Endeavour Mining Results Presentation Deck

ATTRACTIVE SHAREHOLDER RETURNS PROGRAMME

Minimum progressive dividend provides visibility during growth phase

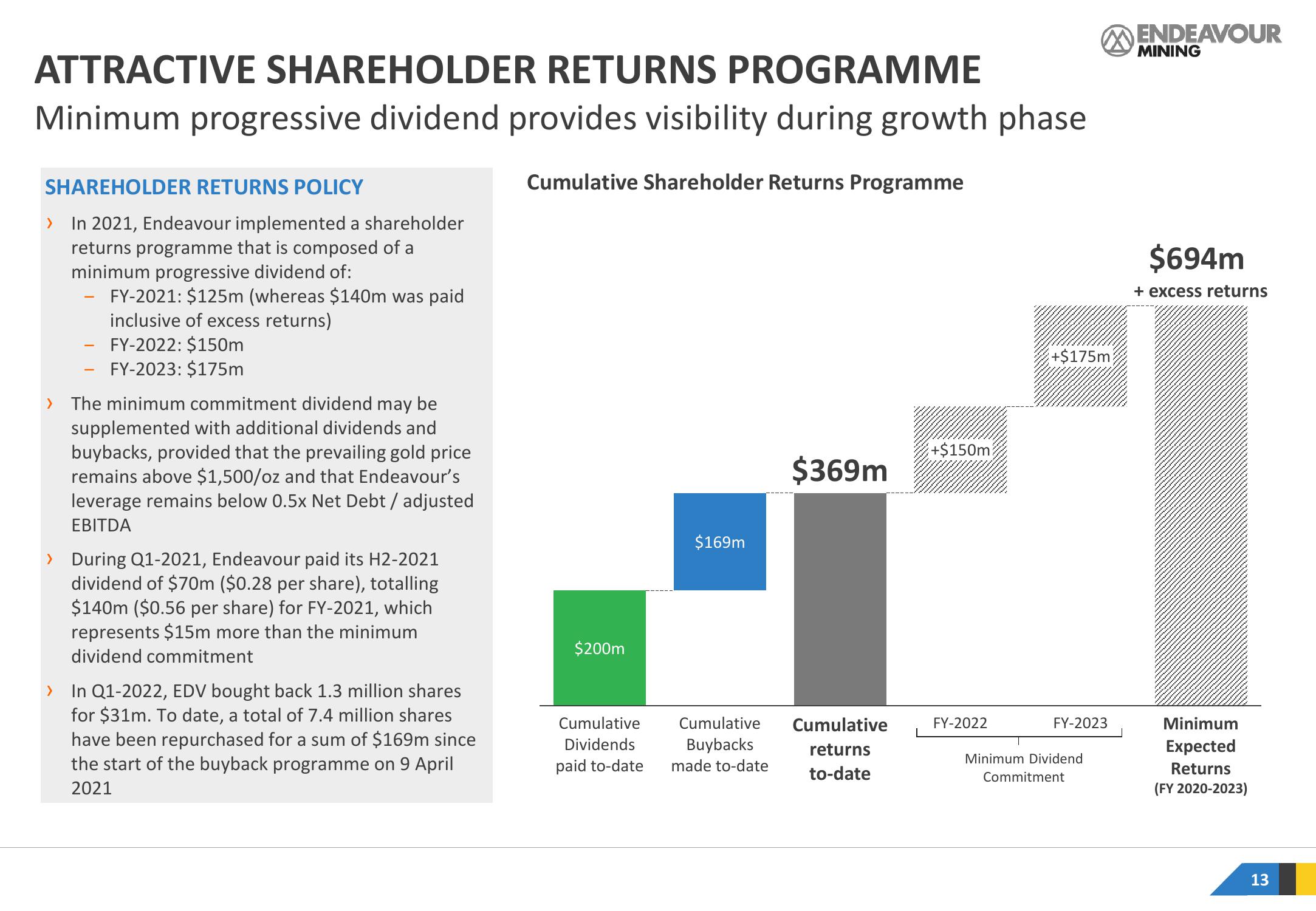

Cumulative Shareholder Returns Programme

SHAREHOLDER RETURNS POLICY

> In 2021, Endeavour implemented a shareholder

returns programme that is composed of a

minimum progressive dividend of:

FY-2021: $125m (whereas $140m was paid

inclusive of excess returns)

FY-2022: $150m

- FY-2023: $175m

> The minimum commitment dividend may be

supplemented with additional dividends and

buybacks, provided that the prevailing gold price

remains above $1,500/oz and that Endeavour's

leverage remains below 0.5x Net Debt / adjusted

EBITDA

During Q1-2021, Endeavour paid its H2-2021

dividend of $70m ($0.28 per share), totalling

$140m ($0.56 per share) for FY-2021, which

represents $15m more than the minimum

dividend commitment

> In Q1-2022, EDV bought back 1.3 million shares

for $31m. To date, a total of 7.4 million shares

have been repurchased for a sum of $169m since

the start of the buyback programme on 9 April

2021

$200m

$169m

Cumulative

Dividends

Cumulative

Buybacks

paid to-date made to-date

$369m

Cumulative

returns

to-date

+$150m

www

FY-2022

+$175m:

FY-2023

Minimum Dividend

Commitment

ENDEAVOUR

MINING

$694m

+ excess returns

Minimum

Expected

Returns

(FY 2020-2023)

13View entire presentation