Bank of America Investment Banking Pitch Book

A

22

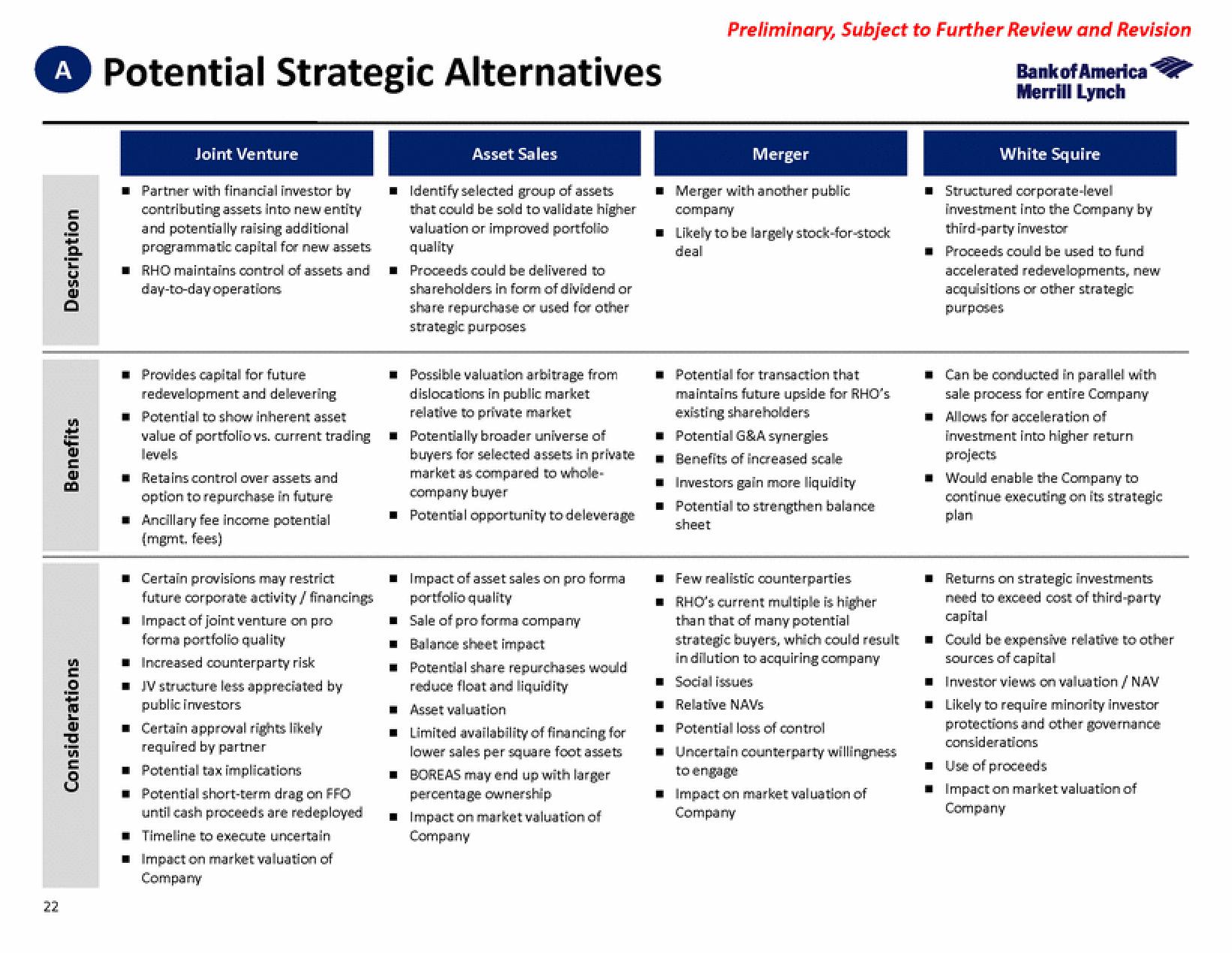

Description

Benefits

Considerations

Potential Strategic Alternatives

Joint Venture

Partner with financial investor by

contributing assets into new entity

and potentially raising additional

programmatic capital for new assets

■ RHO maintains control of assets and

day-to-day operations

Provides capital for future

redevelopment and delevering

Potential to show inherent asset

value of portfolio vs. current trading

levels

■ Retains control over assets and

option to repurchase in future

■ Ancillary fee income potential

(mgmt. fees)

■ Certain provisions may restrict

future corporate activity/financings

Impact of joint venture on pro

forma portfolio quality

Increased counterparty risk

JV structure less appreciated by

public investors

Certain approval rights likely

required by partner

Potential tax implications

■ Potential short-term drag on FFO

until cash proceeds are redeployed

Timeline to execute uncertain

Impact on market valuation of

Company

■ Identify selected group of assets

that could be sold to validate higher

valuation or improved portfolio

quality

■

■

Asset Sales

■

■

Proceeds could be delivered to

shareholders in form of dividend or

share repurchase or used for other

strategic purposes

Possible valuation arbitrage from

dislocations in public market

relative to private market

Impact of asset sales on pro forma

portfolio quality

Sale of pro forma company

Balance sheet impact

■ Potential share repurchases would

reduce float and liquidity

Asset valuation

Potentially broader universe of

buyers for selected assets in private

market as compared to whole-

company buyer

Potential opportunity to deleverage

■ Limited availability of financing for

lower sales per square foot assets

BOREAS may end up with larger

percentage ownership

Impact on market valuation of

Company

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

Merger

Merger with another public

company

■ Likely to be largely stock-for-stock

deal

■

Potential for transaction that

maintains future upside for RHO's

existing shareholders

Potential G&A synergies

Benefits of increased scale

■ Investors gain more liquidity

Potential to strengthen balance

sheet

■ Few realistic counterparties

RHO's current multiple is higher

than that of many potential

strategic buyers, which could result

in dilution to acquiring company

Social issues

Relative NAVs

Potential loss of control

■ Uncertain counterparty willingness

to engage

Impact on market valuation of

Company

White Squire

Structured corporate-level

investment into the Company by

third-party investor

■ Proceeds could be used to fund

accelerated redevelopments, new

acquisitions or other strategic

purposes

■Can be conducted in parallel with

sale process for entire Company

■Allows for acceleration of

investment into higher return

projects

■ Would enable the Company to

continue executing on its strategic

plan

■ Returns on strategic investments

need to exceed cost of third-party

capital

■ Could be expensive relative to other

sources of capital

Investor views on valuation / NAV

■ Likely to require minority investor

protections and other governance

considerations

■ Use of proceeds

■ Impact on market valuation of

CompanyView entire presentation