Polestar Investor Presentation Deck

1

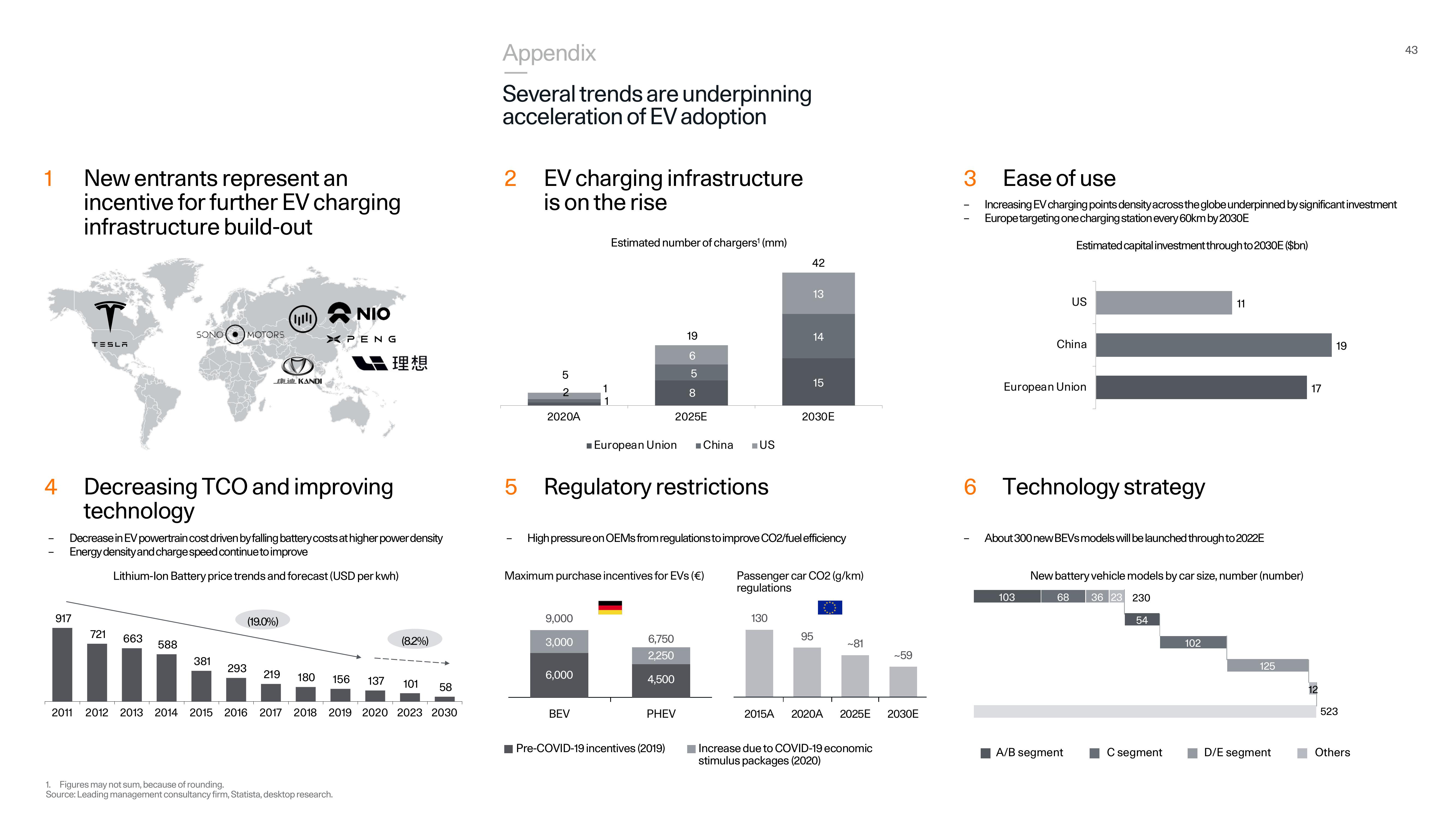

New entrants represent an

incentive for further EV charging

infrastructure build-out

T

917

TESLA

721

SONO MOTORS

663

588

4 Decreasing TCO and improving

technology

Decrease in EV powertrain cost driven by falling battery costs at higher power density

Energy density and charge speed continue to improve

Lithium-Ion Battery price trends and forecast (USD per kwh)

381

(414)

(19.0%)

KANDI

293

XPENG

NIO

219 180 156

理想

1. Figures may not sum, because of rounding.

Source: Leading management consultancy firm, Statista, desktop research.

(8.2%)

137 101

58

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2023 2030

Appendix

Several trends are underpinning

acceleration of EV adoption

2 EV charging infrastructure

is on the rise

5

2020A

Estimated number of chargers¹ (mm)

5 Regulatory restrictions

9,000

3,000

6,000

19

6

5

8

2025E

■ European Union Chinal ■US

Maximum purchase incentives for EVs (€)

BEV

High pressure on OEMs from regulations to improve CO2/fuel efficiency

6,750

2,250

4,500

PHEV

Pre-COVID-19 incentives (2019)

42

13

130

15

2030E

Passenger car CO2 (g/km)

regulations

95

~81

2015A 2020A 2025E

Increase due to COVID-19 economic

stimulus packages (2020)

-59

2030E

3

Ease of use

Increasing EV charging points density across the globe underpinned by significant investment

Europe targeting one charging station every 60km by 2030E

Estimated capital investment through to 2030E ($bn)

US

China

European Union

Technology strategy

103

About 300 new BEVS models will be launched through to 2022E

A/B segment

New battery vehicle models by car size, number (number)

68

36 23 230

54

11

C segment

102

125

D/E segment

17

12

19

523

Others

43View entire presentation