Trian Partners Activist Presentation Deck

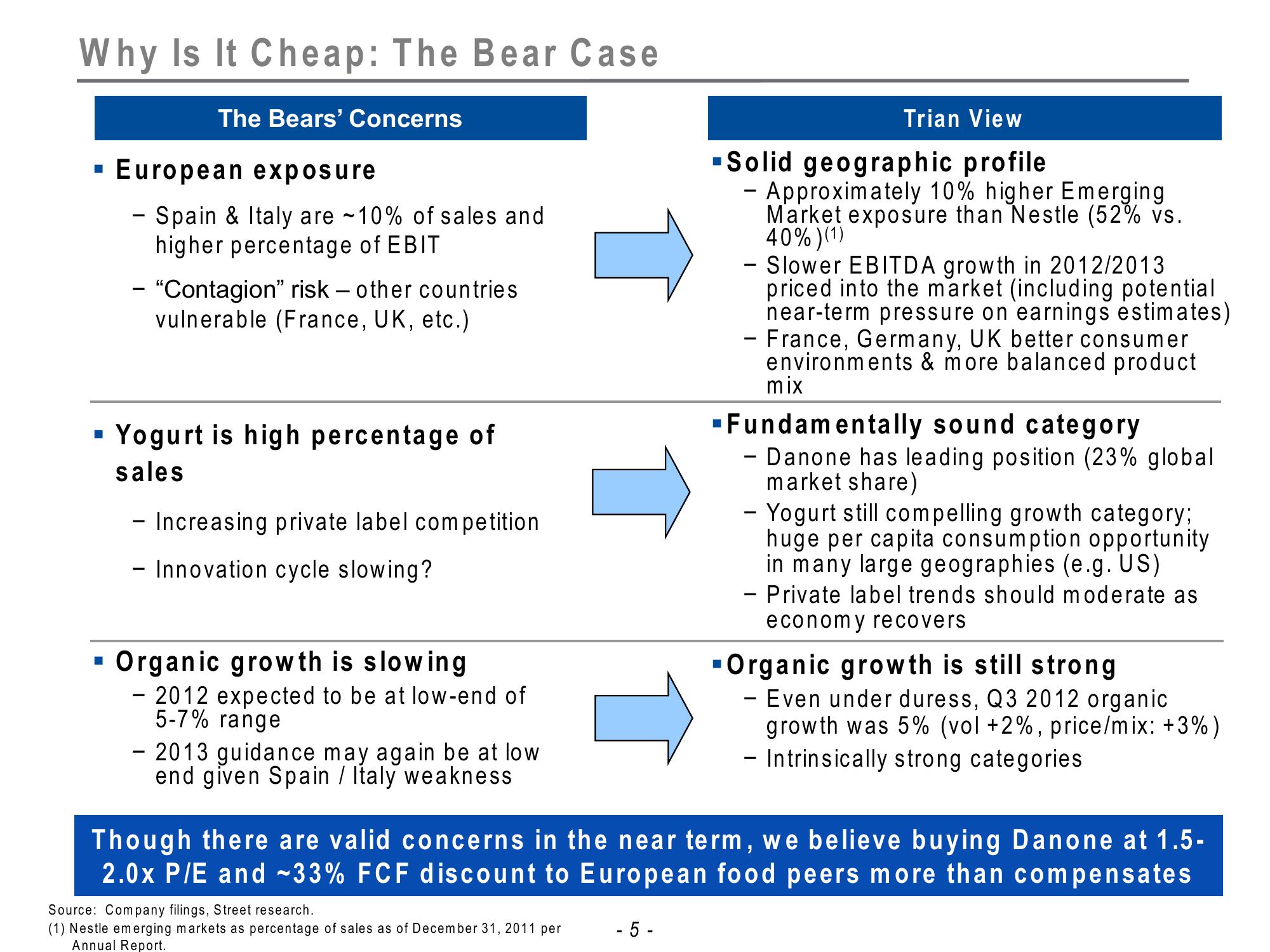

Why Is It Cheap: The Bear Case

The Bears' Concerns

■

European exposure

- Spain & Italy are ~10% of sales and

higher percentage of EBIT

- "Contagion" risk - other countries

vulnerable (France, UK, etc.)

Yogurt is high percentage of

sales

- Increasing private label competition

- Innovation cycle slowing?

Organic growth is slowing

- 2012 expected to be at low-end of

5-7% range

- 2013 guidance may again be at low

end given Spain / Italy weakness

Source: Company filings, Street research.

(1) Nestle emerging markets as percentage of sales as of December 31, 2011 per

Annual Report.

Trian View

▪Solid geographic profile

- Approximately 10% higher Emerging

Market exposure than Nestle (52% vs.

40%)(1)

-5-

- Slower EBITDA growth in 2012/2013

priced into the market (including potential

near-term pressure on earnings estimates)

- France, Germany, UK better consumer

environments & more balanced product

mix

- Fundamentally sound category

- Danone has leading position (23% global

market share)

- Yogurt still compelling growth category;

huge per capita consumption opportunity

in many large geographies (e.g. US)

- Private label trends should moderate as

economy recovers

Though there are valid concerns in the near term, we believe buying Danone at 1.5-

2.0x P/E and -33% FCF discount to European food peers more than compensates

▪ Organic growth is still strong

- Even under duress, Q3 2012 organic

growth was 5% (vol +2%, price/mix: +3%)

- Intrinsically strong categoriesView entire presentation