3Q20 Earnings Call Presentation

Revolver Commitments and Financial Covenants

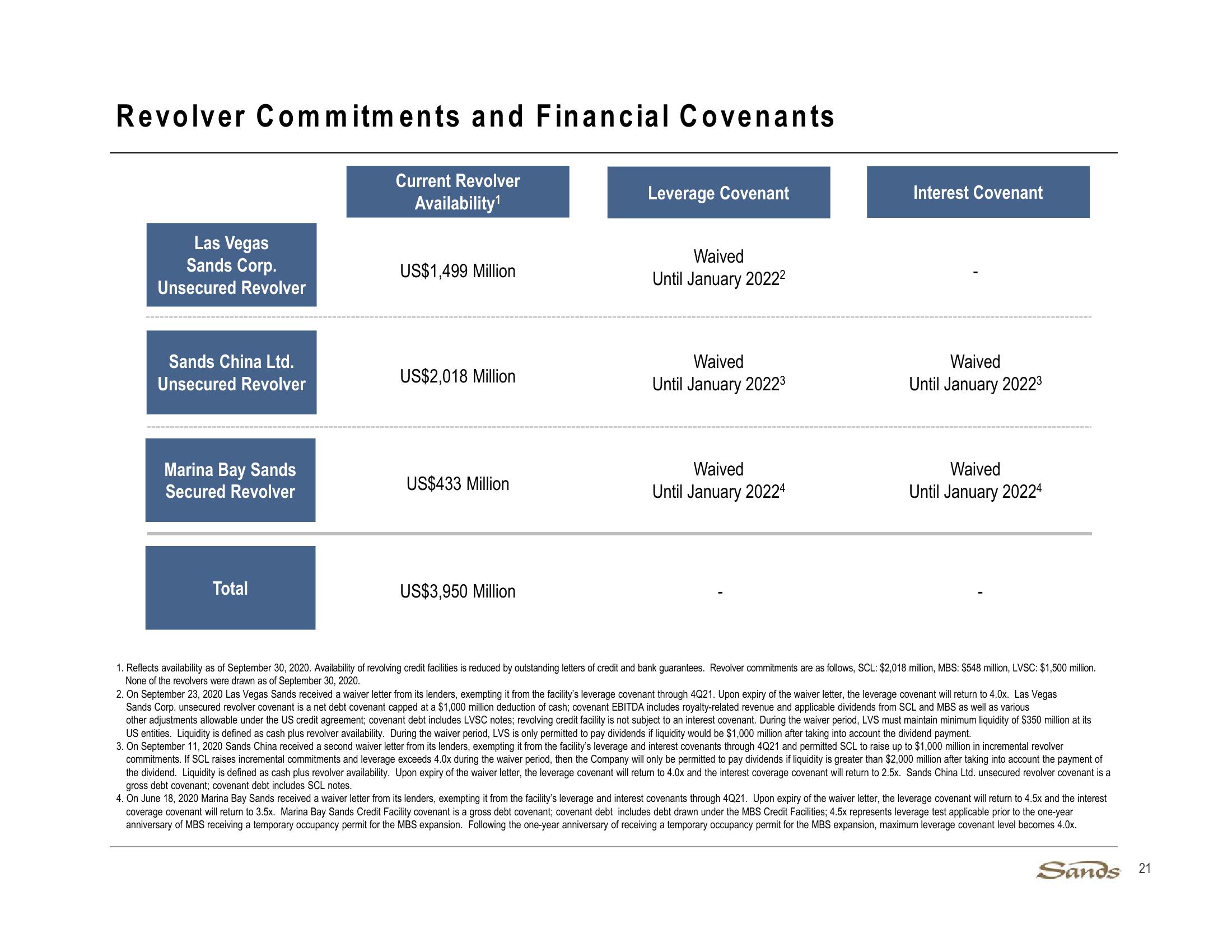

Las Vegas

Sands Corp.

Unsecured Revolver

Sands China Ltd.

Unsecured Revolver

Current Revolver

Availability1

US$1,499 Million

Leverage Covenant

Interest Covenant

Waived

Until January 20222

US$2,018 Million

Waived

Until January 20223

Waived

Until January 20223

Marina Bay Sands

Secured Revolver

US$433 Million

Waived

Until January 20224

Waived

Until January 20224

Total

US$3,950 Million

1. Reflects availability as of September 30, 2020. Availability of revolving credit facilities is reduced by outstanding letters of credit and bank guarantees. Revolver commitments are as follows, SCL: $2,018 million, MBS: $548 million, LVSC: $1,500 million.

None of the revolvers were drawn as of September 30, 2020.

2. On September 23, 2020 Las Vegas Sands received a waiver letter from its lenders, exempting it from the facility's leverage covenant through 4Q21. Upon expiry of the waiver letter, the leverage covenant will return to 4.0x. Las Vegas

Sands Corp. unsecured revolver covenant is a net debt covenant capped at a $1,000 million deduction of cash; covenant EBITDA includes royalty-related revenue and applicable dividends from SCL and MBS as well as various

other adjustments allowable under the US credit agreement; covenant debt includes LVSC notes; revolving credit facility is not subject to an interest covenant. During the waiver period, LVS must maintain minimum liquidity of $350 million at its

US entities. Liquidity is defined as cash plus revolver availability. During the waiver period, LVS is only permitted to pay dividends if liquidity would be $1,000 million after taking into account the dividend payment.

3. On September 11, 2020 Sands China received a second waiver letter from its lenders, exempting it from the facility's leverage and interest covenants through 4Q21 and permitted SCL to raise up to $1,000 million in incremental revolver

commitments. If SCL raises incremental commitments and leverage exceeds 4.0x during the waiver period, then the Company will only be permitted to pay dividends if liquidity is greater than $2,000 million after taking into account the payment of

the dividend. Liquidity is defined as cash plus revolver availability. Upon expiry of the waiver letter, the leverage covenant will return to 4.0x and the interest coverage covenant will return to 2.5x. Sands China Ltd. unsecured revolver covenant is a

gross debt covenant; covenant debt includes SCL notes.

4. On June 18, 2020 Marina Bay Sands received a waiver letter from its lenders, exempting it from the facility's leverage and interest covenants through 4Q21. Upon expiry of the waiver letter, the leverage covenant will return to 4.5x and the interest

coverage covenant will return to 3.5x. Marina Bay Sands Credit Facility covenant is a gross debt covenant; covenant debt includes debt drawn under the MBS Credit Facilities; 4.5x represents leverage test applicable prior to the one-year

anniversary of MBS receiving a temporary occupancy permit for the MBS expansion. Following the one-year anniversary of receiving a temporary occupancy permit for the MBS expansion, maximum leverage covenant level becomes 4.0x.

Sands 21View entire presentation