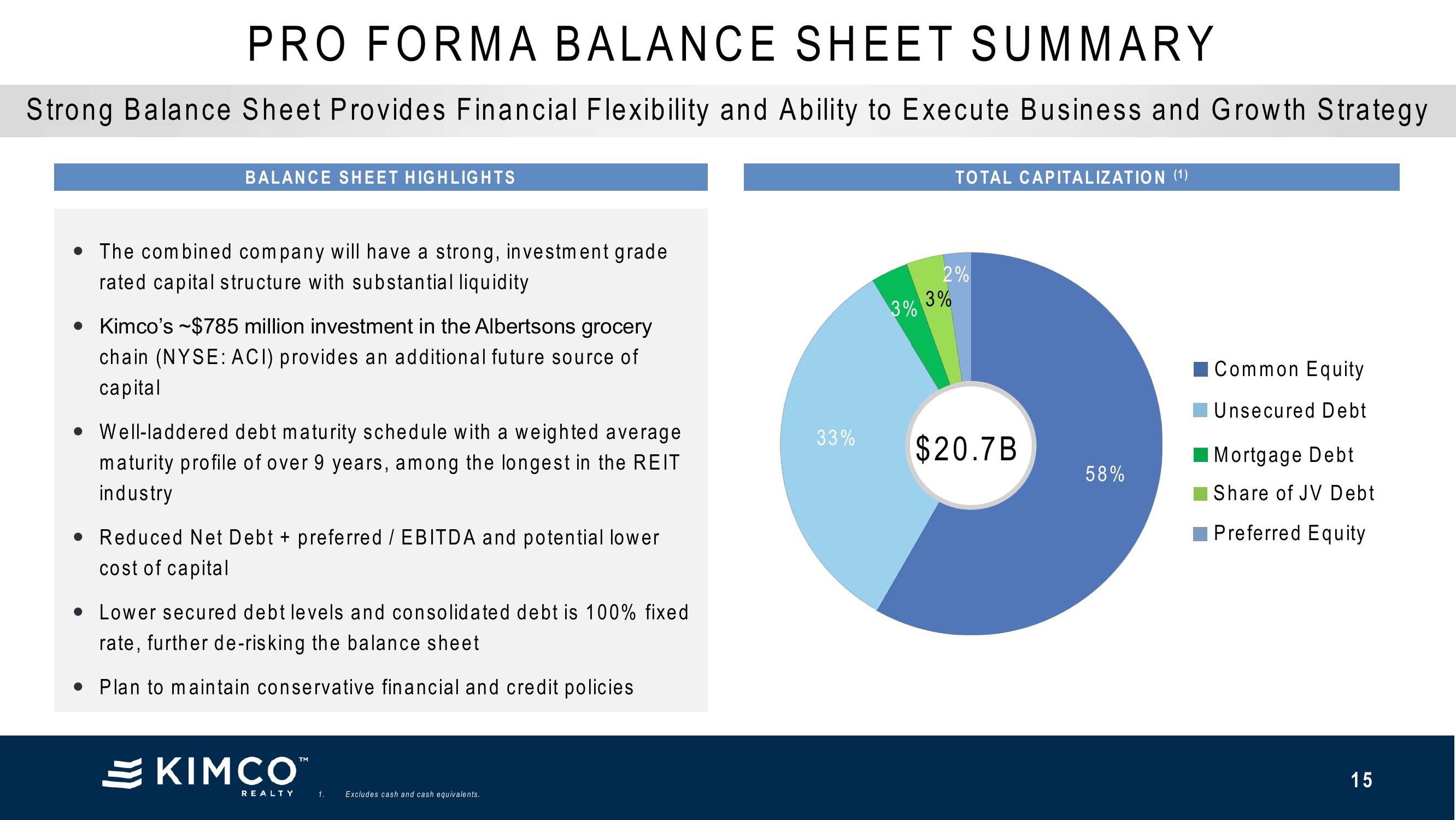

Strong Balance Sheet Provides Financial Flexibility and Ability to Execute Business and Growth Strategy

BALANCE SHEET HIGHLIGHTS

• The combined company will have a strong, investment grade

rated capital structure with substantial liquidity

• Kimco's $785 million investment in the Albertsons grocery

chain (NYSE: ACI) provides an additional future source of

capital

• Well-laddered debt maturity schedule with a weighted average

maturity profile of over 9 years, among the longest in the REIT

industry

Reduced Net Debt + preferred / EBITDA and potential lower

cost of capital

• Lower secured debt levels and consolidated debt is 100% fixed

rate, further de-risking the balance sheet

• Plan to maintain conservative financial and credit policies

KIMCO™

REALTY

1. Excludes cash and cash equivalents.

33%

3%

TOTAL CAPITALIZATION (1)

2%

3%

$20.7B

58%

Common Equity

Unsecured Debt

Mortgage Debt

Share of JV Debt

Preferred Equity

15View entire presentation