SoftBank Results Presentation Deck

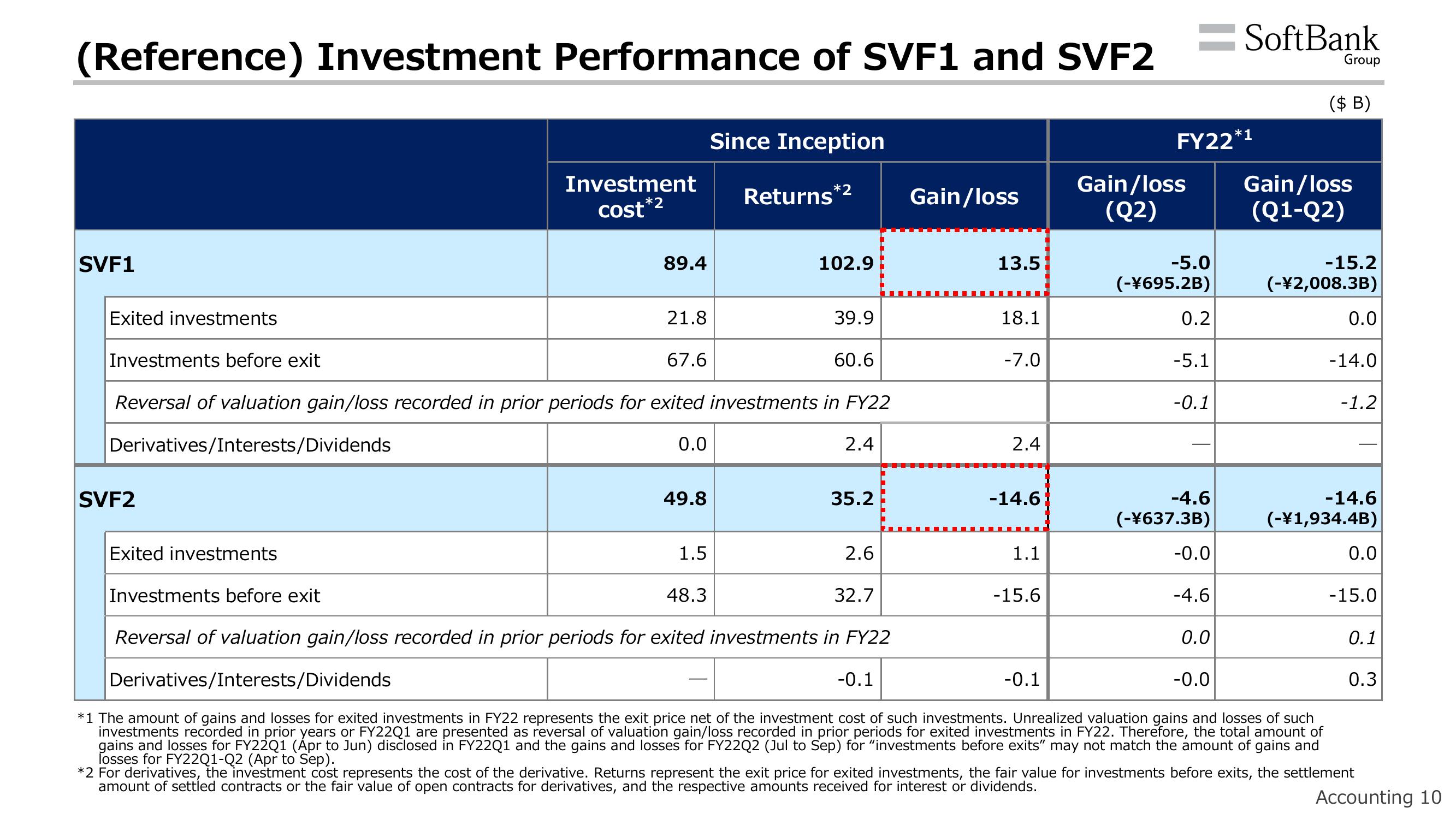

(Reference) Investment Performance of SVF1 and SVF2

SVF1

Exited investments

SVF2

Investment

cost *2

Exited investments

89.4

21.8

0.0

Investments before exit

67.6

Reversal of valuation gain/loss recorded in prior periods for exited investments in FY22

2.4

Derivatives/Interests/Dividends

49.8

1.5

Since Inception

Returns

48.3

102.9

39.9

60.6

35.2

2.6

Gain/loss

32.7

13.5

18.1

-7.0

2.4

-14.6

1.1

-15.6

-0.1

FY22*¹

Gain/loss

(Q2)

-5.0

(-¥695.2B)

0.2

-5.1

-0.1

-4.6

(-¥637.3B)

-0.0

Investments before exit

Reversal of valuation gain/loss recorded in prior periods for exited investments in FY22

Derivatives/Interests/Dividends

-0.1

*1 The amount of gains and losses for exited investments in FY22 represents the exit price net of the investment cost of such investments. Unrealized valuation gains and losses of such

investments recorded in prior years or FY22Q1 are presented as reversal of valuation gain/loss recorded in prior periods for exited investments in FY22. Therefore, the total amount of

gains and losses for FY22Q1 (Ápr to Jun) disclosed in FY22Q1 and the gains and losses for FY22Q2 (Jul to Sep) for "investments before exits" may not match the amount of gains and

losses for FY22Q1-Q2 (Apr to Sep).

-4.6

SoftBank

0.0

-0.0

Group

($ B)

Gain/loss

(Q1-Q2)

-15.2

(-¥2,008.3B)

0.0

-14.0

-1.2

-14.6

(-¥1,934.4B)

0.0

-15.0

0.1

0.3

*2 For derivatives, the investment cost represents the cost of the derivative. Returns represent the exit price for exited investments, the fair value for investments before exits, the settlement

amount of settled contracts or the fair value of open contracts for derivatives, and the respective amounts received for interest or dividends.

Accounting 10View entire presentation