Crocs Investor Presentation Deck

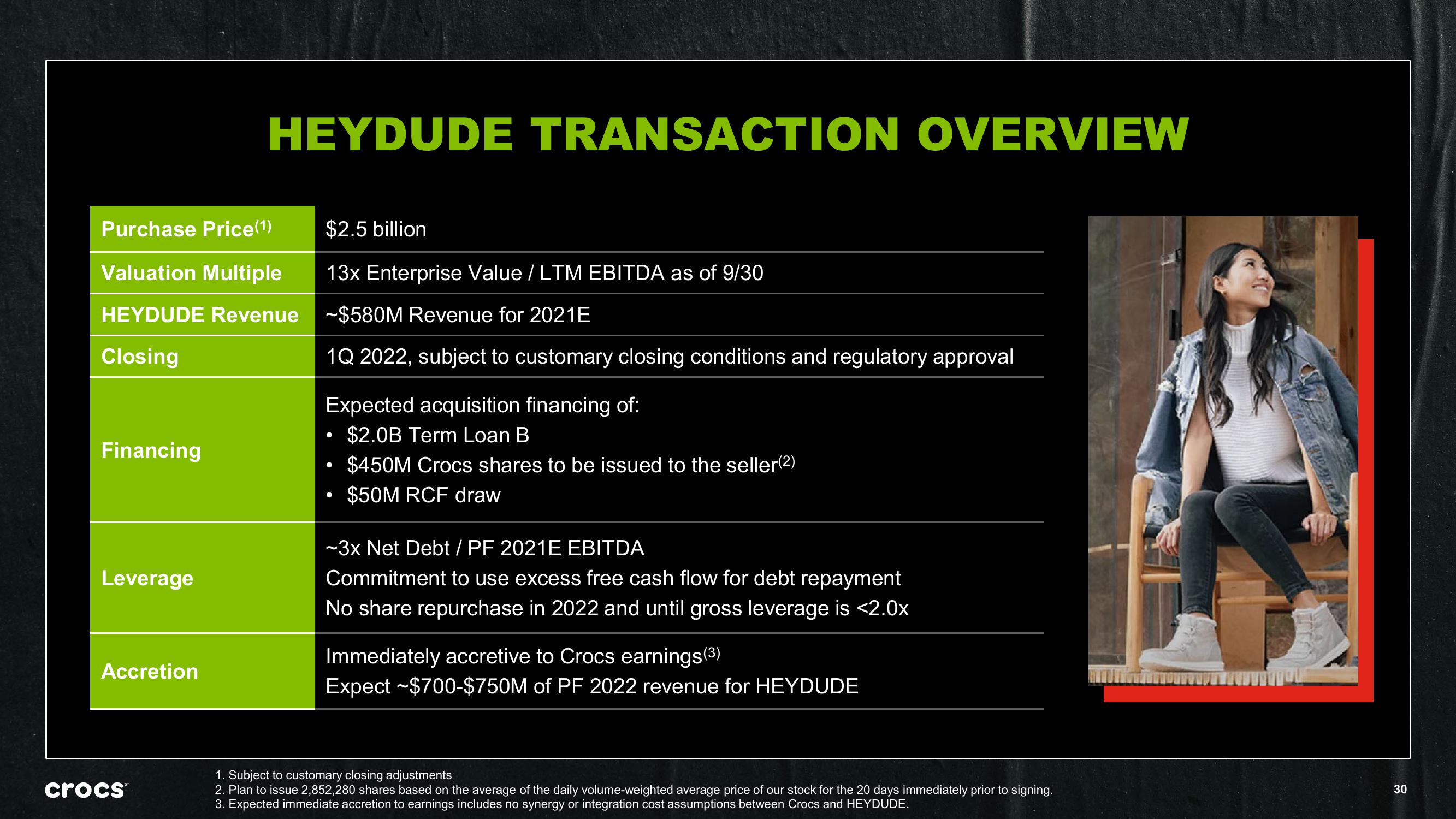

Purchase Price (1)

Valuation Multiple

HEYDUDE Revenue

Closing

Financing

Leverage

Accretion

HEYDUDE TRANSACTION OVERVIEW

crocs™

$2.5 billion

13x Enterprise Value / LTM EBITDA as of 9/30

~$580M Revenue for 2021E

1Q 2022, subject to customary closing conditions and regulatory approval

Expected acquisition financing of:

$2.0B Term Loan B

$450M Crocs shares to be issued to the seller(²)

$50M RCF draw

●

●

●

~3x Net Debt / PF 2021E EBITDA

Commitment to use excess free cash flow for debt repayment

No share repurchase in 2022 and until gross leverage is <2.0x

Immediately accretive to Crocs earnings (3)

Expect ~$700-$750M of PF 2022 revenue for HEYDUDE

1. Subject to customary closing adjustments

2. Plan to issue 2,852,280 shares based on the average of the daily volume-weighted average price of our stock for the 20 days immediately prior to signing.

3. Expected immediate accretion to earnings includes no synergy or integration cost assumptions between Crocs and HEYDUDE.

30View entire presentation