First Quarter 2017 Financial Review

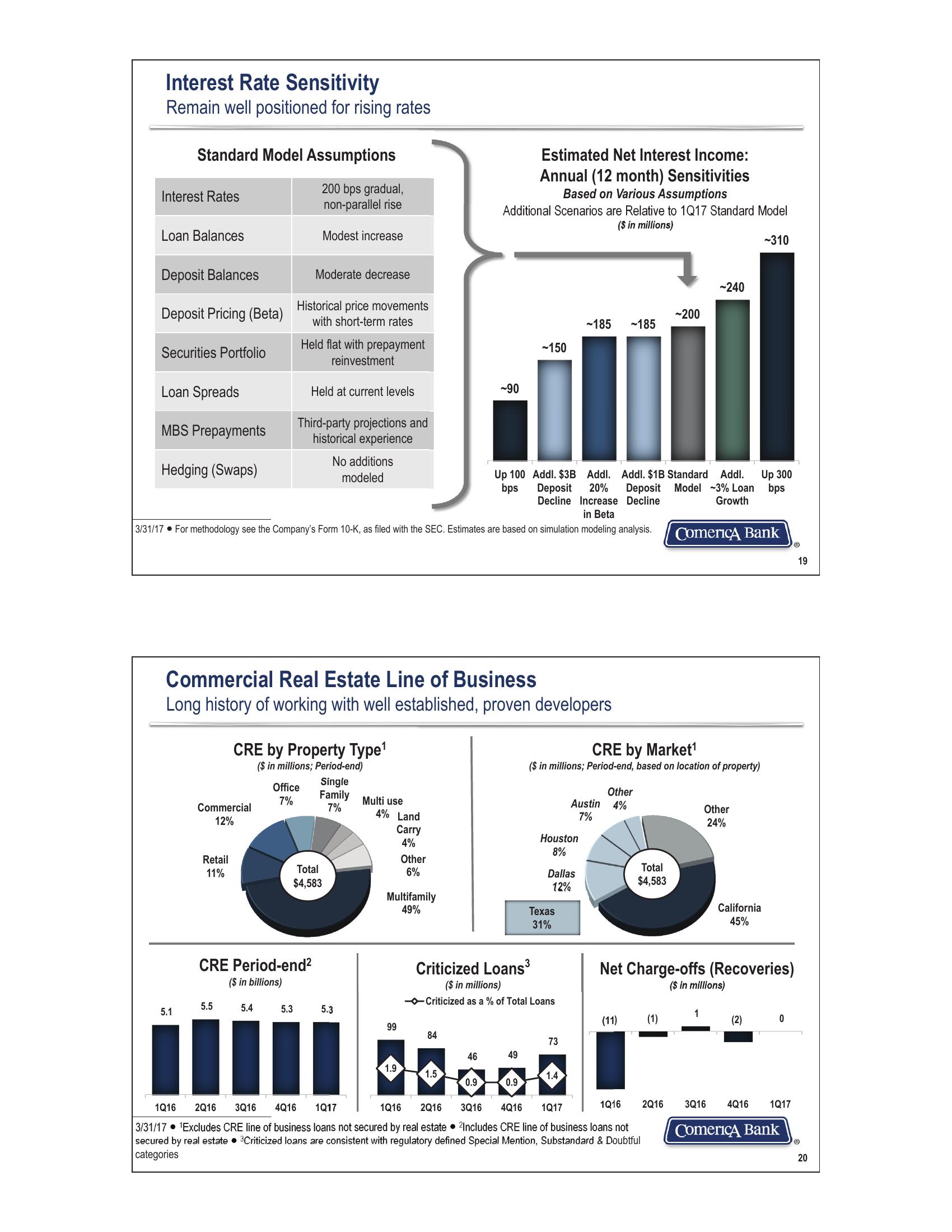

Interest Rate Sensitivity

Remain well positioned for rising rates

Standard Model Assumptions

Interest Rates

200 bps gradual,

non-parallel rise

Modest increase

Loan Balances

Deposit Balances

Deposit Pricing (Beta)

Securities Portfolio

Loan Spreads

MBS Prepayments

Hedging (Swaps)

Moderate decrease

Historical price movements

with short-term rates

Held flat with prepayment

reinvestment

Held at current levels

Third-party projections and

historical experience

No additions

modeled

Estimated Net Interest Income:

Annual (12 month) Sensitivities

Based on Various Assumptions

Additional Scenarios are Relative to 1Q17 Standard Model

($ in millions)

-90

~240

-200

~185

-185

150

-310

Up 100 Addl. $3B Addl. Addl. $1B Standard Addl.

bps

Deposit 20% Deposit Model -3% Loan

Decline Increase Decline

in Beta

Up 300

bps

Growth

3/31/17 For methodology see the Company's Form 10-K, as filed with the SEC. Estimates are based on simulation modeling analysis.

Comerica Bank

Ⓡ

19

Commercial Real Estate Line of Business

Long history of working with well established, proven developers

CRE by Property Type¹

($ in millions; Period-end)

CRE by Market¹

($ in millions; Period-end, based on location of property)

Office

7%

Single

Family Multi use

Commercial

12%

7%

4% Land

Carry

4%

Other

Austin 4%

7%

Other

24%

Houston

8%

Retail

11%

Other

Total

$4,583

6%

Dallas

12%

Total

$4,583

Multifamily

49%

Texas

31%

California

45%

CRE Period-end²

($ in billions)

Criticized Loans³

($ in millions)

Criticized as a % of Total Loans

Net Charge-offs (Recoveries)

($ in millions)

5.5

5.1

5.4

5.3

5.3

(11)

(1)

(2)0

99

84

73

46

49

1.9

1.5

1.4

0.9

0.9

1Q16

2Q16 3Q16 4Q16

1Q17

1Q16

2Q16

3Q16

4Q16

1Q17

1Q16

2Q16

3Q16

4Q16

1Q17

3/31/17 Excludes CRE line of business loans not secured by real estate ⚫2Includes CRE line of business loans not

secured by real estate ⚫3Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful

categories

Comerica Bank

20View entire presentation