HireRight Results Presentation Deck

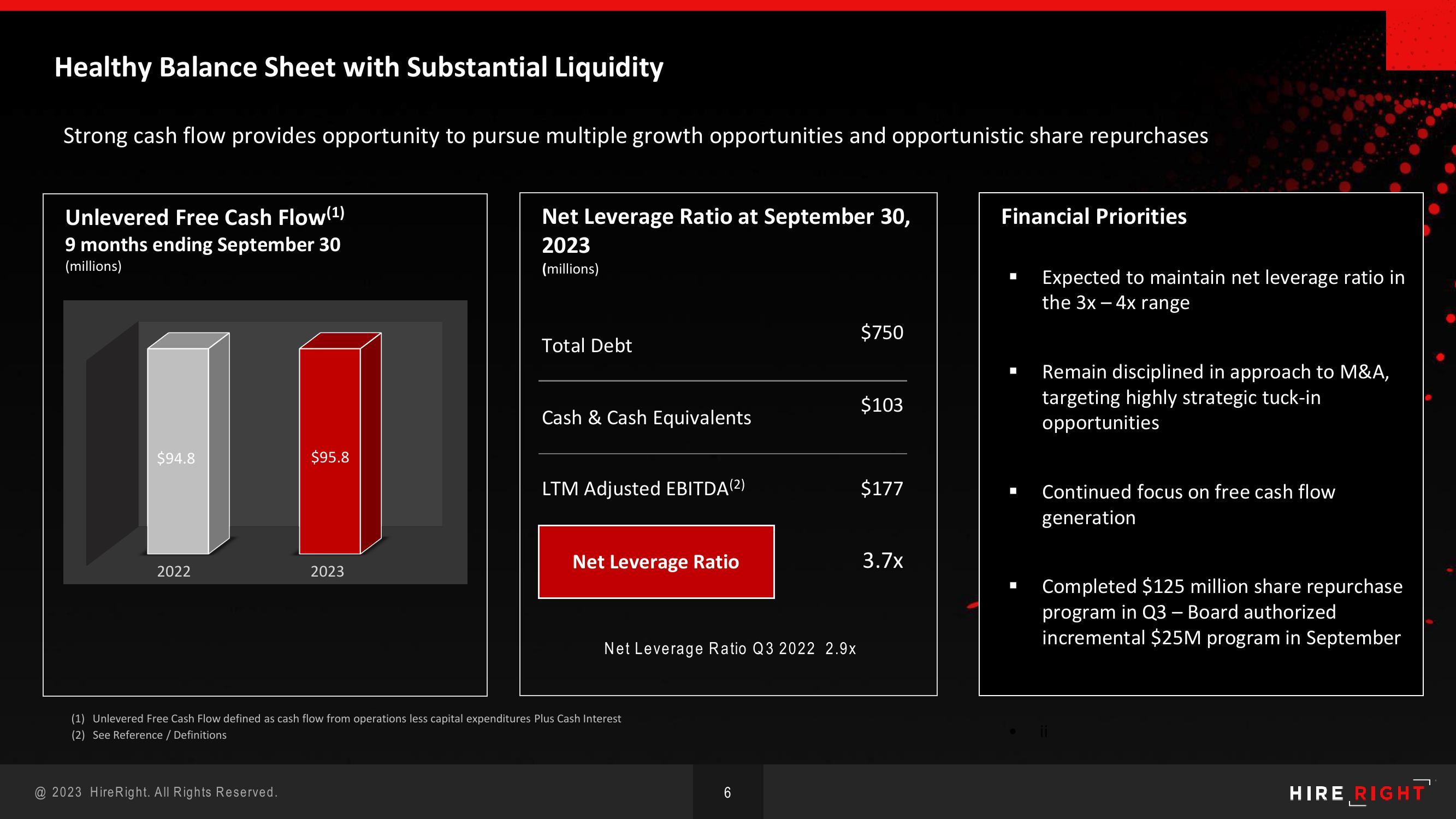

Healthy Balance Sheet with Substantial Liquidity

Strong cash flow provides opportunity to pursue multiple growth opportunities and opportunistic share repurchases

Unlevered Free Cash Flow(1)

9 months ending September 30

(millions)

$94.8

2022

$95.8

@ 2023 Hire Right. All Rights Reserved.

2023

Net Leverage Ratio at September 30,

2023

(millions)

Total Debt

Cash & Cash Equivalents

LTM Adjusted EBITDA (²)

Net Leverage Ratio

Net Leverage Ratio Q3 2022 2.9x

(1) Unlevered Free Cash Flow defined as cash flow from operations less capital expenditures Plus Cash Interest

(2) See Reference / Definitions

6

$750

$103

$177

3.7x

Financial Priorities

■

Expected to maintain net leverage ratio in

the 3x - 4x range

Remain disciplined in approach to M&A,

targeting highly strategic tuck-in

opportunities

Continued focus on free cash flow

generation

Completed $125 million share repurchase

program in Q3 - Board authorized

incremental $25M program in September

HIRE RIGHTView entire presentation