Active and Passive Investing

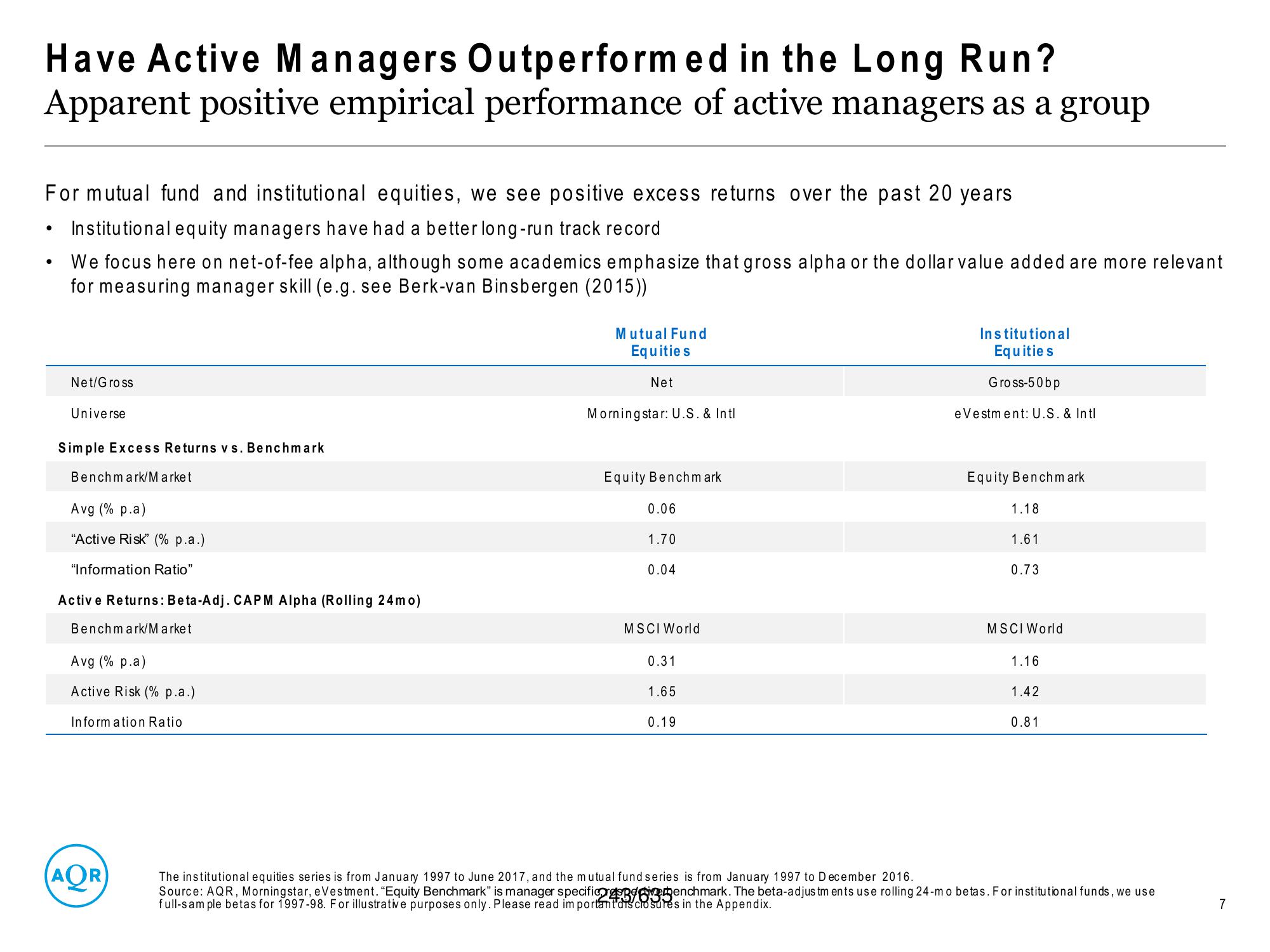

Have Active Managers Outperformed in the Long Run?

Apparent positive empirical performance of active managers as a group

For mutual fund and institutional equities, we see positive excess returns over the past 20 years

Institutional equity managers have had a better long-run track record

We focus here on net-of-fee alpha, although some academics emphasize that gross alpha or the dollar value added are more relevant

for measuring manager skill (e.g. see Berk-van Binsbergen (2015))

●

Net/Gross

Universe

Simple Excess Returns vs. Benchmark

Benchmark/Market

Avg (% p.a)

"Active Risk" (% p.a.)

"Information Ratio"

Active Returns: Beta-Adj. CAPM Alpha (Rolling 24mo)

Benchmark/Market

Avg (% p.a)

Active Risk (% p.a.)

Information Ratio

(AOR

Mutual Fund

Equities

Net

Morningstar: U.S. & Intl

Equity Benchmark

0.06

1.70

0.04

MSCI World

0.31

1.65

0.19

Institutional

Equities

Gross-50bp

e Vestment: U.S. & Intl

Equity Benchmark

1.18

1.61

0.73

MSCI World

1.16

1.42

0.81

The institutional equities series is from January 1997 to June 2017, and the mutual fund series is from January 1997 to December 2016.

Source: AQR, Morningstar, eVestment. "Equity Benchmark" is manager specific speeenchmark. The beta-adjustments use rolling 24-mo betas. For institutional funds, we use

full-sample betas for 1997-98. For illustrative purposes only. Please read important disclosures in the Appendix.

7View entire presentation