Evotec ESG Presentation Deck

evotec

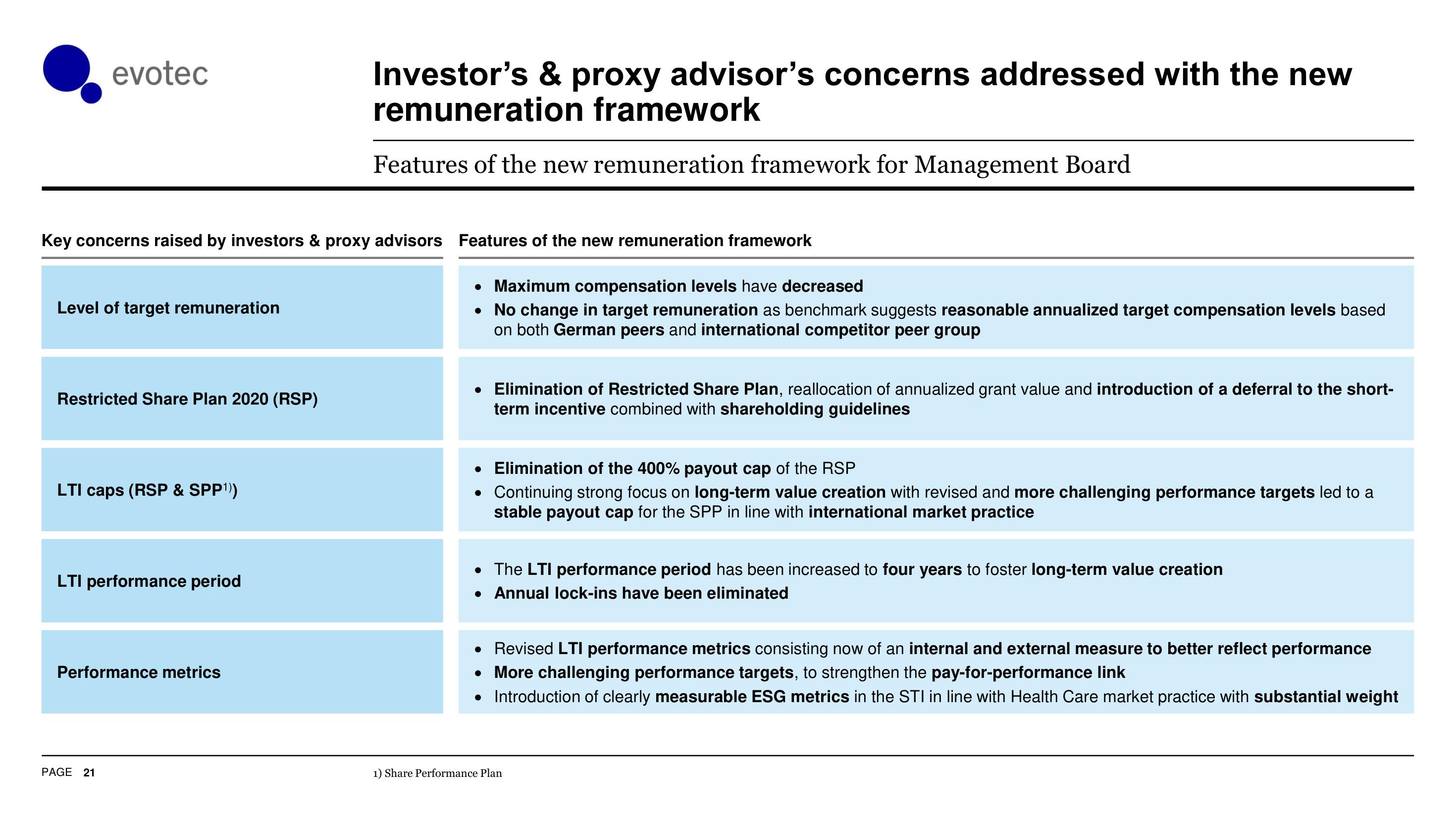

Key concerns raised by investors & proxy advisors Features of the new remuneration framework

Level of target remuneration

Restricted Share Plan 2020 (RSP)

LTI caps (RSP & SPP¹))

LTI performance period

Performance metrics

PAGE 21

Investor's & proxy advisor's concerns addressed with the new

remuneration framework

Features of the new remuneration framework for Management Board

• Maximum compensation levels have decreased

•

No change in target remuneration as benchmark suggests reasonable annualized target compensation levels based

on both German peers and international competitor peer group

• Elimination of Restricted Share Plan, reallocation of annualized grant value and introduction of a deferral to the short-

term incentive combined with shareholding guidelines

• Elimination of the 400% payout cap of the RSP

Continuing strong focus on long-term value creation with revised and more challenging performance targets led to a

stable payout cap for the SPP in line with international market practice

• The LTI performance period has been increased to four years to foster long-term value creation

• Annual lock-ins have been eliminated

• Revised LTI performance metrics consisting now of an internal and external measure to better reflect performance

• More challenging performance targets, to strengthen the pay-for-performance link

• Introduction of clearly measurable ESG metrics in the STI in line with Health Care market practice with substantial weight

1) Share Performance PlanView entire presentation