Main Street Capital Investor Day Presentation Deck

Lower Middle Market (LMM) Investments Overview (cont.)

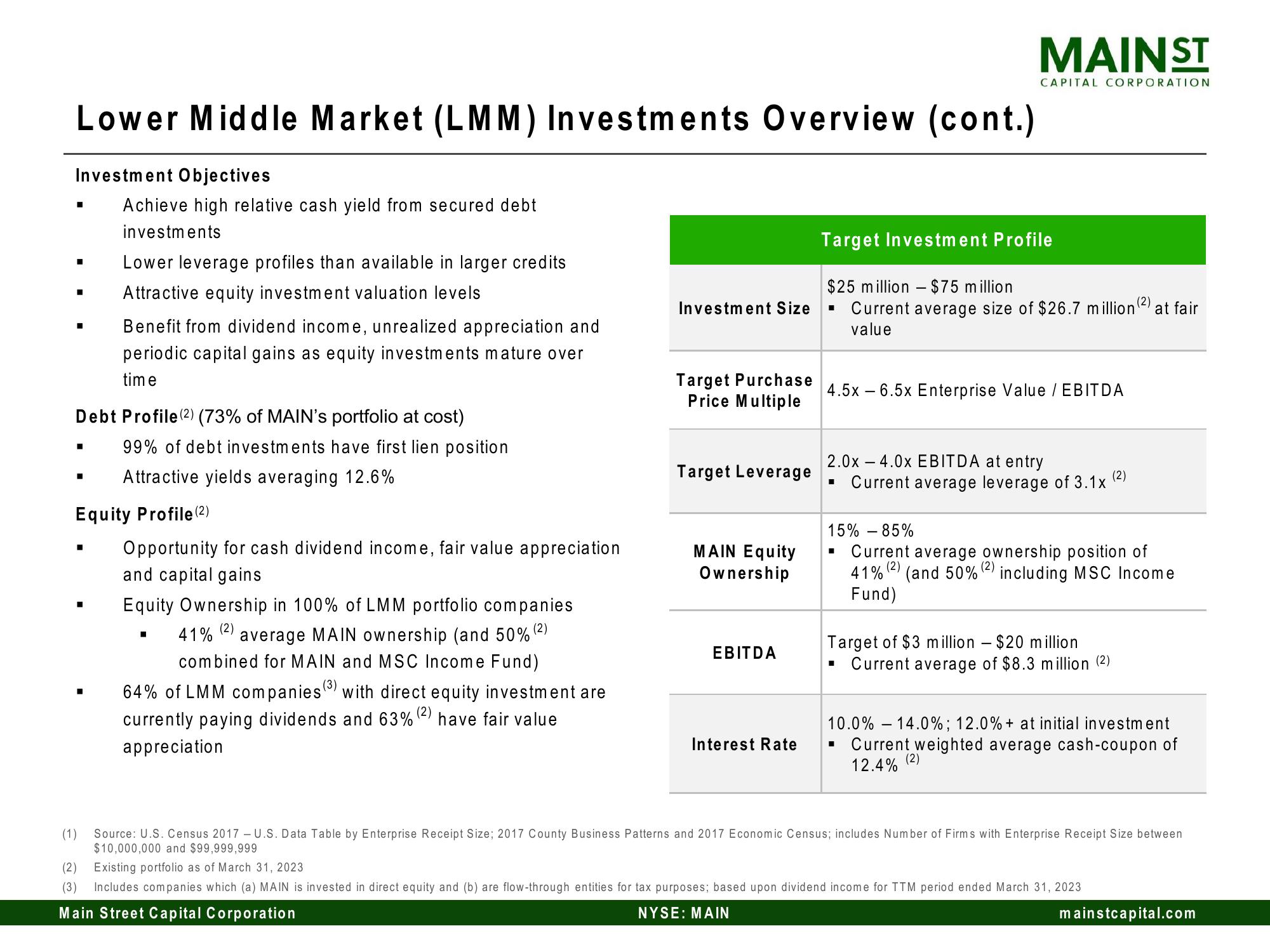

Investment Objectives

■

■

■

■

■

Achieve high relative cash yield from secured debt

investments

Debt Profile (2) (73% of MAIN's portfolio at cost)

■

Lower leverage profiles than available in larger credits

Attractive equity investment valuation levels

(1)

Benefit from dividend income, unrealized appreciation and

periodic capital gains as equity investments mature over

tim e

Equity Profile (2)

Opportunity for cash dividend income, fair value appreciation

and capital gains

99% of debt investments have first lien position

Attractive yields averaging 12.6%

Equity Ownership 100% of LMM portfolio companies

41% (2) average MAIN ownership (and 50% (2)

combined for MAIN and MSC Income Fund)

■

(3)

64% of LMM companies with direct equity investment are

currently paying dividends and 63% have fair value

(2)

appreciation

Investment Size

Target Purchase

Price Multiple

Target Leverage

MAIN Equity

Ownership

EBITDA

Interest Rate

Target Investment Profile

$25 million $75 million

Current average size of $26.7 million

value

■

MAINST

-

4.5x6.5x Enterprise Value / EBITDA

CAPITAL CORPORATION

2.0x 4.0x EBITDA at entry

(2)

Current average leverage of 3.1x

-

I

Target of $3 million $20 million

Current average of $8.3 million (2)

-

15% - 85%

(2)

Current average ownership position of

41% (2)

(and 50% including MSC Income

Fund)

(2)

at fair

10.0% - 14.0%; 12.0%+ at initial investment

Current weighted average cash-coupon of

(2)

12.4%

(2)

Existing portfolio as of March 31, 2023

(3) Includes companies which (a) MAIN is invested in direct equity and (b) are flow-through entities for tax purposes; based upon dividend income for TTM period ended March 31, 2023

Main Street Capital Corporation

NYSE: MAIN

Source: U.S. Census 2017 - U.S. Data Table by Enterprise Receipt Size; 2017 County Business Patterns and 2017 Economic Census; includes Number of Firms with Enterprise Receipt Size between

$10,000,000 and $99,999,999

mainstcapital.comView entire presentation