Clean Battery Solutions for a Better Planet

Transaction Overview

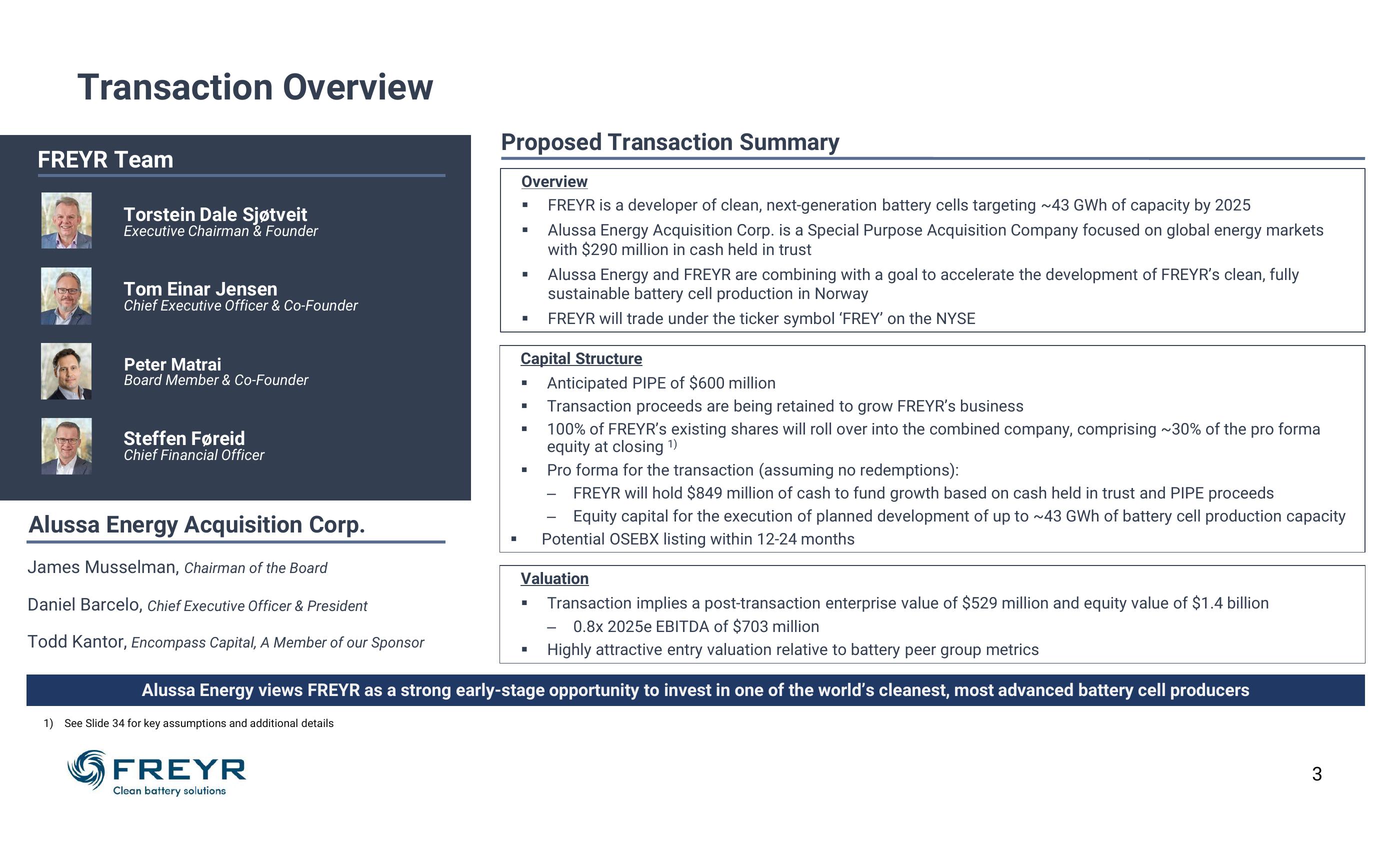

FREYR Team

Torstein Dale Sjøtveit

Executive Chairman & Founder

Tom Einar Jensen

Chief Executive Officer & Co-Founder

Peter Matrai

Board Member & Co-Founder

Steffen Føreid

Chief Financial Officer

Proposed Transaction Summary

Overview

■

■

■

FREYR is a developer of clean, next-generation battery cells targeting ~43 GWh of capacity by 2025

Alussa Energy Acquisition Corp. is a Special Purpose Acquisition Company focused on global energy markets

with $290 million in cash held in trust

Alussa Energy and FREYR are combining with a goal to accelerate the development of FREYR's clean, fully

sustainable battery cell production in Norway

FREYR will trade under the ticker symbol 'FREY' on the NYSE

Capital Structure

Anticipated PIPE of $600 million

Transaction proceeds are being retained to grow FREYR's business

100% of FREYR's existing shares will roll over into the combined company, comprising ~30% of the pro forma

equity at closing 1)

Pro forma for the transaction (assuming no redemptions):

FREYR will hold $849 million of cash to fund growth based on cash held in trust and PIPE proceeds

Equity capital for the execution of planned development of up to ~43 GWh of battery cell production capacity

Potential OSEBX listing within 12-24 months

Alussa Energy Acquisition Corp.

James Musselman, Chairman of the Board

-

Daniel Barcelo, Chief Executive Officer & President

Todd Kantor, Encompass Capital, A Member of our Sponsor

Valuation

Transaction implies a post-transaction enterprise value of $529 million and equity value of $1.4 billion

0.8x 2025e EBITDA of $703 million

Highly attractive entry valuation relative to battery peer group metrics

Alussa Energy views FREYR as a strong early-stage opportunity to invest in one of the world's cleanest, most advanced battery cell producers

1) See Slide 34 for key assumptions and additional details

FREYR

Clean battery solutions

3View entire presentation