Azek Investor Presentation Deck

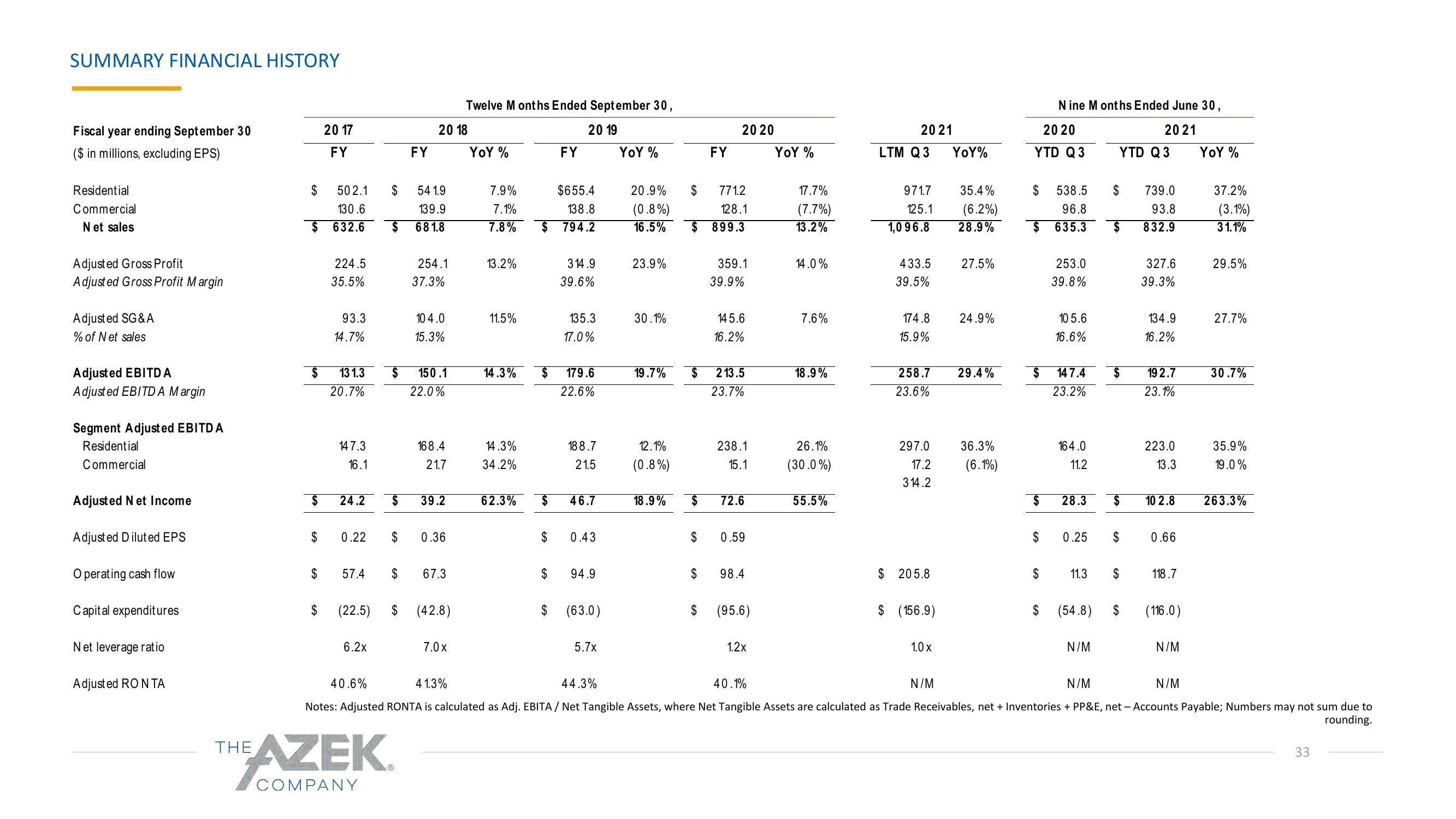

SUMMARY FINANCIAL HISTORY

Fiscal year ending September 30

($ in millions, excluding EPS)

Residential

Commercial

N et sales

Adjusted Gross Profit

Adjusted Gross Profit Margin

Adjusted SG & A

% of Net sales

Adjusted EBITDA

Adjusted EBITDA Margin

Segment Adjusted EBITDA

Residential

Commercial

Adjusted Net Income

Adjusted Diluted EPS

Operating cash flow

Capital expenditures

Net leverage ratio

Adjusted RON TA

$

$

20 17

FY

502.1

130.6

632.6

224.5

35.5%

93.3

14.7%

13 1.3

20.7%

147.3

16.1

$ 24.2 $

$ 0.22 $

$ (22.5)

$

$ 57.4 $

6.2x

$

54 1.9

139.9

$ 681.8

THE AZEK

COMPANY

FY

$

2018

254.1

37.3%

10 4.0

15.3%

150.1

22.0%

168.4

21.7

39.2

0.36

67.3

(42.8)

Twelve M onths Ended September 30,

20 19

YOY %

7.0 x

YOY %

$655.4

138.8

7.8% $ 794.2

7.9%

7.1%

13.2%

11.5%

14.3%

14.3%

34.2%

$

FY

$

$

314.9

39.6%

135.3

17.0%

179.6

22.6%

62.3% $ 46.7

188.7

21.5

0.43

94.9

$ (63.0)

5.7x

20.9%

(0.8%)

16.5%

23.9%

30.1%

19.7% $

12.1%

(0.8%)

18.9%

$ 771.2

128.1

899.3

$

FY

$

20 20

$

359.1

39.9%

145.6

16.2%

$ 72.6

213.5

23.7%

238.1

15.1

0.59

98.4

(95.6)

1.2x

YOY %

17.7%

(7.7%)

13.2%

14.0%

7.6%

18.9%

26.1%

(30.0%)

55.5%

20 21

LTM Q3

971.7

125.1

1,096.8

433.5

39.5%

174.8

15.9%

258.7

23.6%

297.0

17.2

314.2

$ 205.8

$ (156.9)

1.0 x

YoY%

N/M

35.4%

(6.2%)

28.9%

27.5%

24.9%

29.4%

36.3%

(6.1%)

20 20

YTD Q3

$ 538.5

96.8

635.3

N ine M onths Ended June 30,

20 21

$

$ 147.4

23.2%

$

253.0

39.8%

$

105.6

16.6%

$ 28.3

164.0

11.2

0.25

(54.8)

YTD Q 3

N/M

$

$

$

$

11.3 $

$

$

739.0

93.8

832.9

327.6

39.3%

134.9

16.2%

19 2.7

23.1%

223.0

13.3

10 2.8

0.66

118.7

(116.0)

N/M

YOY %

37.2%

(3.1%)

3 1.1%

29.5%

27.7%

30.7%

35.9%

19.0%

44.3%

40.1%

N/M

N/M

40.6%

4 1.3%

Notes: Adjusted RONTA is calculated as Adj. EBITA / Net Tangible Assets, where Net Tangible Assets are calculated as Trade Receivables, net + Inventories + PP&E, net - Accounts Payable; Numbers may not sum due to

rounding.

263.3%

33View entire presentation