First Citizens BancShares Results Presentation Deck

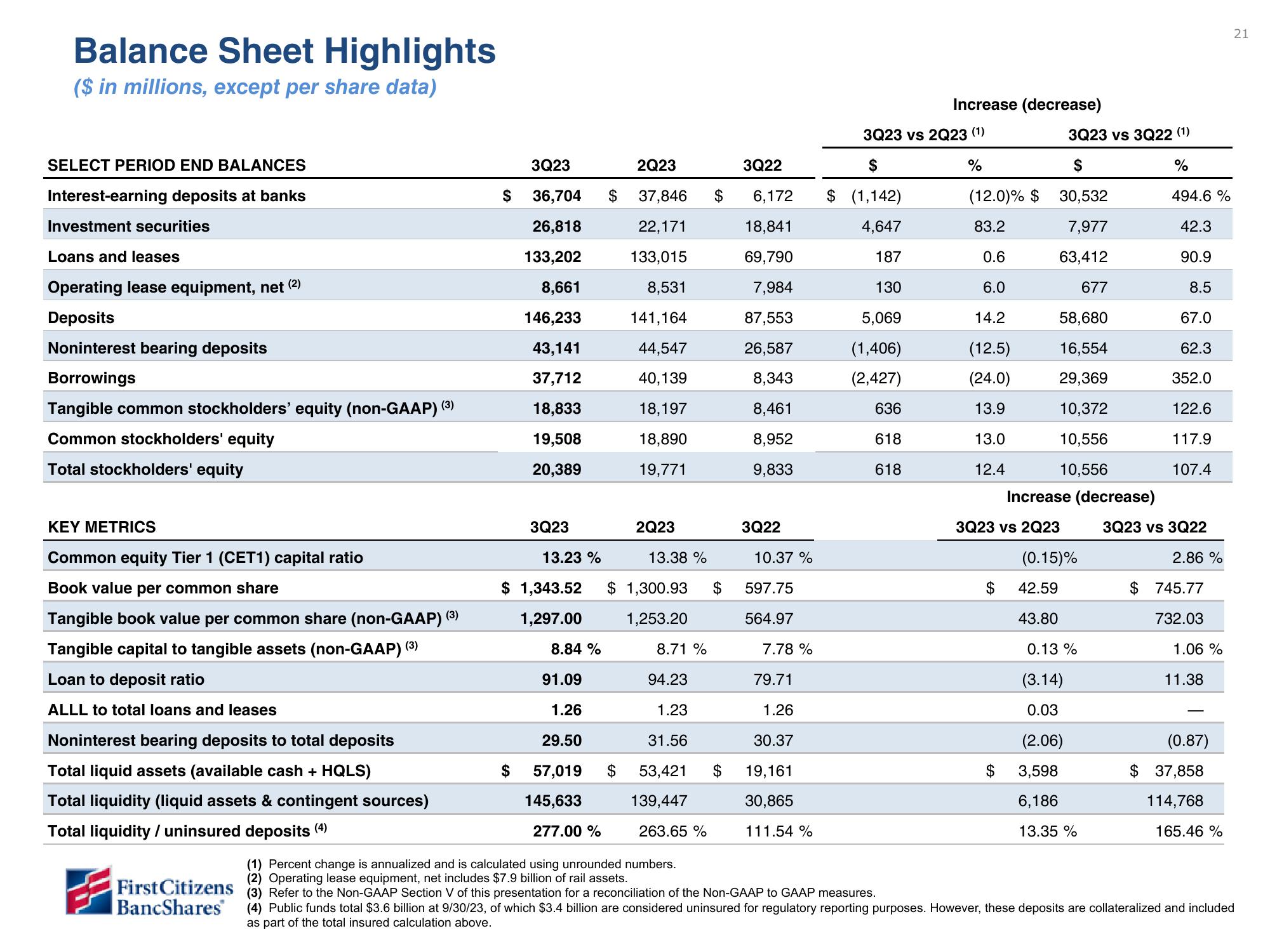

Balance Sheet Highlights

($ in millions, except per share data)

SELECT PERIOD END BALANCES

Interest-earning deposits at banks

Investment securities

Loans and leases

Operating lease equipment, net (2)

Deposits

Noninterest bearing deposits

Borrowings

Tangible common stockholders' equity (non-GAAP) (3)

Common stockholders' equity

Total stockholders' equity

KEY METRICS

Common equity Tier 1 (CET1) capital ratio

Book value per common share

Tangible book value per common share (non-GAAP) (3)

Tangible capital to tangible assets (non-GAAP) (3)

Loan to deposit ratio

ALLL to total loans and leases

Noninterest bearing deposits to total deposits

Total liquid assets (available cash + HQLS)

Total liquidity (liquid assets & contingent sources)

Total liquidity / uninsured deposits (4)

First Citizens

BancShares

$

3Q23

36,704

26,818

133,202

8,661

146,233

43,141

37,712

18,833

19,508

20,389

$

3Q23

13.23%

$ 1,343.52

1,297.00

8.84 %

91.09

1.26

29.50

57,019

145,633

277.00 %

$

2Q23

37,846

22,171

133,015

8,531

141,164

44,547

40,139

18,197

18,890

19,771

$

2Q23

13.38 %

$ 1,300.93 $

1,253.20

8.71%

94.23

1.23

31.56

53,421

139,447

$

263.65 %

$

3Q22

6,172

18,841

69,790

7,984

87,553

26,587

8,343

8,461

8,952

9,833

3Q22

10.37 %

597.75

564.97

7.78%

79.71

1.26

30.37

19,161

30,865

111.54 %

Increase (decrease)

3Q23 vs 2Q23 (1)

$

%

$ (1,142)

4,647

187

130

5,069

(1,406)

(2,427)

636

618

618

(12.0)% $

83.2

0.6

6.0

14.2

(12.5)

(24.0)

13.9

13.0

12.4

$

3Q23 vs 3Q22 (¹)

$

30,532

7,977

63,412

677

58,680

16,554

29,369

10,372

10,556

10,556

3Q23 vs 2Q23

$

Increase (decrease)

(0.15)%

42.59

43.80

0.13%

(3.14)

0.03

(2.06)

3,598

6,186

13.35 %

%

494.6 %

42.3

90.9

8.5

67.0

62.3

352.0

122.6

117.9

107.4

3Q23 vs 3Q22

2.86 %

$ 745.77

732.03

1.06 %

11.38

(0.87)

$ 37,858

114,768

165.46 %

21

(1) Percent change is annualized and is calculated using unrounded numbers.

(2) Operating lease equipment, net includes $7.9 billion of rail assets.

(3) Refer to the Non-GAAP Section V of this presentation for a reconciliation of the Non-GAAP to GAAP measures.

(4) Public funds total $3.6 billion at 9/30/23, of which $3.4 billion are considered uninsured for regulatory reporting purposes. However, these deposits are collateralized and included

as part the total insured calculation above.View entire presentation