Stryker Acquisition Vocera

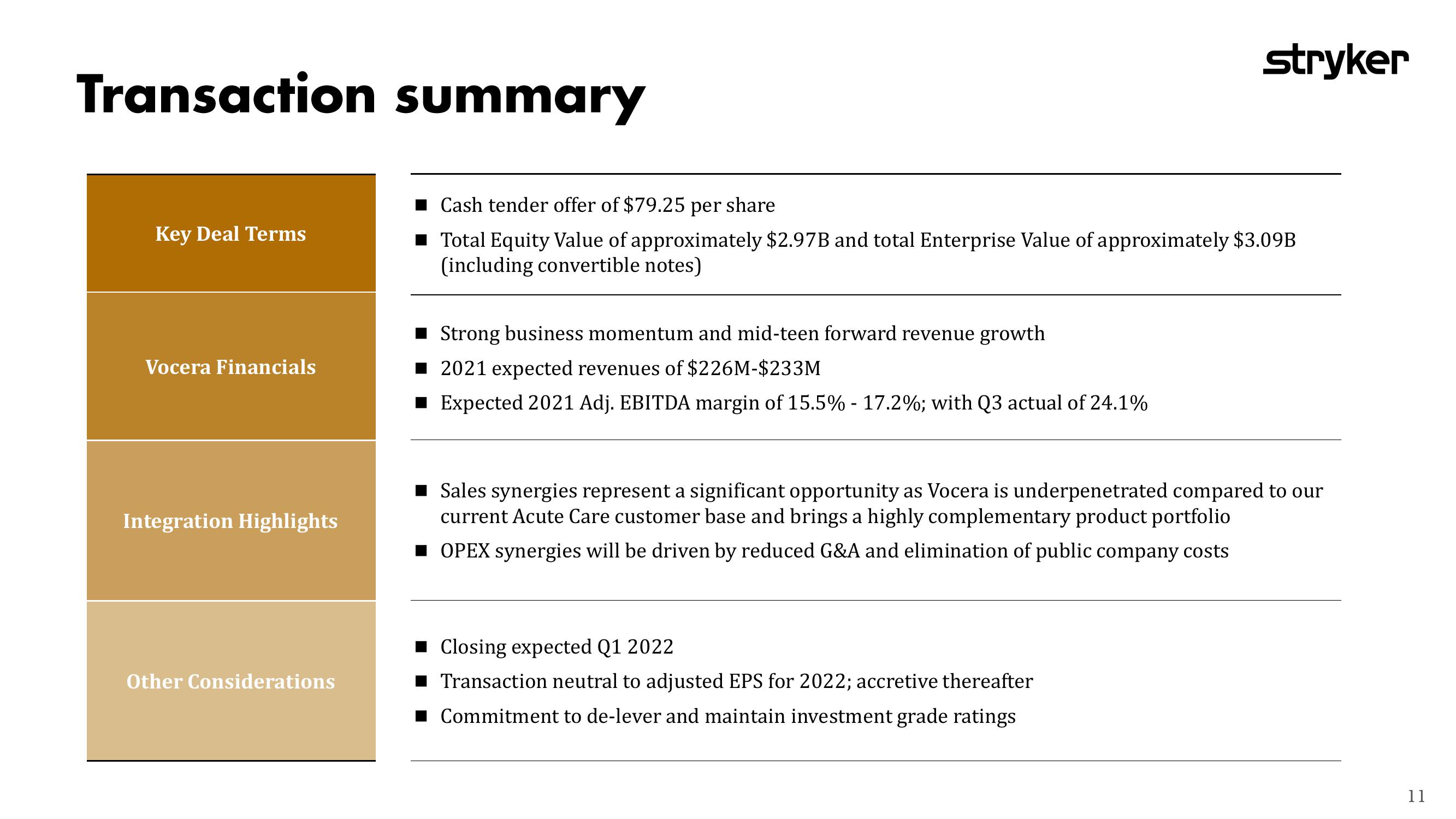

Transaction summary

Key Deal Terms

Vocera Financials

Integration Highlights

Other Considerations

Cash tender offer of $79.25 per share

■ Total Equity Value of approximately $2.97B and total Enterprise Value of approximately $3.09B

(including convertible notes)

■ Strong business momentum and mid-teen forward revenue growth

■ 2021 expected revenues of $226M-$233M

■ Expected 2021 Adj. EBITDA margin of 15.5% - 17.2%; with Q3 actual of 24.1%

stryker

■ Sales synergies represent a significant opportunity as Vocera is underpenetrated compared to our

current Acute Care customer base and brings a highly complementary product portfolio

OPEX synergies will be driven by reduced G&A and elimination of public company costs

■ Closing expected Q1 2022

Transaction neutral to adjusted EPS for 2022; accretive thereafter

■ Commitment to de-lever and maintain investment grade ratings

11View entire presentation