Tapestry Mergers and Acquisitions Presentation Deck

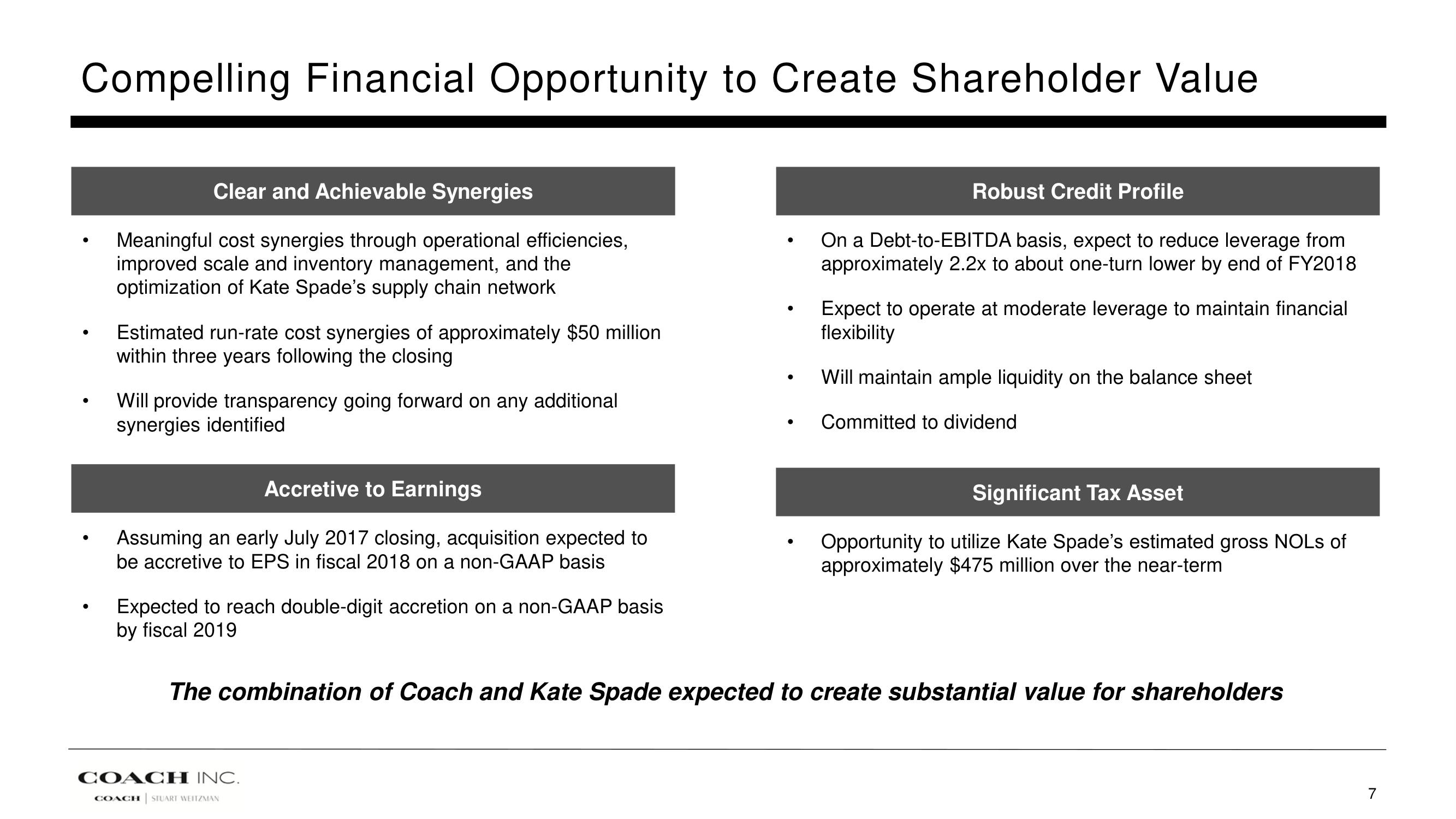

Compelling Financial Opportunity to Create Shareholder Value

●

●

●

●

Clear and Achievable Synergies

Meaningful cost synergies through operational efficiencies,

improved scale and inventory management, and the

optimization of Kate Spade's supply chain network

Estimated run-rate cost synergies of approximately $50 million

within three years following the closing

Will provide transparency going forward on any additional

synergies identified

Accretive to Earnings

Assuming an early July 2017 closing, acquisition expected to

be accretive to EPS in fiscal 2018 on a non-GAAP basis

Expected to reach double-digit accretion on a non-GAAP basis

by fiscal 2019

COACH INC.

●

COACH STUART WEITZMAN

●

●

Robust Credit Profile

On a Debt-to-EBITDA basis, expect to reduce leverage from

approximately 2.2x to about one-turn lower by end of FY2018

Expect to operate at moderate leverage to maintain financial

flexibility

Will maintain ample liquidity on the balance sheet

Committed to dividend

The combination of Coach and Kate Spade expected to create substantial value for shareholders

Significant Tax Asset

Opportunity to utilize Kate Spade's estimated gross NOLs of

approximately $475 million over the near-term

7View entire presentation