Mesirow Private Equity

Co-Investment Example

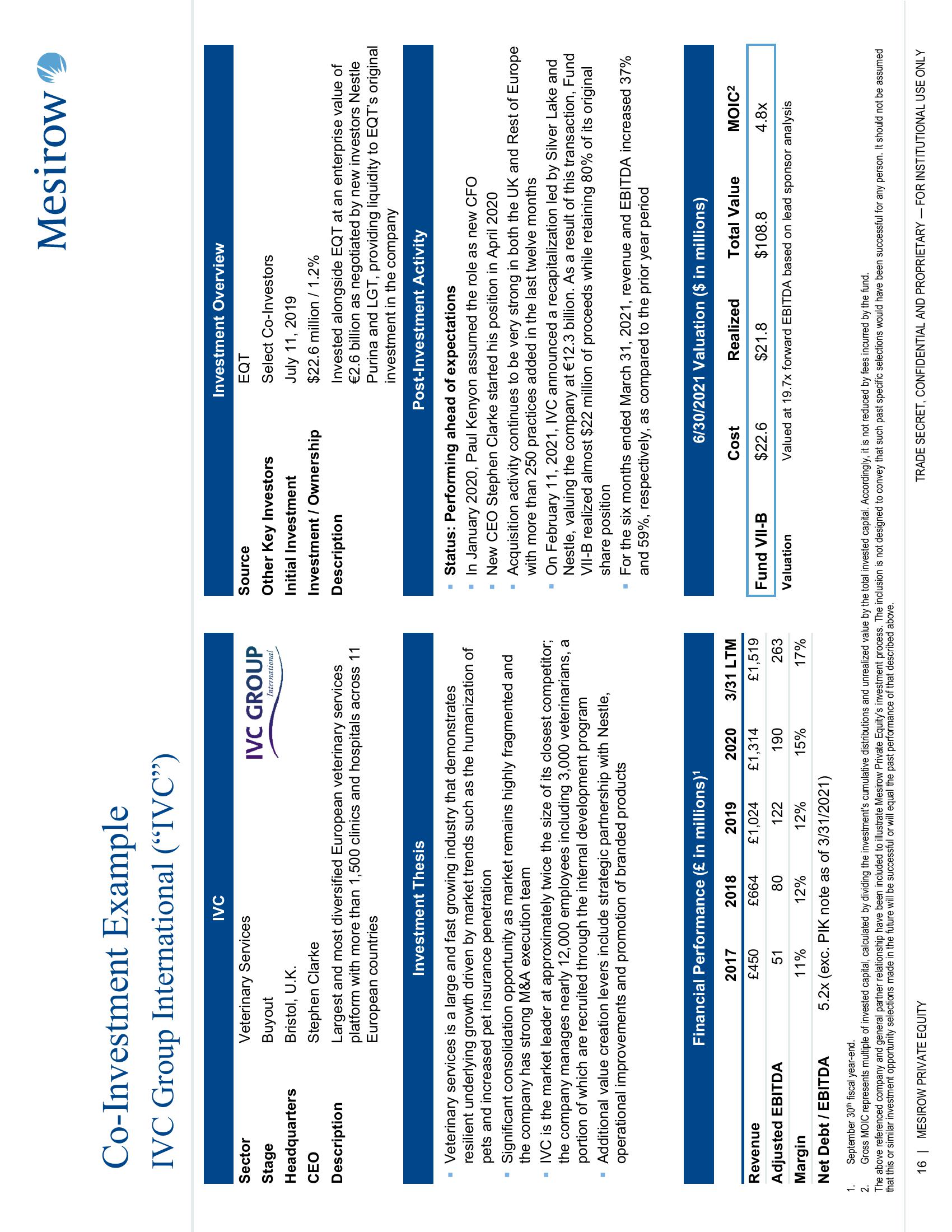

IVC Group International ("IVC")

Sector

Stage

Headquarters

CEO

Description

Veterinary Services

Buyout

Bristol, U.K.

IVC

Stephen Clarke

Largest and most diversified European veterinary services

platform with more than 1,500 clinics and hospitals across 11

European countries

Investment Thesis

Veterinary services is a large and fast growing industry that demonstrates

resilient underlying growth driven by market trends such as the humanization of

pets and increased pet insurance penetration

Revenue

Adjusted EBITDA

Margin

Net Debt / EBITDA

Significant consolidation opportunity as market remains highly fragmented and

the company has strong M&A execution team

▪ IVC is the market leader at approximately twice the size of its closest competitor;

the company manages nearly 12,000 employees including 3,000 veterinarians, a

portion of which are recruited through the internal development program

IVC GROUP

International

▪ Additional value creation levers include strategic partnership with Nestle,

operational improvements and promotion of branded products

Financial Performance (£ in millions)¹

2017

£450

2019 2020

£1,024 £1,314

122

190

51

11%

12%

15%

5.2x (exc. PIK note as of 3/31/2021)

16 MESIROW PRIVATE EQUITY

2018

£664

80

12%

3/31 LTM

£1,519

263

17%

Source

Other Key Investors

Initial Investment

Investment / Ownership

Description

■

Mesirow

Investment Overview

EQT

Select Co-Investors

July 11, 2019

$22.6 million / 1.2%

- Status: Performing ahead of expectations

▪ In January 2020, Paul Kenyon assumed the role as new CFO

New CEO Stephen Clarke started his position in April 2020

Acquisition activity continues to be very strong in both the UK and Rest of Europe

with more than 250 practices added in the last twelve months

Invested alongside EQT at an enterprise value of

€2.6 billion as negotiated by new investors Nestle

Purina and LGT, providing liquidity to EQT's original

investment in the company

Post-Investment Activity

Fund VII-B

Valuation

▪ On February 11, 2021, IVC announced a recapitalization led by Silver Lake and

Nestle, valuing the company at €12.3 billion. As result of this transaction, Fund

VII-B realized almost $22 million of proceeds while retaining 80% of its original

share position

■ For the six months ended March 31, 2021, revenue and EBITDA increased 37%

and 59%, respectively, as compared to the prior year period

6/30/2021 Valuation ($ in millions)

Realized

Total Value

Cost

$22.6

MOIC²

4.8x

$21.8

$108.8

Valued at 19.7x forward EBITDA based on lead sponsor analysis

1.

September 30th fiscal year-end.

Gross MOIC represents multiple of invested capital, calculated by dividing the investment's cumulative distributions and unrealized value by the total invested capital. Accordingly, it is not reduced by fees incurred by the fund.

The above referenced company and general partner relationship have been included to illustrate Mesirow Private Equity's investment process. The inclusion is not designed to convey that such past specific selections would have been successful for any person. It should not be assumed

that this or similar investment opportunity selections made in the future will be successful or will equal the past performance of that described above.

2.

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation