Bed Bath & Beyond Investor Day Presentation Deck

BUSINESS & STRATEGY UPDATE

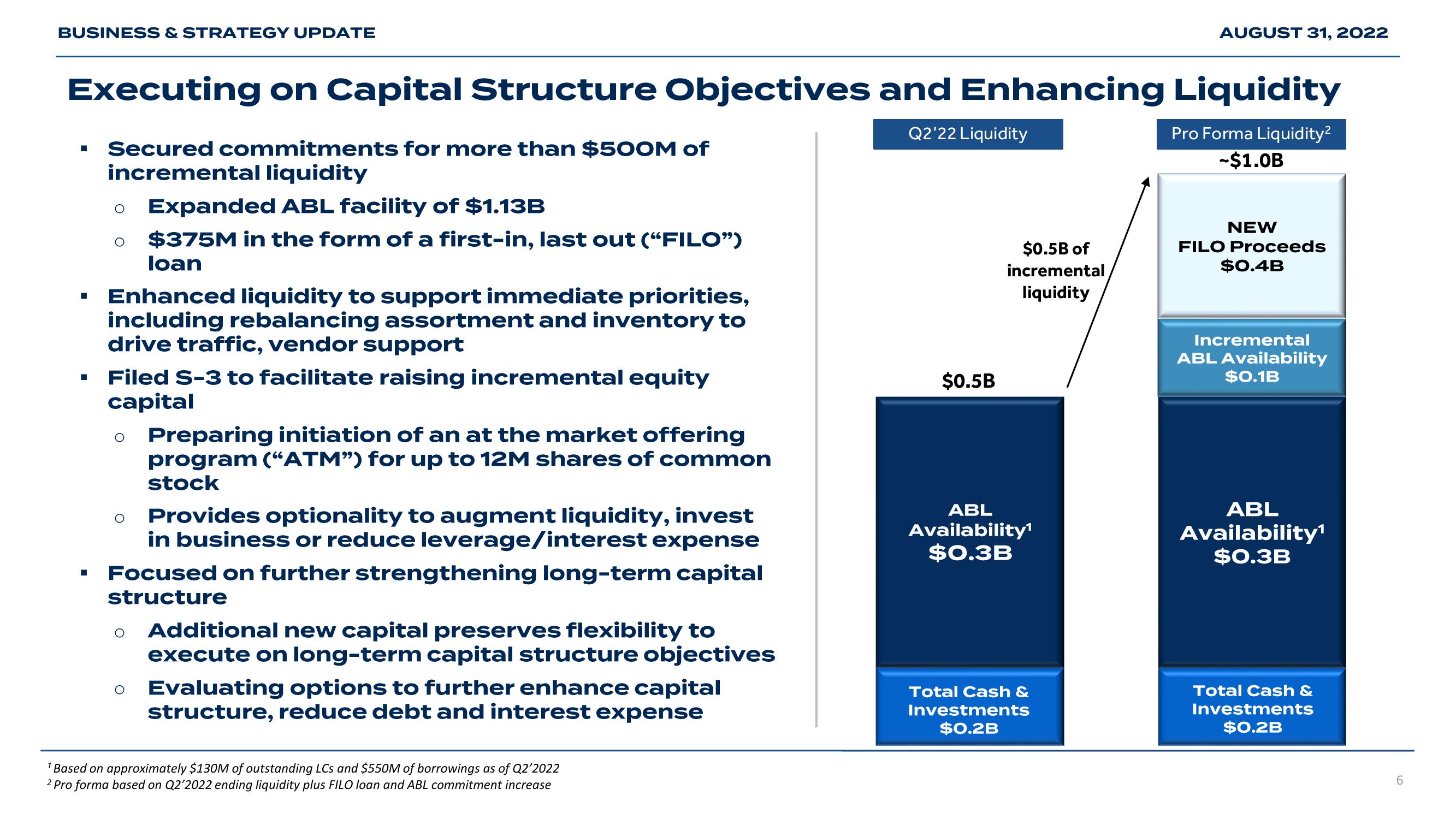

Executing on Capital Structure Objectives and Enhancing Liquidity

Q2'22 Liquidity

■

Secured commitments for more than $500M of

incremental liquidity

O Expanded ABL facility of $1.13B

O $375M in the form of a first-in, last out ("FILO")

loan

Enhanced liquidity to support immediate priorities,

including rebalancing assortment and inventory to

drive traffic, vendor support

Filed S-3 to facilitate raising incremental equity

capital

O Preparing initiation of an at the market offering

program ("ATM") for up to 12M shares of common

stock

O Provides optionality to augment liquidity, invest

in business or reduce leverage/interest expense

Focused on further strengthening long-term capital

structure

O Additional new capital preserves flexibility to

execute on long-term capital structure objectives

O

Evaluating options to further enhance capital

structure, reduce debt and interest expense

¹ Based on approximately $130M of outstanding LCs and $550M of borrowings as of Q2'2022

2 Pro forma based on Q2'2022 ending liquidity plus FILO loan and ABL commitment increase

$0.5B

$0.5B of

incremental

liquidity

ABL

Availability¹

$0.3B

AUGUST 31, 2022

Total Cash &

Investments

$0.2B

Pro Forma Liquidity²

-$1.0B

NEW

FILO Proceeds

$0.4B

Incremental

ABL Availability

$0.1B

ABL

Availability¹

$0.3B

Total Cash &

Investments

$0.2B

6View entire presentation