Main Street Capital Investor Day Presentation Deck

BDCs

Dividend

Public for > 2 Years (3)

Main Street Capital Corporation

Monroe Capital Corporation

New Mountain Finance Corporation

Oaktree Specialty Lending Corporation

OFS Capital Corporation

Owl Rock Capital Corp

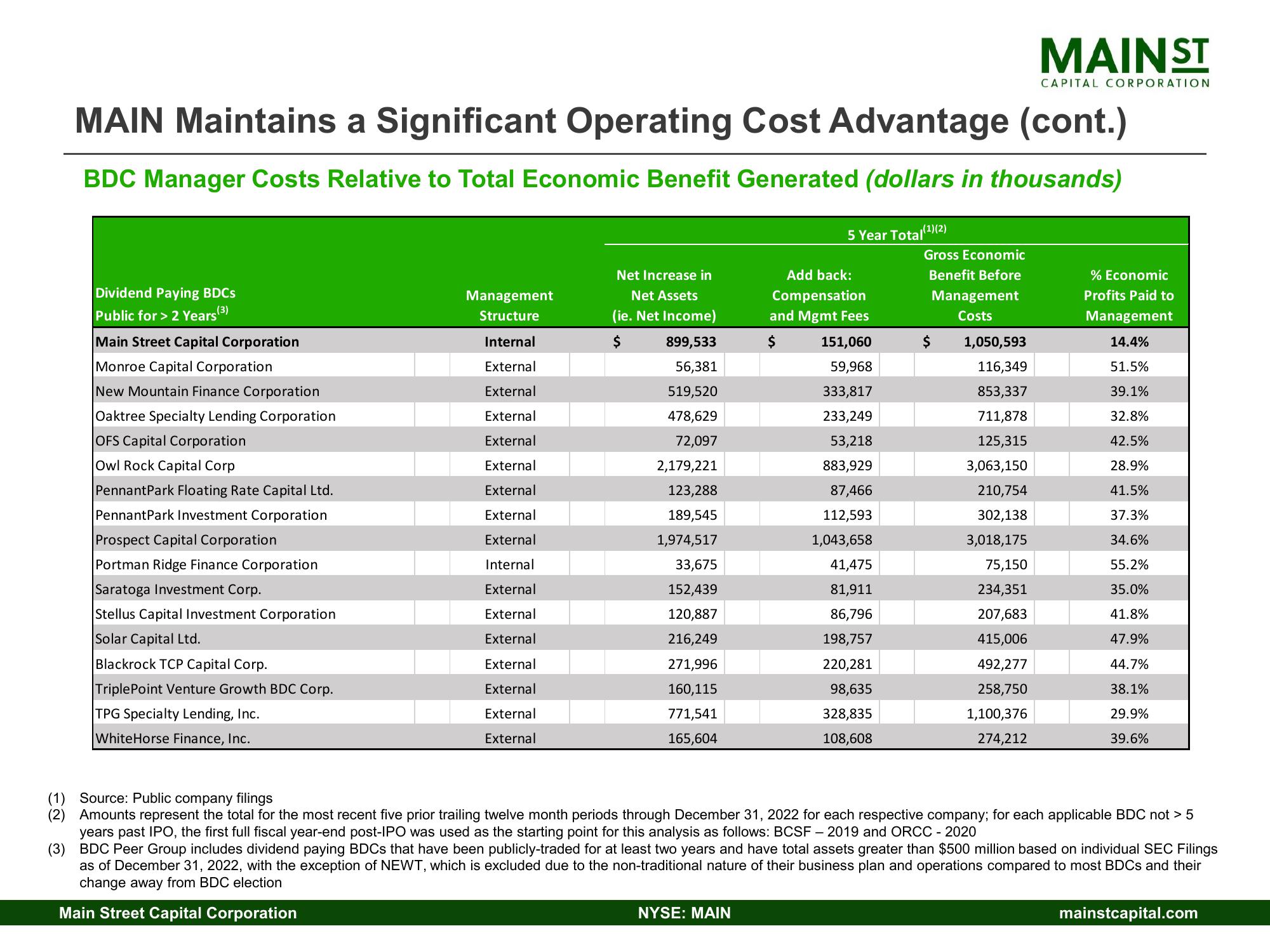

MAIN Maintains a Significant Operating Cost Advantage (cont.)

BDC Manager Costs Relative to Total Economic Benefit Generated (dollars in thousands)

Pennant Park Floating Rate Capital Ltd.

Pennant Park Investment Corporation

Prospect Capital Corporation

Portman Ridge Finance Corporation

Saratoga Investment Corp.

Stellus Capital Investment Corporation

Solar Capital Ltd.

Blackrock TCP Capital Corp.

Triple Point Venture Growth BDC Corp.

TPG Specialty Lending, Inc.

WhiteHorse Finance, Inc.

Management

Structure

Internal

External

External

External

External

External

External

External

External

Internal

External

External

External

External

External

External

External

Net Increase in

Net Assets

(ie. Net Income)

899,533

56,381

519,520

$

478,629

72,097

2,179,221

123,288

189,545

1,974,517

33,675

152,439

120,887

216,249

271,996

160,115

771,541

165,604

5 Year Total(¹)(2)

NYSE: MAIN

Add back:

Compensation

and Mgmt Fees

$ 151,060

59,968

333,817

233,249

53,218

883,929

87,466

112,593

1,043,658

41,475

81,911

86,796

198,757

220,281

98,635

328,835

108,608

Gross Economic

Benefit Before

Management

Costs

$

MAIN ST

1,050,593

116,349

853,337

711,878

125,315

3,063,150

210,754

302,138

3,018,175

75,150

234,351

207,683

415,006

492,277

258,750

1,100,376

274,212

CAPITAL CORPORATION

% Economic

Profits Paid to

Management

14.4%

51.5%

39.1%

32.8%

42.5%

28.9%

41.5%

37.3%

34.6%

55.2%

35.0%

41.8%

47.9%

44.7%

38.1%

29.9%

39.6%

(1) Source: Public company filings

(2) Amounts represent the total for the most recent five prior trailing twelve month periods through December 31, 2022 for each respective company; for each applicable BDC not > 5

years past IPO, the first full fiscal year-end post-IPO was used as the starting point for this analysis as follows: BCSF - 2019 and ORCC - 2020

(3) BDC Peer Group includes dividend paying BDCs that have been publicly-traded for at least two years and have total assets greater than $500 million based on individual SEC Filings

as of December 31, 2022, with the exception of NEWT, which is excluded due to the non-traditional nature of their business plan and operations compared to most BDCs and their

change away from BDC election

Main Street Capital Corporation

mainstcapital.comView entire presentation