J.P.Morgan Results Presentation Deck

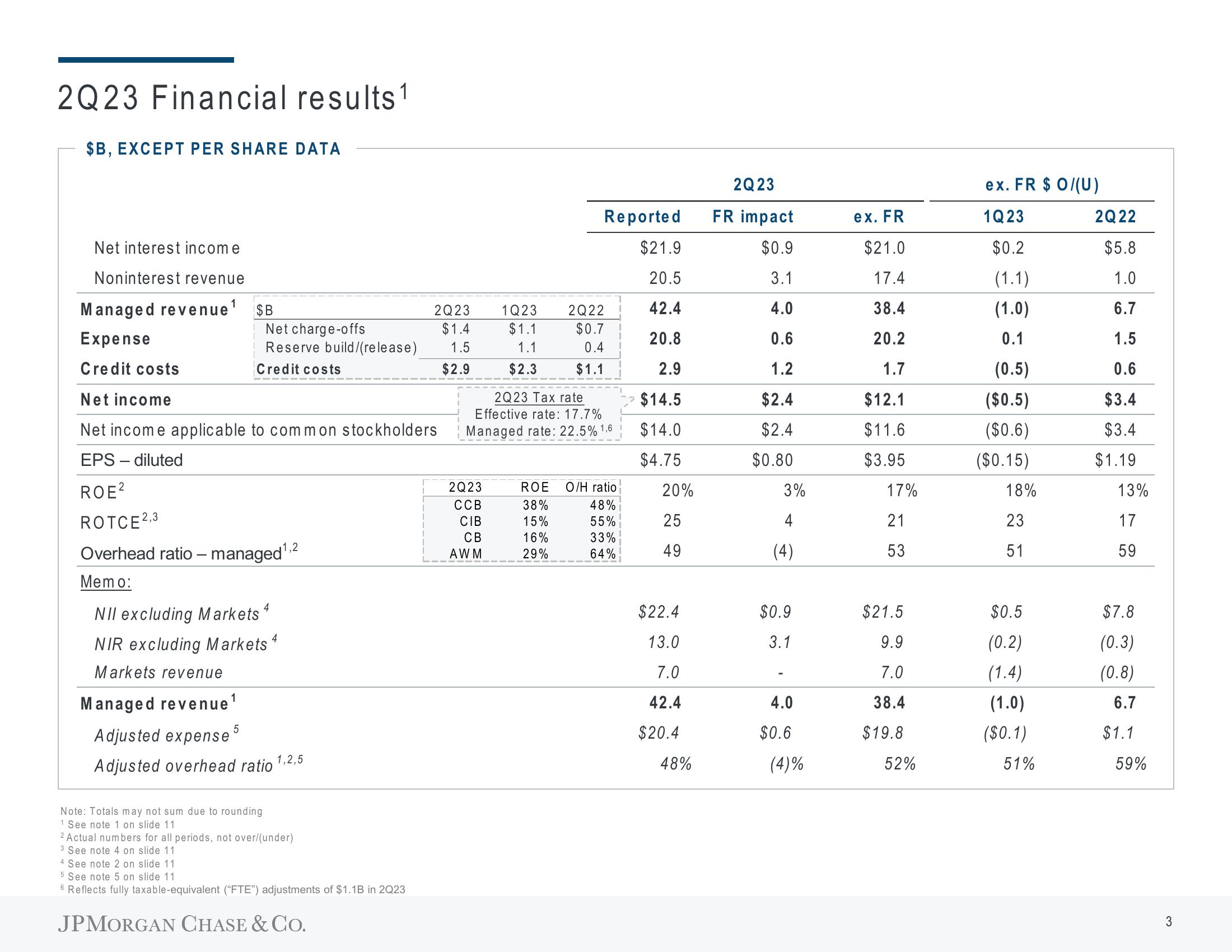

2Q23 Financial results 1

$B, EXCEPT PER SHARE DATA

Net interest income

Noninterest revenue

Managed revenue¹

Expense

Credit costs

$B

Net charge-offs

Reserve build/(release)

Credit costs

Net income

Net income applicable to common stockholders

EPS - diluted

ROE²

ROTCE²,

Overhead ratio - managed ¹,2

Memo:

NII excluding Markets 4

NIR excluding Markets 4

Markets revenue

Managed revenue ¹

Adjusted expense 5

Adjusted overhead ratio

1,2,5

Note: Totals may not sum due to rounding

1 See note 1 on slide 11

2 Actual numbers for all periods, not over/(under)

3 See note 4 on slide 11

2Q23

$1.4

1.5

4 See note 2 on slide 11

5 See note 5 on slide 11

6 Reflects fully taxable-equivalent ("FTE") adjustments of $1.1B in 2Q23

JPMORGAN CHASE & CO.

$2.9

Reported

$21.9

20.5

42.4

20.8

2.9

$14.5

$14.0

$4.75

2Q23

CCB

CIB

CB

AWM

1Q23 2Q22

$1.1

$0.7

1.1

0.4

$2.3

$1.1

2Q23 Tax rate

Effective rate: 17.7%

Managed rate: 22.5% 1,6

ROE O/H ratio

38%

48%

15%

55%

16%

33%

29%

64%

20%

25

49

$22.4

13.0

7.0

42.4

$20.4

48%

2Q23

FR impact

$0.9

3.1

4.0

0.6

1.2

$2.4

$2.4

$0.80

3%

4

(4)

$0.9

3.1

-

4.0

$0.6

(4)%

ex. FR

$21.0

17.4

38.4

20.2

1.7

$12.1

$11.6

$3.95

17%

21

53

$21.5

9.9

7.0

38.4

$19.8

52%

ex. FR $ 0/(U)

1Q23

$0.2

(1.1)

(1.0)

0.1

(0.5)

($0.5)

($0.6)

($0.15)

18%

23

51

$0.5

(0.2)

(1.4)

(1.0)

($0.1)

51%

2Q22

$5.8

1.0

6.7

1.5

0.6

$3.4

$3.4

$1.19

13%

17

59

$7.8

(0.3)

(0.8)

6.7

$1.1

59%

3View entire presentation