Barclays Global Financial Services Conference

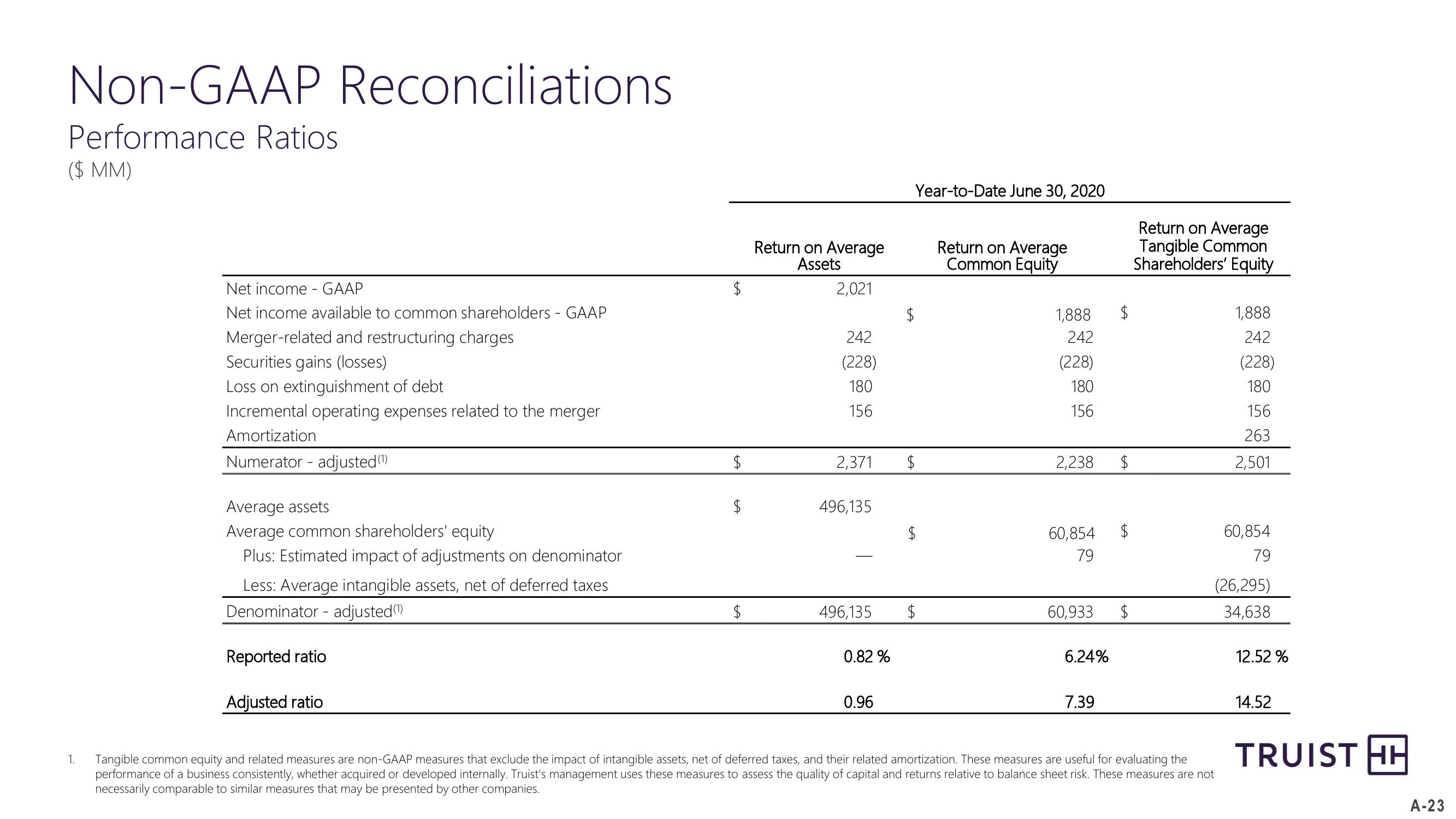

Non-GAAP Reconciliations

Performance Ratios

($ MM)

Return on Average

Assets

Return on Average

Common Equity

Year-to-Date June 30, 2020

Return on Average

Tangible Common

Shareholders' Equity

Net income GAAP

$

2,021

Net income available to common shareholders - GAAP

Merger-related and restructuring charges

Securities gains (losses)

Loss on extinguishment of debt

Incremental operating expenses related to the merger

Amortization

Numerator adjusted (1)

Average assets

242

(228)

180

156

1,888

242

(228)

180

156

263

$

2,371

$

2,238

$

2,501

+A

496,135

1,888

$

242

(228)

180

156

Average common shareholders' equity

60,854

$

60,854

Plus: Estimated impact of adjustments on denominator

79

79

Less: Average intangible assets, net of deferred taxes

Denominator adjusted (1)

(26,295)

$

496,135

$

60,933

$

34,638

Reported ratio

0.82%

6.24%

12.52 %

Adjusted ratio

0.96

7.39

1.

Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization. These measures are useful for evaluating the

performance of a business consistently, whether acquired or developed internally. Truist's management uses these measures to assess the quality of capital and returns relative to balance sheet risk. These measures are not

necessarily comparable to similar measures that may be presented by other companies.

14.52

TRUIST HH

A-23View entire presentation